USD/VND rates remain under upward pressure

According to KB Securities, the USD/VND exchange rate is expected to rise 3.5% year on year by the end of 2023.

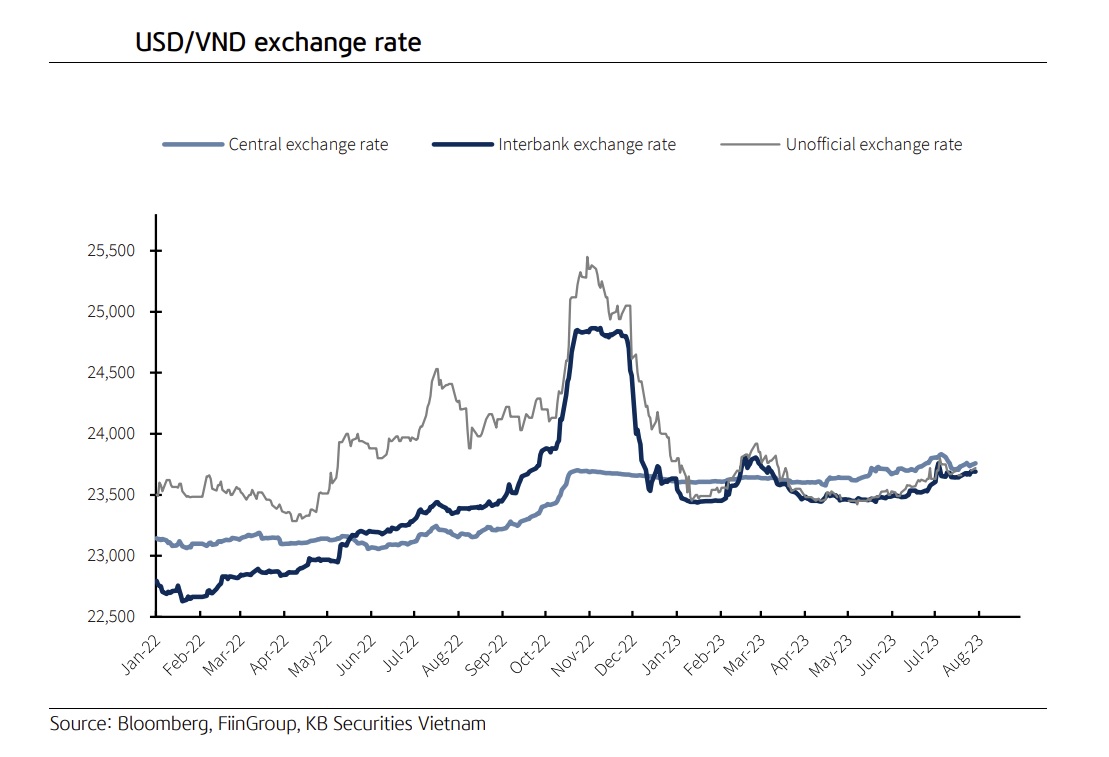

The USD/VND exchange rate fell in the first half of the year due to a falling USD and an abundance of USD supply from trade surpluses, FDI, and remittances.

>> SBV rolls out measures to reign in raising USD-VNĐ exchange rate

The USD/VND exchange rate fell in the first half of the year due to a falling USD and an abundance of USD supply from trade surpluses, FDI, and remittances. However, the DXY's rebound from July, together with the growing difference between USD and VND interest rates as a result of the SBV's softening measures, caused the exchange rate to revert to an upward trend. The interbank USD/VND exchange rate is now hovering around 24,450, up 3.4% year to date. The SBV has not made any substantial changes to the asking price, which is now approximately $25,200. However, the SBV was forced to raise the central exchange rate by 1.9% YTD to 24,065, demonstrating that it is willing to accept a higher exchange rate to assist the economy.

Mr. Tran Duc Anh, Head of Macro and Strategy at KB Securities, estimated a 3.5% YTD increase in the USD/VND exchange rate to roughly 24,460 (interbank exchange rate) by the end of this year. With the DXY and US bond yields forecast to rise further, it is probable that the SBV will continue to issue T-bills to net withdraw a maximum of VND250,000 trillion, and may even take more extreme steps if the exchange rate exceeds the 25,000 level.

According to Mr. Tran Duc Anh, the USD/VND exchange rate will be under pressure in the remaining months of the year owing to:

>> Rising USD/VND rates have mixed impacts on the economy

First, the DXY and the US bond yield would continue to rise. The third-quarter numbers show that the US economy is still in good shape. In particular, September statistics revealed that the services PMI stayed above 50 points and that nonfarm payrolls surged by 336,000 (much more than market estimates). In the same month, CPI increased again due to 1.5% MoM increases in energy expenses and 4.2% MoM increases in rentals, but core CPI fell to 4.1% YoY, as forecast. This suggests a likely slowdown in interest rate rises at the Fed's forthcoming November meeting, but it also means that interest rates will remain high for a longer period of time in the battle against inflation. Furthermore, given bond issuances to counter the US budget deficit, the US 10-year bond yield increased to a 15-year high.

Second, the Fed's and SBV's opposing policies would continue in 4Q23. This development may cause the spread between USD and VND interest rates to widen, triggering carry trade activities (investors use a low-interest-rate currency to buy a high-interest-rate currency), boosting demand for USD and putting pressure on the exchange rate.

Third, import-export demand will increase in the year-end timeframe. While imports need immediate payment in USD, manufacturing, processing, and sales procedures result in late payment collection. The short-term USD shortfall will be compensated for by the end of the year when the import-export scenario improves. As a result, despite a huge trade surplus, a short-term USD shortage owing to increased import demand and late payment collection by export firms might have an impact on the exchange rate.

Despite loosening monetary policy, the VND was one of the most stable currencies in the area in the first nine months of the year due to sufficient USD supplies. "We believe that these benefits, combined with the SBV's intervention, will keep the exchange rate from rising sharply in the final three months of the year. USD supply will continue to come from trade surplus, FDI, and remittances", Mr. Tran Duc Anh stated.