VietinBank as a Vietnam’s banking "dividend star"

Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank, HoSE: CTG) has emerged as the bank with the largest dividend payout in the sector this year.

VietinBank has set December 18, 2025 as the record date to issue shares as dividends, funded by retained earnings from the 2009–2016 period and the years 2021 and 2022.

Capital Increase to Strengthen Competitiveness

VietinBank plans to issue nearly 2.4 billion shares as stock dividends, equivalent to an issuance ratio of 44.64%. Following the issuance, the bank’s charter capital is expected to rise from nearly VND 53.7 trillion to approximately VND 77.67 trillion.

Earlier, VietinBank had set October 15, 2025 as the record date for a cash dividend payment at a rate of 4.5%, meaning shareholders received VND 450 per share. With nearly 5.37 billion shares outstanding, the bank paid out around VND 2.4 trillion in cash dividends.

For VietinBank, charter capital serves as the basis for determining limits on fixed asset investment, capital contributions, and credit extension. As such, increasing charter capital is a prerequisite for meeting business expansion needs by raising credit and investment limits. This, in turn, enhances the bank’s ability to supply credit to the economy, contributing to economic growth, social security, and the achievement of macroeconomic objectives in line with the orientations of the Government and the State Bank of Vietnam.

The bank stated that the additional charter capital will be fully allocated to business activities, distributed across VietinBank’s operations under principles of safety, efficiency, and maximizing shareholder value. Specifically, the increased capital will be used for investments in physical infrastructure and technology, service development, expansion of credit and investment activities, and other core business operations.

Scale and Advantages of a Major Bank

As of the end of the third quarter of 2025, VietinBank ranked as Vietnam’s second-largest bank by total assets, which reached VND 2.76 quadrillion. In 2024, the bank accounted for 11% of total system-wide deposits and loans. It also held significant market shares in services, including 21.2% of import-export payment transactions and 19% of card payment transactions.

In the first nine months of 2025, VietinBank’s credit growth reached 15.6%, exceeding the system-wide average of 13.37% and marking the highest growth rate among state-owned banks. On this trajectory, the bank is expected to achieve its 2025 credit growth target of 16% to 18%. Asset quality continued to improve, with the non-performing loan (NPL) ratio falling sharply to 1.09% from 1.31% at the end of the second quarter, while the NPL coverage ratio rose to 176.48%, the second-highest in the industry.

Earnings Outlook and Valuation

Regarding business prospects, Saigon–Hanoi Securities (SHS) noted that VietinBank is entering a peak period for recognizing positive earnings results, driven by declining credit costs after a prolonged phase of aggressive provisioning for bad debts. SHS revised its 2025 pre-tax profit forecast upward by 6% to VND 40.595 trillion, representing year-on-year growth of 28%. This growth is underpinned by better-than-expected asset quality and the fact that tariff-related risks have not yet materially affected operating results.

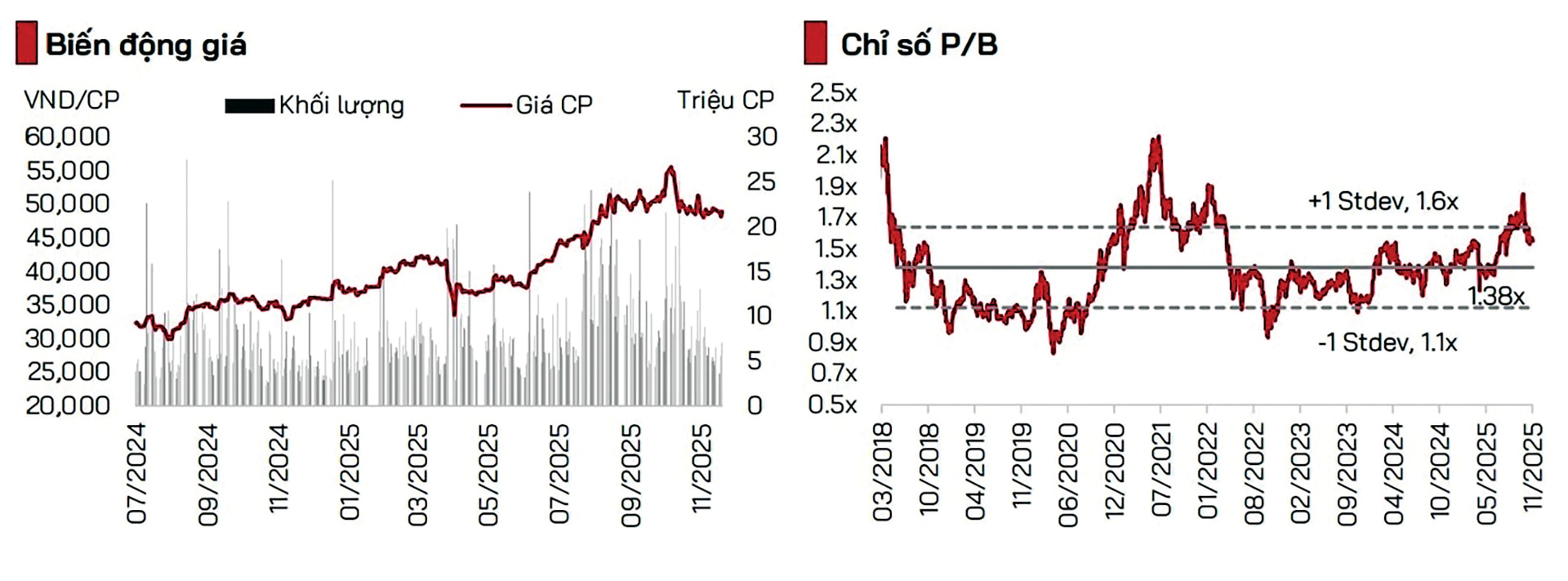

SHS also observed that VietinBank’s return on equity (ROE) as of the end of the third quarter of 2025 had surpassed its 2021 peak. However, the bank’s price-to-book (P/B) ratio remains significantly below its previous high, supporting expectations for a potential valuation re-rating.

An update through the end of November 2025 showed that credit growth remained at 15.6%, unchanged from the end of the third quarter as outstanding loans had nearly reached the allocated credit limit, prompting the bank to focus more on credit quality control. The NPL ratio edged up slightly to 1.2%. According to SHS, key risks for VietinBank include sector-wide net interest margin (NIM) compression, tariff risks and trade tensions that could become more pronounced in 2026, and potential pressure on asset quality following a period of rapid credit expansion.

Similarly, Ho Chi Minh City Securities (HDS) highlighted risks such as persistently low lending rates weighing on NIM, especially as deposit rates show signs of rising. In addition, provisioning expenses could increase again if credit risks escalate in line with the economic cycle.