Unlocking medium- and long-term capital

Banks encounter obstacles in increasing credit disbursement, while firms want to borrow at preferential medium- and long-term interest rates, although it is difficult.

Given this situation, the urgent issue is to quickly unlock medium- and long-term capital channels for businesses.

Businesses Seek Medium- and Long-Term Loans

In principle, firms should be able to get medium- and long-term capital from the capital market through stock issues and loan instruments. However, because the bond market is still emerging and recovering, and the stock market remains a "playground" for little over 1,700 businesses over three exchanges, banks continue to be the primary source of short-, medium-, and long-term lending.

As a result, in addition to their own equity, many private enterprises continue to seek bank borrowing to boost their investment capital.

At a seminar in Dong Thap, Nguyen Khac Duy, Deputy Director of Chon Chinh Import-Export firm, stated that his firm borrowed VND 150-200 billion from banks at an annual interest rate of 4-5%. This money will be used to buy rice and, more importantly, to enhance storage capacity, doubling the current system and increasing drying capacity.

Similarly, Tran Truong Tan Tai, CEO of Vietnam Rice Company, stated that in order to operate on a big scale and invest safely in one million hectares of high-quality, low-emission rice as part of the government's plans, the company wants to get medium- and long-term finance.

Rice is a key sector for agricultural concessional finance, ranking as one of the banking system's five top priorities. Banks declare that cash are available to satisfy the borrowing demands of businesses and individuals. In fact, this sector's outstanding loans account for more than 53% of total outstanding loans in the largest rice-growing area. However, firms continue to have challenges in obtaining full access to financing.

In another priority sector, a coffee company noted that despite high credibility with banks, it has not accessed medium- and long-term loans for ESG investment and instead opted for fund capital. “Whether we borrow from a bank or another source, we still pay interest on investment, but banks provide low limits, require collateral, and have specific ESG and development criteria that make it difficult to access and allocate funds,” shared the company’s CEO.

Many businesses struggle to access medium- and long-term credit. Illustrative image.

Challenges for Banks

There are several constraints to the short-term capital ratio for medium- and long-term loans. According to statistics, this percentage has risen to more than 28% in the financial system (almost 30%), with certain institutions reaching 30%.

According to Dr. Dinh The Hien, economist, the challenges in the real estate market are one of the reasons why money is "locked" in this sector—typically, loans to real estate investors are medium- and long-term, resulting in a high ratio and capital flow blockages. Furthermore, the challenge of boosting investor returns in the face of limited market liquidity has raised non-performing loans in retail banking, reflecting the sector's large real estate lending share in comparison to others.

At a recent National Assembly report, SBV Governor Nguyen Thi Hong reiterated the World Bank's long-standing recommendation regarding Vietnam’s debt-to-GDP ratio of 120%, which is high. Theoretically, this poses a risk for the banking system but could help maintain a higher net interest margin (NIM).

Notably, NIM across the system averages about 3.4-3.8%, which is not high compared to some other countries and is decreasing as lending rates drop while deposit rates rise, alongside the mandate to support debt restructuring.

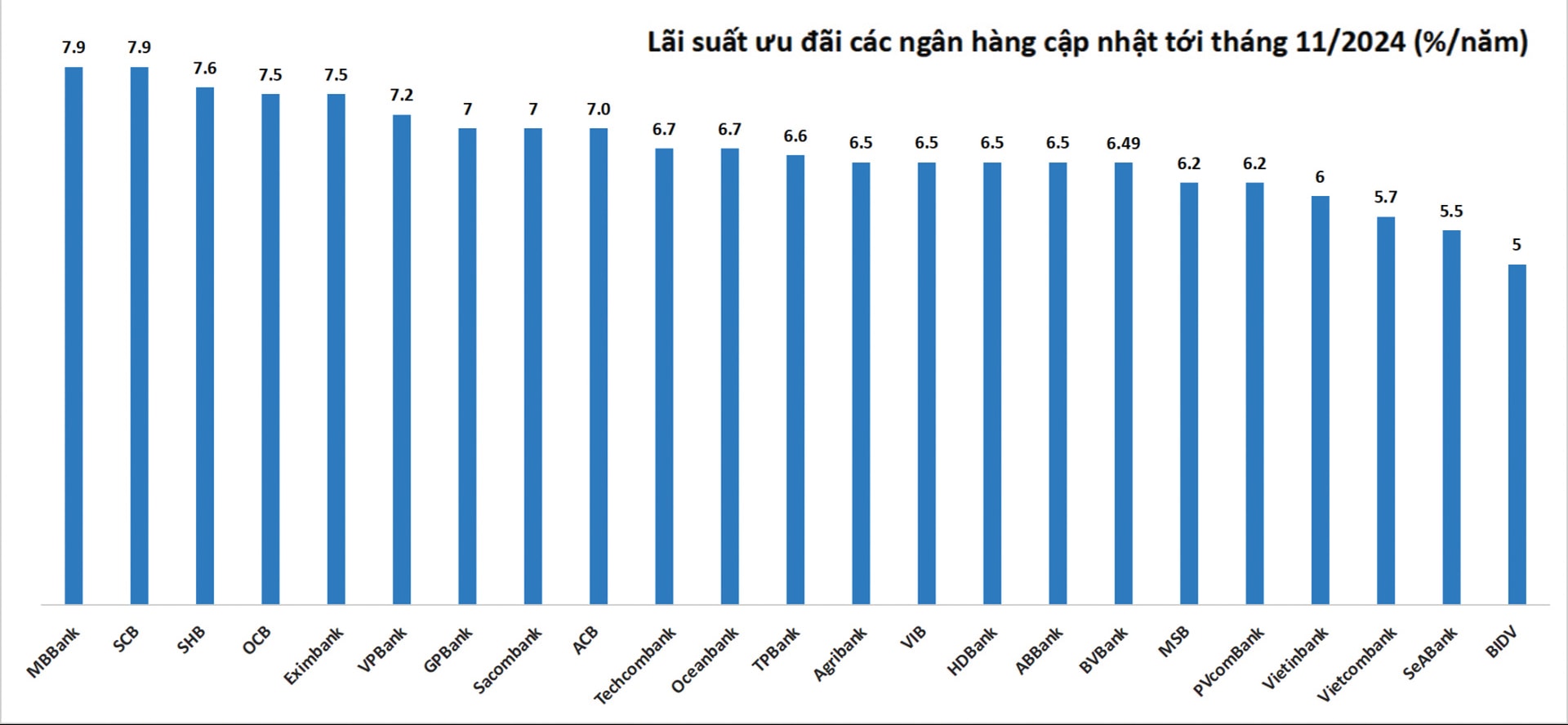

According to SBV statistics, lending rates have declined significantly recently. In 2023, lending rates fell by over 2.5% per year, and as of October 20, 2024, they further decreased by 0.76% per year compared to the end of 2023. The SBV also confirmed that in the current context, further rate cuts are unlikely.

Banks offer short-term loan rates of roughly 3.7% per year, while medium- and long-term lending rates are around 6% per year. Regardless of whether they can access these rates, borrowers are willing to accept higher rates in exchange for more relaxed access conditions, particularly for medium- and long-term loans with fixed preferential interest periods and suitable floating margins—something they desperately need to confidently fund investments for more than a year.