Vietnam's securities market: Optimism and cashflow fuel sector-wide growth

Market optimism, stronger management of risky assets, and active capital raising are laying a solid foundation for the Vietnam securities industry’s expansion.

Viet Nam’s securities sector is gaining momentum in the second half of 2025, supported by improving asset quality, stable profitability, and robust capital mobilisation, according to VIS Rating.

Profitability on the Rise

Declining bond default rates and efforts to resolve risky assets have helped stabilise asset quality, while a high collateral coverage ratio continues to control risks from margin lending. Profitability remains strong as firms keep credit losses under control and maintain healthy returns on equity.

The share of high-risk assets—such as unlisted stocks and corporate bonds—rose slightly to 20% in Q2 2025 from 19% in Q1, driven by HDBS, TCBS, and BSI increasing their corporate bond holdings amid declining default rates, VIS Rating reported.

Firms holding overdue corporate bonds such as VNDirect (VND, rated A–/Stable) and TPS (BBB/Stable) have been accelerating bond resolution and minimising credit losses. Improved access to bank financing by issuers has also contributed to stabilising asset risk.

Asset risks from margin loans remain under control thanks to high collateral ratios, though experts warn that some brokerages affiliated with private banks face concentration risks with large clients.

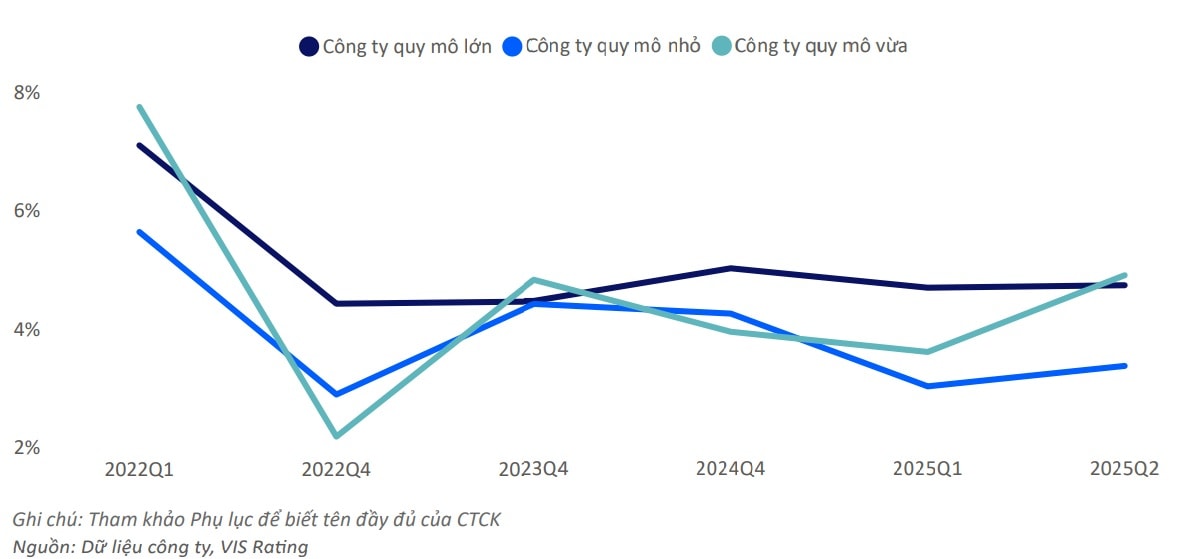

Buoyant stock trading and positive investor sentiment are expected to drive industry-wide profitability. The sector’s average return on average assets (ROAA) rose by 70 basis points quarter-on-quarter to 4.9% in Q2 2025, boosted by strong gains in proprietary trading, bond advisory, and margin lending income.

Brokerages with large bond portfolios such as TCBS and HDBS posted ROAA increases of between 2 and 9.5 percentage points from the previous quarter, driven by higher investment income and bond advisory fees. Surging stock trading volumes also boosted margin lending income at major firms such as VPBankS and SSI.

According to VIS Rating, profitability among firms with large equity portfolios shows clear divergence. Mid-sized firms such as VIX, SHS (A/Stable), and CTS benefited from improved market valuations, while others—such as VDS, VCI, and FTS—recorded portfolio losses.

