US inflation may "shock" gold prices next week

US inflation has increased faster than anticipated, raising concerns that the Fed will continue to delay interest rate cuts. This may put the gold price under pressure.

The price of the SJC gold bar dropped from VND 78.85 million to VND 77.69 million before recovering to VND 78.95 million.

>> Two factors to drive gold prices next week

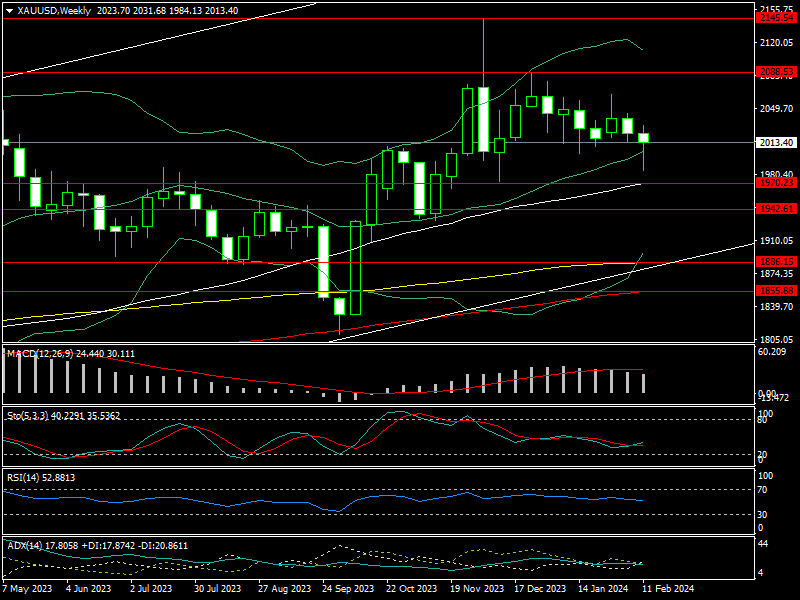

This week, the global gold price fell from $2,031/oz to $1,984/oz, then recovered to $2,0215/oz before closing the week at $2,013.

In the Vietnamese gold market, the price of the SJC gold bar dropped from 78.85 million to 77.69 million before recovering to 78.95 million.

Gold prices have continuously fallen in recent trading sessions as US inflation data continue to grow faster than projected, despite the fact that inflation has fallen considerably from its high in 2022.

According to the Labor Department's Bureau of Labor Statistics, the US producer pricing index (PPI) for final demand increased 0.3% last month, the most since August 2023, after falling by a corrected 0.1% in December. Economists surveyed by Reuters expected the PPI to rise 0.1% after falling 0.2% before. The PPI rose 0.9% in the year ending in January, following a 1.0% gain in December.

According to a Reuters survey, the U.S. Consumer Price Index (CPI) for January 2024 jumped by 3.1%, far more than the projected 2.9% increase.

Based on CPI and PPI data, experts predict that the U.S. core personal consumption price index (PCE) for January 2024 (excluding food and energy) will grow by 0.4%. The core PCE is expected to be 2.9% for the year ending in January.

Notably, the University of Michigan reported that its preliminary consumer sentiment index increased to 79.6, up marginally from 79.0 in January. The report is basically in line with predictions, with analysts anticipating a value of around 80. At the same time, inflation expectations are generally stable and within their range. According to the research, shoppers expect inflation to reach 3% by this time next year. Expectations are only a bit higher than the 2.9% reported in January.

>> Next week's gold price: Impacts from US inflation

Analysts note that gold has suffered as higher-than-expected consumer and producer prices cause investors to postpone the start of the Federal Reserve's easing cycle. Markets see only a 10% likelihood of a March rate decrease, while the CME FedWatch Tool predicts only a 33% possibility of a change in May. However, there are still strong predictions that the US central bank would begin lowering interest rates in June.

Mr. Colin, an independent foreign exchange specialist, believes that while gold prices may remain under pressure in the near term, the price of gold will climb in the long run.

"The gold price is expected to remain stable until we know more about the Fed's planned interest rate decreases. While gold's price may fall lower, it will surge dramatically when the Fed begins decreasing interest rates for the first time in this cycle," Colin said.

From a technical standpoint, the price of gold is expected to decline further in the near term before recovering. As a result, if the price of gold remains over $1,970/oz (MA50) next week, it may continue to accumulate until there is fresh support to push the gold price higher. However, if the price of gold falls below this level next week, it may fall to $1,886/oz (MA100), followed by $1,855/oz (MA200) in the near future.

Next week, in addition to the FOMC meeting minutes, only flash US PMI, weekly jobless claims, and US existing home sales will be issued. These numbers may not have a significant influence on the gold price next week.