FED may be less aggressive in rate hike

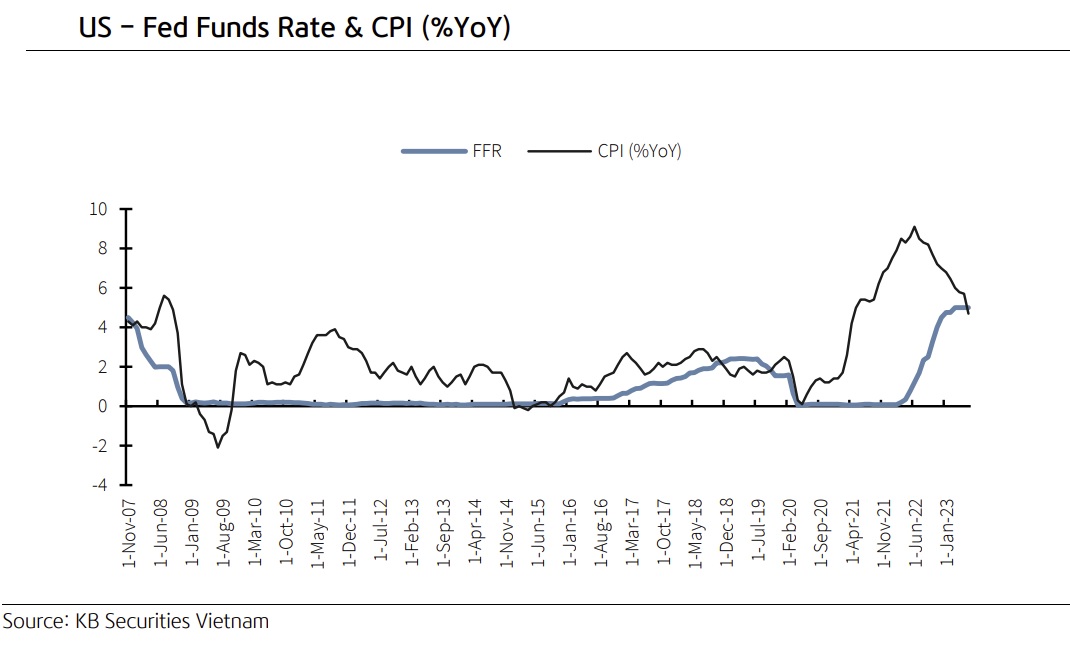

Since US inflation has decreased over the past few months, the FED may scale back the extent of its rate hike in 2023.

By the end of March 2023, the Fed Funds Rate may reach a range of 4.75%–5%. Photo: FED Chairman Powell

>> FED may trim the size of rate hikes from December

More so than was anticipated, US inflation decreased. For example, CPI increased 0.4% MoM last month and increased 7.7% YoY in 10M22, both of which were substantially slower growth rates than the 8% economists had predicted and the lowest annual inflation figure since January. Notably, the 0.3% MoM increase in core CPI (which excludes volatile food and energy prices) was lower than both the consensus estimate of 0.5% MoM and the actual increase of 0.6% MoM in September.

Key elements that impacted the US CPI in October include (i) Factors contributing to the CPI's gain: (1) Food prices increased by 0.6% MoM (compared to 0.8% MoM in September and 0.8% MoM in August); (2) Energy prices increased by 1.8% MoM as gasoline and fuel oil prices increased by 4% and 19.8% MoM, respectively; and (3) Rent continued its upward trend from the start of the year, increasing by 0.8% MoM as a result of the Fed funds rate skyrocketing. (ii) The following factors all contributed to lower inflation rates: (1) Used automobile prices declined by 2.4% MoM; (2) apparel prices fell by 0.7% MoM; and (3) medical care services fell by 0.6% MoM.

In the base case scenario, Mr. Tran Duc Anh, Head of Macro & Strategy at KB Securities, assumes that US CPI keeps growing at 0.3% MoM in the coming months until mid-2023, and core CPI should touch 4.7% YoY in May 2023. It is a relatively conservative scenario when US core CPI decreased sharply last month after peaking in July (up 0.7% MoM).

>> Many central banks reduced the size of their rate hikes

“We maintain this cautious view due to unpredictable factors related to the supply chain in light of China's longstanding zero-Covid policy, the ongoing Russia-Ukraine war,...”, said Mr. Tran Duc Anh.

Correspondingly, Mr. Tran Duc Anh believes with an anticipated 50 basis point increase this December and two additional increases of 25 basis points at its meetings in January and March of the following year, the FED will gradually boost interest rates. By the end of March 2023, the Fed Funds Rate may reach a range of 4.75%–5% (higher than anticipated given the core CPI's 4.7% YoY in May 2023), and the US central bank would maintain interest rates in that range through the end of the year in order to further monitor inflation and the state of the US economy before making the next move. It is consistent with the Fed's goal of gradually stabilizing inflation..

According to Mr. Tran Duc Anh, when the US economy exhibits definite signs of weakening in an environment with well-controlled inflation, the FED will probably lower interest rates at the end of 2023.