What potential risks for gold price next week?

While gold prices have gained considerably this week, U.S. employment data and the Fed Chairman's comments might put them at danger next week.

>> Gold prices next week: Two unforeseen impacts

This week, the worldwide gold price climbed from $2,163/oz to $2,236/oz before closing at $2232/oz.

In the Vietnamese gold market, the price of SJC gold bar has increased from VND 79.75 million to VND 81.4 million.

International gold prices climbed dramatically this week as the US economy expanded faster than predicted in the fourth quarter of 2023, albeit at a slower rate than in prior quarters. Meanwhile, the US inflation continues to fall. Investors expect the Fed will struggle to resist interest rate decreases beginning in June of this year.

Gross domestic product expanded at a 3.4% annualized rate last quarter, up from the previously reported 3.2% pace, according to the Commerce Department's Bureau of Economic Analysis' third estimate of fourth-quarter GDP.

The revision included increases in consumer expenditure, corporate investment, and state and local government spending, which offset declines in inventory accumulation and exports. Reuters polled economists, who predicted no revisions to GDP growth.

Consumer spending, which contributes for more than two-thirds of US economic activity, grew by 3.3%, contributing 2.20 percentage points to GDP growth. It was earlier predicted to have expanded at a 3.0% rate. The upward modification was in services.

The increase in corporate spending represented bigger outlays for manufacturing, commercial, and healthcare structures than previously expected. Spending on intellectual property items was also increased, although the fall in equipment outlays was not as severe as originally thought.

Thus, the US economy remains reasonably positive, although a considerably slower fall than in the third quarter of 2023 (4.9%), following a 525-basis Fed rate rise since March 2022 to manage inflation.

>> US inflation may "shock" gold prices next week

Furthermore, the US Department of Commerce said that its core Personal Consumption Expenditures price index rose 0.3% last month. The figures climbed in line with economists' predictions.

However, as a hint that inflationary pressures are not abating, the report indicated an upward revision for January, with core inflation climbing by 0.5%.

Consumer price pressure has eased over the previous 12 months, reaching 2.8% in February. Although inflation remains significantly over the Federal Reserve's 2% objective, it is gradually declining.

According to the data, headline inflation increased by 0.3% last month, which was somewhat less than projected. Economists were expecting a 0.4% gain. Headline inflation increased by 2.5% year on year, as expected.

Although gold is finishing a shorter trading week on a high note, the coming week brings additional concerns. The U.S. labor market will be the focus of next week's economic calendar, with the highlight being March's nonfarm payrolls data on Friday.

The week also offers an impressive lineup of central bank speakers, including Federal Reserve Chair Jerome Powell, who will talk at Stanford's Business, Government, and Society Forum.

Among these, the non-farm payroll (NFP) data for March 2024 forecast just 198,000 jobs, up from 275,000 the previous quarter. If this projection is correct, it supports expectations that the Fed will lower interest rates as expected, causing the price of gold to rise next week. However, if the NFP climbs much more strongly than expected, gold prices will fall next week. Not to mention the tone the Fed Chairman will strike in his address next week.

Mr. Colin, an FX analyst, believes that if the US economy slows, gold prices will increase even more, masking the risk of a recession, particularly when the bond yield curve reverses. As a result, the Fed plans to cut interest rates at least three times this year. Furthermore, central banks continue to acquire gold, which will boost long-term gold prices. However, investors, particularly ETFs, would be put at risk by the short-term increase in gold prices.

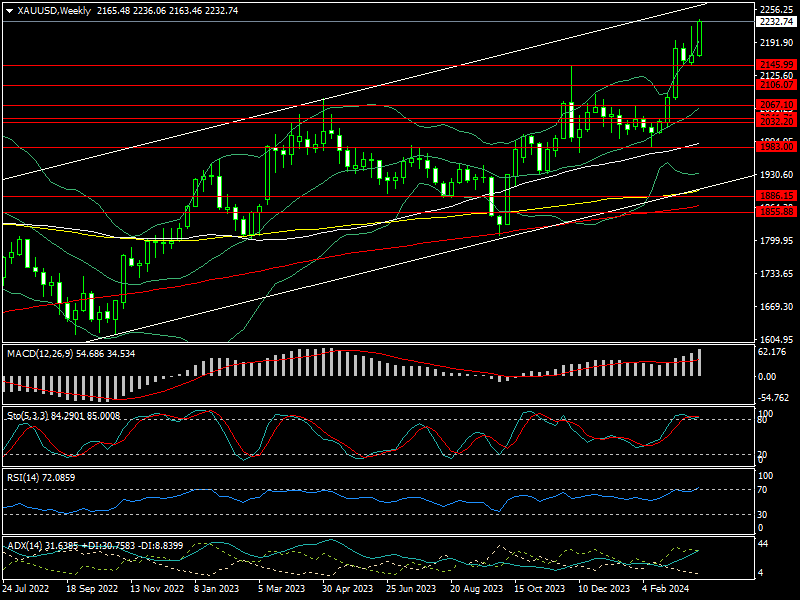

According to technical analysis, the price of gold remains in the uptrend on the weekly chart. As a result, if gold prices pass the $2,270-2,280/oz range next week, they may increase further to $2,300/oz. In contrast, the price of gold next week may experience end-of-life pressure, with support levels around $2,145, $2,106, and $2,080/oz, respectively.