US inflation and its implications for the FED's rate hike?

All eyes are on the US inflation. The improvement in inflation will cause the Fed to scale back and then end its rate hikes?

FED may scale down interest rate at the upcoming meeting.

>> Where will the terminal FED funds rate land?

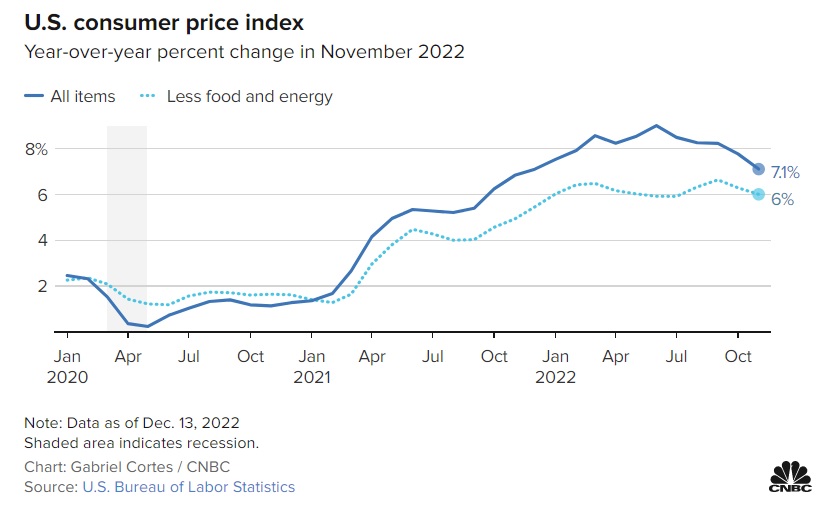

The US CPI in November rose just 0.1% from the previous month and increased 7.1% from a year ago, reported the Labor Department. Economists surveyed by Dow Jones had been expecting a 0.3% monthly increase and a 7.3% 12-month rate. Excluding volatile food and energy prices, the so-called core CPI rose 0.2% on a monthly basis and 6% on an annual basis, compared with respective estimates of 0.3% and 6.1%.

Perhaps the first place to start is to get a handle on where inflation is sitting right now. Instead of just talking in terms of annual inflation, Fed Chair Powell often talks about shorter-term annualized measures of inflation, such as the 3-month rate or the 6-month rate. The advantage of these is that they avoid some of the volatility we see in the month-to-month changes and also help to signal where the annual rate is likely to move to over time.

Unfortunately, these measures suggest that inflation, as measured by core PCE prices, is stuck around the 5% level. Over the past year or so, there has been quite a lot of volatility even in these measures, but in recent months, it does look as if this volatility has eased down and the annual, 3-month annualized, and 6-month annualized rates have all "collapsed" onto the 5% level.

Clearly, this is still well in excess of the 2% target for overall PCE prices, and it is indeed very unlikely that there can be sufficient food and energy deflation to leave core PCE inflation of 5% consistent with an annual headline PCE rate of 2%. So, these core PCE prices need to come down, and the first thing the Fed will be looking for in today’s CPI data and the subsequent PCE data is whether there are any signs of moderation emerging.

Last month’s core CPI rise of just 0.3% and 0.2% for core PCE prices were lower than most of the numbers we’ve seen recently, and we’d need to see similar figures for November to suspect that core PCE inflation might be coming down from its current level of around 5%.

But in addition to the question about the true current rate of inflation, there are also expectations for the future. On this score, there does seem to be some optimism, as many Fed officials have talked about things such as easing supply constraints, lower energy prices, a slight loosening of the labor market, and more. One other factor that’s garnered a good deal of attention is the outlook for rental prices. There are two measures of rental prices that enter into the CPI, with the shelter component that they fit into accounting for almost a third of the CPI index. But this shelter index tends to lag some way behind what’s actually going on in the rental market.

>> What hinders the FED from raising rates?

Right now, for instance, annual shelter prices in the CPI are still increasing, but measures of actual rents, such as the Zillow index, show that annual rental inflation has been coming down for at least six months. Many see this as a sure sign that core CPI inflation will decline in the future, although we do have to bear in mind that the weight of this shelter-type component in the core PCE index is only around a half of that for the CPI measure.

Nonetheless, as long as key forward-looking indicators are suggesting more modest price pressure ahead, the Fed is likely to feel that monetary tightening can be wound down. But just what would it take for the Fed to move to cut rates before the end of 2023, as the market is currently assuming?

Mr. Steve Barrow, Head of Standard Bank G10 Strategy, said the FOMC’s median forecast in September envisaged no rate cuts in 2023 despite annual PCE inflation falling from 5.4% this year to 2.8% in 2023. Since September, private sector economists in the Bloomberg survey have lifted their forecasts for PCE prices, and if FOMC officials are looking at things in the same way, it seems fair to assume that the median PCE forecast for 2023, and perhaps beyond, is more likely to rise than fall, arguably taking the Fed further away from the possibility of a rate cut in 2023, not towards it.

In Mr. Steve Barrow’s view, it will probably require a deep recession and a surprisingly sharp fall in inflation next year to put a rate cut on the table, and right now, he doesn’t think that’s likely. Instead, he sees a modest recession but also a modest fall in inflation.