Gold prices next week: Two unforeseen impacts

The Fed Chairman's testimony to Congress and February's nonfarm payrolls data (NFP) are expected to have a significant influence on gold prices next week.

Investors will be anticipating what Federal Reserve Chair Jerome Powell will say during his two-day testimony before Congress.

>> US inflation may "shock" gold prices next week

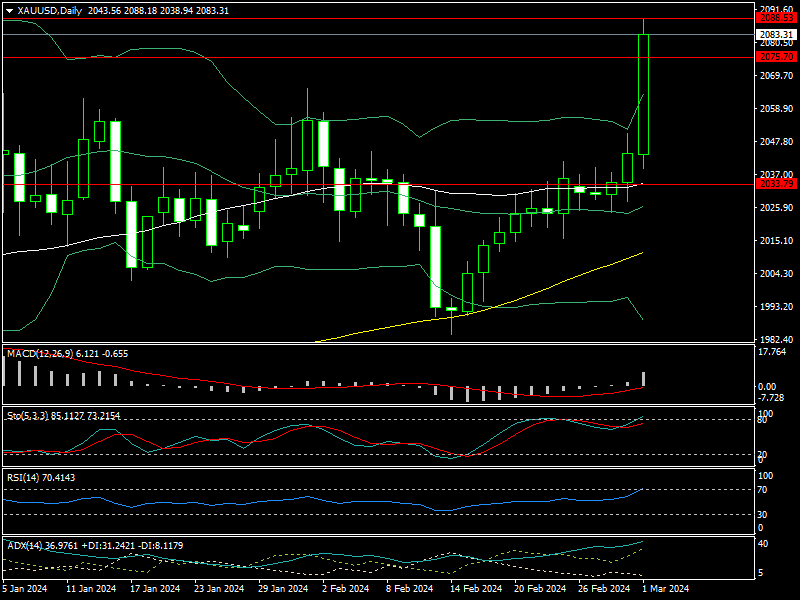

This week, the world gold price rose substantially from $2,024/oz to $2,088, closing at $0,083.

In the Vietnamese gold market, the price of SJC gold listed by DOJI rose from VND 78.85 million to VND 80.95 million.

Gold prices jumped substantially this week as US inflation rose marginally, as predicted and primarily due to seasonal reasons, implying that this increase would not persist long, leading investors to expect the Fed to decrease interest rates shortly. The personal consumption expenditures price index, excluding food and energy expenses, rose 0.4% in the month and 2.8% year on year, as forecast by Dow Jones analysts. The monthly growth in December was only 0.1%, compared to 2.9% the previous year.

Headline PCE, which includes the volatile food and energy categories, up 0.3% monthly and 2.4% year on year, as expected, according to data issued Thursday by the Commerce Department's Bureau of Economic Analysis. The respective December figures were 0.1% and 2.6%.

Stephen Gallagher, chief U.S. economist at Societe Generale, stated, "Overall, PCE is matching forecasts, and some of the market's greatest worries were not realized. The essential point is that we are not witnessing the large-scale increases that we had feared”.

>> Two factors to drive gold prices next week

According to some analysts, gold may face a severe test next week when the nonfarm payrolls report for February is released. At the same time, investors will be anticipating what Federal Reserve Chair Jerome Powell will say during his two-day hearing before Congress.

Gold prices next week may be going sideways

Colin, an FX expert, stated that he will likely pay more attention to labor market data next week, since it may have a greater influence on the US dollar. "We basically know what the FED Chairman is going to say: interest rates will fall, but not soon. The FED will continue to examine incoming data. Weak employment growth might maintain the gold surge," added Colin.

Analysts at CPM Group are likewise skeptical that the gold market can maintain Friday's advances since it is trapped in a well-defined trading pattern.

"Gold prices are currently approaching $2,100 after solidly breaking over $2,050 this week. The market looks to be hunting for reasons to be long gold while also taking profits as technical resistance levels are challenged. It is uncertain if gold prices will continue to rise in the near future, but they have already achieved significant gains, suggesting the possibility of a short-term drop in profit-taking. A price retraction might send gold back around $2,075 or lower, creating a possible buying opportunity if the rising momentum continues", said analysts at CPM Group.