Wary of gold prices reversal in short-term

Gold prices have surged dramatically in response to the Israel-Iran conflct. What would happen to gold prices if the two parties stop repaying one other?

>> Gold price next week: three big leverages

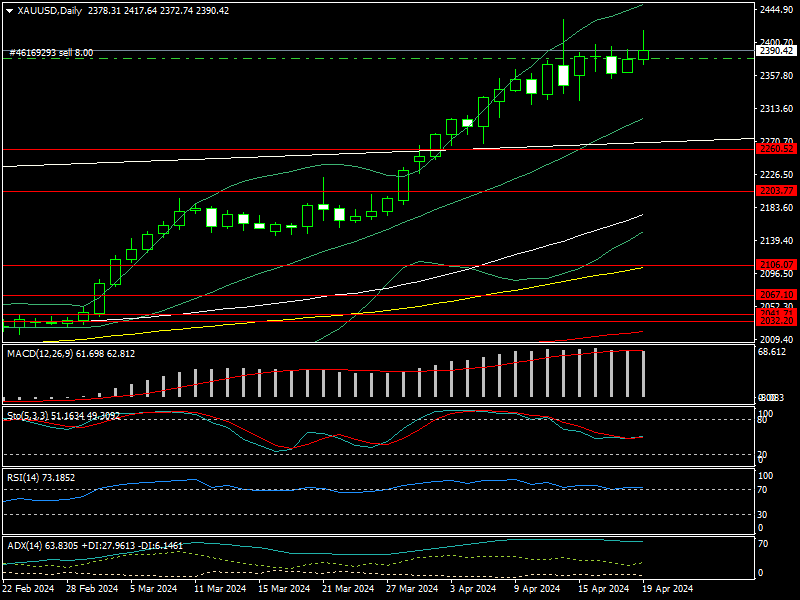

This week, the spot gold price climbed beyond $2,400/oz to $2,417/oz before dropping and closing at $2,390/oz.

In the Vietnamese gold market, the price of SJC gold bars has also climbed marginally, hovering about VND 84 million per teal.

Gold prices soared beyond $2,400/oz on April 19th, following reports that Israel carried out a limit ed military attack against Iran in revenge for Iran's drone and missile attack over the weekend. So far, Israel has not recognized the offense, and Iran has refused to confirm that Israel carried out the strike.

Iranian Foreign Minister Hossein Amirabdollahian stated that it was not an attack. Iran has no plans to react unless Israel launches a retaliation assault against Iran.

Many analysts think that the Middle East war will not end as long as Israel and Iran continue to launch military strikes on each other. However, the Israel-Iran confrontation is unlikely to expand into a broad war, as both parties face major implications if the conflict worsens. As a result, gold's safe haven status is expected to deteriorate, prompting investors to focus on the Fed's monetary policies.

This week, Federal Reserve Chair Jerome Powell startled investors with a quick hawkish statement. Powell said at an event in Washington, D.C., that the revelation of hotter-than-expected inflation statistics has reduced the central bank's confidence in its ability to decrease interest rates.

>> What potential risks for gold price next week?

Following the Fed Chairman's statements, some investors may be willing to take some of their gold profits off the table. The Bank of America Fund Manager survey indicates that gold is overbought.

According to CME Fedwatch, there is presently a 16.2% possibility that the Fed will decrease interest rates by 0.25% at its June meeting. This rate has reduced significantly since roughly a month ago. As a result, if oil prices continue to climb rapidly, the Fed is likely to postpone long-term interest rate decreases, boosting inflationary pressure in the near future.

Lukman Otunuga, Manager of Market Analysis at FXMT, stated that while gold is stabilizing, it is not a market on which investors should bet.

"Gold's rapid rise above $2400 this morning demonstrates how anxious markets are in response to Middle East concerns," he added. "Although gold has given back most of its gains after Iran minimized the impact of Israel's assault, the path of least resistance leads north. The upcoming US Q1 GDP and PCE report, which might affect Fed cut bets, may cause additional volatility in the precious metals market this week. Technically speaking, bulls must sustain prices above $2355 in order to challenge $2400 and beyond. Weakness below $2355 may create a road back to $2320 and $2300", said Lukman Otunuga.