What are the prospects of Vietnam stock market in H2?

PHS’s analysts said, in 2021, VN-Index's forward P/E ratio remains at an attractive level of 14-15x, so VN-Index would go higher.

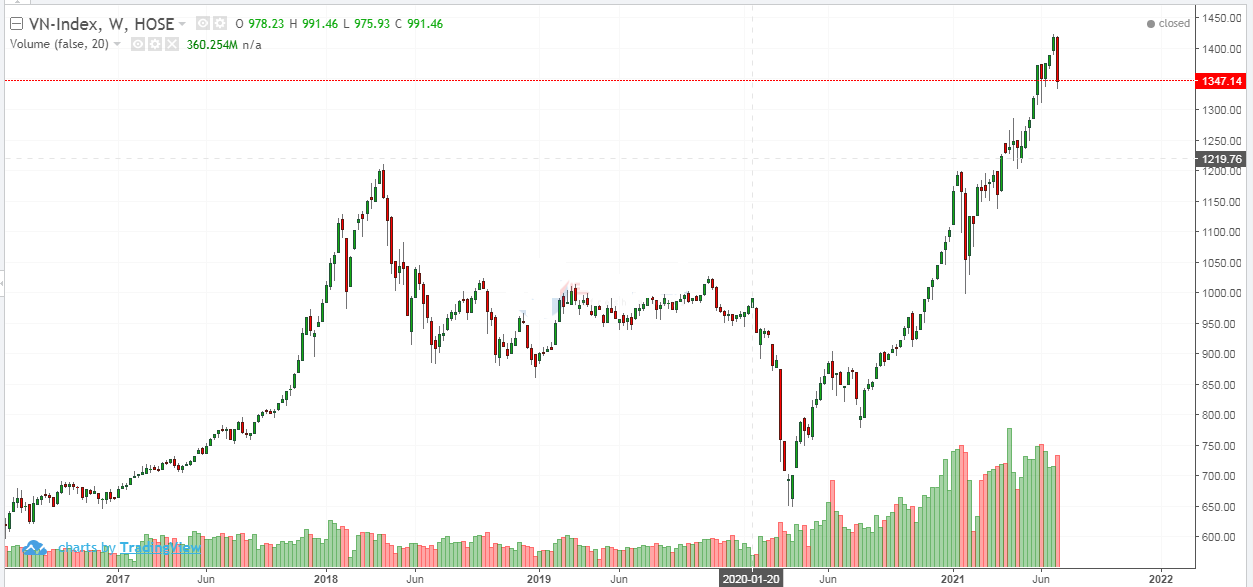

VN-Index is forecasted to continue an uptrend

At the end of June, VN-Index set a new record high of nearly 1,420 points, recording an increase of 28.6% in 6M 2021 and 72.1% in the last 12 months. While liquidity also set a new record with the average trading value in June 2021 of VND 23,807 billion/session, 3.53x higher than the same period last year (VND 6,748 billion/session). Notably, the trading session on 4 June was VND 30,883 billion on the HOSE.

The transaction size officially surpassed the Singapore market, reaching the 2nd position in Southeast Asia (after Thailand). A higher record of trading value is expected to continue in the coming time.

The number of new accounts opened in May reached a record of 114,107 accounts. In which, domestic individuals accounted for 113,543 accounts. Total trading accounts, as a result, reached 3,254,169, accounting for 3.32% of the population.

The securities market capitalization reached 126% of GDP in May 2021, an increase of 15.97% in the first 5 months and 36.91% in the last 12 months. In which, the stock market capitalization alone accounts for 104% of GDP.

The trading value of domestic investors in June 2021 soared 278% YoY and accounts for 92.4% of total trading value, while the trading value of foreign investors just rose 78% YoY and accounted for 7.6%, reducing from last year level of 14.9%.

In 6M 2021, net buying of domestic investors reached VND 43,512 billion, while domestic institutional investors and foreign investors reported VND 12,414 billion and VND 31,098 billion net selling respectively.

The strong cash flow of domestic individual investors came from idle money which is seeking a better profitable channel instead of traditional savings. The deposit growth has declined continuously from 12.2%YoY in January 2020 to 3.64% YoY in January 2021. Meanwhile, the stock market capitalization growth of 21.3% YoY in January 2021.

The macroeconomics continues to justify the moving domestic cash flows to the stock market. Mr. Duc Trieu, PHS’s investment strategy analyst expects this trend will remain at least until the end of 2021 and early 2022 because:

First, interest rates may increase from Q3 2021. However, it may not see a sudden sharp rising because inflation pressure is still low and the economy needs time to recover from the 4th pandemic outbreak.

Second, the demand for corporate loans in the short term is not large. “We found that the financial investment portfolio of listed companies increased by 26% YoY, while total debt only rose 9.85% YoY. Companies have room for a capital injection from reallocating existing assets before making new loans”, Mr. Duc Trieu said.

Third, the amount of cash flow withdrawn from securities to the production sector is not expected to be too large, thereby not affecting the market much in the short term, because transactions conducted by domestic institutional investors only account for 5.3% of the total market trading value.

Although the VN-Index has increased by 72.1% YoY, Mr. Trieu Duc believes that the current valuation of the Vietnam market is cheap compared to other Southeast Asian markets thanks to (1) market profits increased by 91% YoY in Q1 2021, and (2) increase in potential valuation due to low interest rates, while other investment channels are less attractive.

As of 30 June 2021, the P/E of the VN-Index was 19.2x, 21% lower than the average P/E in the frontier market group (24.3x) and 19% lower than the emerging market group (23.6x). In 2021, the profit growth of the whole market is expected to increase by 30-34%, making Forward P/E attractive at 14-15x. “We think that VN-INDEX would continue to head to 1,450-1,500 points in 2H2021, corresponding to a target PE of 20x”, Mr. Trieu Duc forecasted.