“We expect the industry’s profitability to continue improving in the second half of 2025, supported by positive equity market sentiment and Viet Nam’s upgrade to ‘Secondary Emerging Market’ status under FTSE Russell’s classification. This will spur income growth from investment, margin lending, and corporate advisory services,” noted analysts at VIS Rating.

Industry leverage increased slightly to 2.6x in Q2 2025 from 2.4x in Q1, as bank-affiliated brokerages (e.g., SHS, TCBS, VPBankS) boosted short-term borrowings to support margin lending and corporate bond investments.

Some firms, such as HCM and MBS (A/Stable) for margin lending and VND for bond investment, are approaching regulatory limits and will need to raise additional capital to expand.

VIS Rating’s sector update noted that while leverage edged higher due to short-term borrowing, upcoming IPOs and share issuances—potentially adding up to 25% of equity capital for several large firms—should strengthen business capacity and contain leverage, especially as companies scale up in 2026. Conversely, some smaller firms (e.g., CTS) may remain dependent on external borrowing.

Industry cash inflow/outflow ratios slipped slightly to 100% in Q2 2025 from 102% in Q1, reflecting increased short-term borrowing by bank-affiliated securities firms such as VPBankS, TCBS, KAFI, and LPBS.

“We assess liquidity risks as manageable, with firms actively issuing long-term bonds (e.g., ACBS, SHS), launching new capital increases (e.g., VPBankS, TCBS, KAFI), and maintaining effective access to bank credit lines (e.g., CTS, LPBS),” said Nguyen Duc Huy, CFA, Head of Research at VIS Rating.

Anticipating a Wave of Major IPOs

Following the resounding success of TCBS’s IPO—where investor demand far exceeded supply at an issue price of VND 46,800 per share, raising about VND 10.82 trillion (US$410 million)—the capital-raising “playground” is expected to welcome a new wave of blockbuster offerings.

The next landmark event will be VPBankS’s IPO, set to become the largest in Viet Nam’s securities industry history. The company and its underwriters (Vietcap, SSI, SHS) will accept subscriptions from 8:00 on 10 October to 16:00 on 31 October 2025. A total of 375 million shares will be offered at VND 33,900 per share, representing 25% of post-issue capital, and expected to raise VND 12.7 trillion (US$481 million)—valuing the firm at over US$2.4 billion.

Ahead of the IPO, VPBankS announced robust results for the first nine months of 2025, reflecting strong growth across multiple segments. Interest income from loans and receivables—mainly margin lending—reached nearly VND 1.213 trillion, almost double year-on-year. Brokerage income rose to VND 310 billion, while financial advisory revenue surged to VND 789 billion, driven by strong deal flow in both debt (DCM) and equity (ECM) markets.

Gains from financial assets at fair value through profit or loss (FVTPL) reached VND 2.999 trillion—nearly four times higher year-on-year—bringing total operating income to VND 5.457 trillion, triple the same period last year.

Despite rapid revenue growth, VPBankS maintained high operational efficiency, with a cost-to-income ratio (CIR) of 18.7%. Pre-tax profit for the nine months hit a record VND 3.26 trillion, nearly four times higher year-on-year, achieving 73% of its full-year target (VND 4.45 trillion—the second highest in the industry).

By the end of Q3 2025, VPBankS’s margin loan balance reached VND 26.664 trillion, up VND 9.011 trillion (51%) from the previous quarter and nearly triple the start of the year. The firm attributes this to its competitive margin products, simplified procedures, and broad customer appeal, supported by strong, low-cost funding from its parent VPBank (HoSE: VPB).

With equity capital of VND 20.273 trillion, VPBankS still has lending headroom exceeding VND 13.5 trillion, positioning it to capture strong growth as foreign inflows rise following the market upgrade.

Total assets reached VND 62.127 trillion by end-Q3 2025—more than double the start of the year—placing VPBankS among the market leaders.

Following VPBankS, VPS has also announced plans for an IPO, proposing the issuance of 710 million shares (a 1:1.25 bonus share ratio) to increase charter capital from VND 5.7 trillion to 12.8 trillion.

VIS Rating concludes that with sustained market optimism, proactive risk asset resolution, and aggressive capital raising, Viet Nam’s securities industry is building a strong foundation for stable growth and expanding scale as it enters 2026.