Where will the terminal FED funds rate land?

The FED’s policy is front and centre of market attention but investors could do well to note some of the hints that are coming from other central banks.

FED may reduce its size of rate hike in the upcoming meetings

>> What hinders the FED from raising rates?

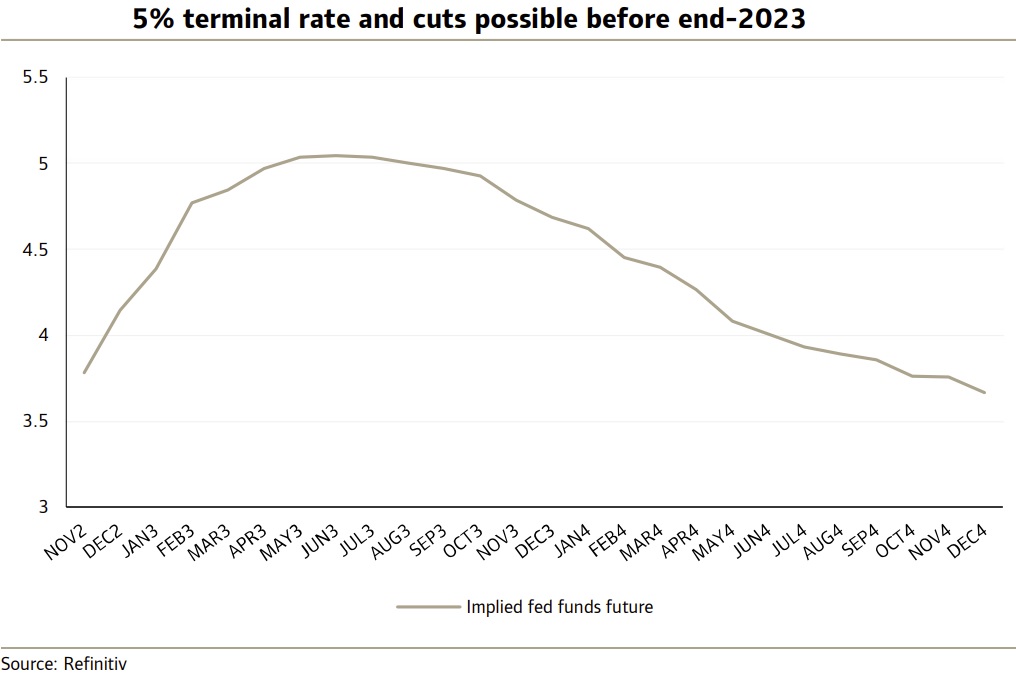

Right now, there are four things to ponder when it comes to US rate policy: the scope for smaller rate hikes, the terminal rate, the time until rate cuts, and the speed of those cuts. If we look at the fed funds futures strip, it seems to be saying the following things.

The first is that the size of rate hikes will shrink, although many Fed officials have just about said as much already.

The second is that the terminal rate will be in the region of 5%.

Thirdly, modest rate cuts could begin before the end of 2023 and lastly, rate cuts will not be at the pace of the hikes that we’ve seen given that the funds rate is seen down to around 3.75% by the end of 2024.

The last set of forecasts from the Fed show a flatter rate profile with a terminal range of 4.5%-4.75% and an end-2024 rate of 3.75%-4.0% according to the median FOMC projection. But these forecasts were made in September and we’d expect a higher terminal rate in the December Summary of Economic Projections (SEP) and possibly a higher end-2024 forecast as well.

Finally, when we look at analysts’ forecasts, the message seems to be that the terminal rate will be around 5% with the fed funds target lower than market pricing at 3% come the end of 2024.

What are the risks to this pricing? Quite clearly many of the risks are associated with the outcome of economic data, particularly on inflation. But we don’t want to talk about that here. Instead, we are more focussed on the Fed’s reaction function should data come through as most seem to be anticipating. And, on that score, it is instructive to look at the Reserve Bank of New Zealand’s policy meeting earlier this week.

Now we are not suggesting for one second that the Fed will copy the RBNZ’s 75-bps rate hike. But what we would point out is that many of the factors that drove the RBNZ to produce, not just a large rate hike, but also a 140-bps rise in its forecast for the terminal rate, are shared by the US.

There’s not just the surge in inflation but also the robustness of household spending, the tightness of the labour market, rises in wages and more. What’s notable as well about the RBNZ’s decision to push much harder on rate hikes (after 8 consecutive hikes already) is that it is doing so in full knowledge of the fact that the economy is likely to slide into recession.

>> FED may be less aggressive in rate hike

Another point to bear in mind is that, while the RBNZ’s primary target relates to inflation (as opposed to the dual inflation/employment goals for the Fed), it has been heavily leaned on by the government in recent years to take account of other factors, such as housing – and employment. Hence, Mr. Steve Barrow, Head of Standard Bank G10 Strategy, doesn’t think that the RBNZ is a million miles away from the Fed when it considers the interplay of rate hikes with its monetary policy objectives. Now this does not mean that the Fed will necessarily lift its terminal rate forecast by nearly 150-bps as the RBNZ has done (which would take it to over 6%).

However, relative to current market expectations, the risk is that the pricing of the terminal rate will have to increase to well over 5% and, if the Fed does turn out to be like the RBNZ, it is most likely to deliver on these expectations by taking the rate above 5%. Is that bad news for assets such as stocks, bonds and non-dollar currencies?

Again, much depends on how the data are coming through but if, as we’ve assumed, the data come through more or less in line with market forecasts, a higher terminal rate need not be destructive for asset prices if it leads to expectations of more aggressive rate cuts from the Fed in the future.

“Our sense is that this is how the market will react. For as the Fed gets closer to the terminal rate, the focus will not be on its level so much as the speed of the subsequent fall, and that could just help risk assets accept a higher terminal rate without too much discomfort”, said Mr. Steve Barrow.