USD/VND rate is expected to cool down in 2023

Despite being on the increase, the USD/VND exchange rate is predicted to decline in 2023.

The State Bank of Vietnam (SBV) has decided to widen the trade band of USD/VND spot exchange rate from /-3% to /-5%.

>> Policy rate hike unavoidable to curb exchange rate, inflation risks

With effect from October 17, 2022, the State Bank of Vietnam (SBV) has decided to increase the trading range of the USD/VND current currency rate from /-3% to /-5%. After that, on October 17 the USD/VND exchange rate in the interbank market increased to VND24,320 (6.5% ytd). The USD/VND currency rate, which is controlled by the Vietnam Central Bank, was 23,586, up 1.1% mum (2.0% yoy), whereas the free market rate increased by 1.3% since the end of August 2022 (4.0% ytd).

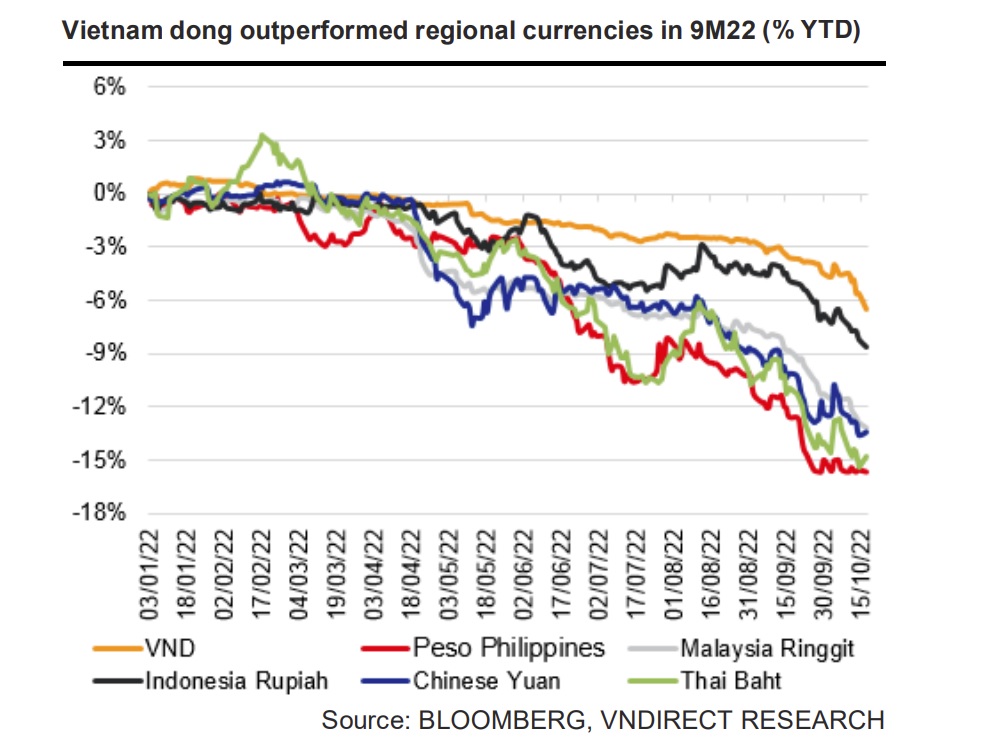

However, compared to regional currencies, the dong is still the most stable one. Since the beginning of 2022, most regional currencies have fallen by more than 8% against the USD, including Philippine Peso (-15.7% versus USD), Thai Baht (-14.8% versus USD), Chinese Yuan (-13.4% versus USD), Malaysia Ringgit (-13.2% versus USD), and Indonesian Rupiah (-8.6% versus USD).

As a result of the Fed raising rates by another 75 basis points to 3.75–4% at the previous meeting, the VND is currently continuing experiencing downward pressure. The SBV's decision to increase policy rates and the deposit ceiling for some short terms coincided with the decision to widen the trade band of the USD/VND rate, partially demonstrating the SBV's desire to maintain foreign exchange reserves, particularly at a time when Vietnam's foreign exchange reserves have been depleting. Due to the strong depreciation of many other currencies versus the USD and the fact that Vietnam is still on the US currency manipulation watchlist, the depreciation of the VND will also support the competitiveness of Vietnam's exports while giving the SBV more policy flexibility in 2023. The devaluation of the VND this year will diminish the concerns of the US Department of the Treasury.

>> Hedging against exchange rate risk

Mr. Dinh Quang Hinh, Senior analyst at VNDirect, believes that the USD/VND rate will continue to be under upward pressure in the remaining months of 2022 due to the stronger USD in the context that the FED continues its roadmap to raise interest rates. Besides, the SBV also had to sell a part of foreign exchange reserves to stabilize the exchange rate.

According to VNDirect’s estimates, foreign exchange reserves have now fallen to around 3.0 months of imports (US$89bn) from the previous level of 3.9 months at year-end 2021. Therefore, the SBV has less room to support the exchange rate than before if the USD strengthens further in the last months of 2022. So, it expected that the VND would depreciate about 6-8% against the USD in 2022 (from a previous forecast of 4%).

“For 2023, we expect the upward pressure on USD/VND rates to cool down considerably and we expect the VND to appreciate 1-2% against the USD in 2023 due to (1) a shift from "tightened monetary policy" to "normalized one" by the Fed next year, (2) a slight decline of USD interest rate in the second half of 2023, (3) an increase in VND interest rates in 2023, (4) strong buffers from higher trade surplus and balance account payment”, said Mr. Dinh Quang Hinh.