What businesses benefit from the USD/VND rate reduction?

Numerous evidence suggest that by the end of the year, the USD/VND exchange rate will have stabilized and may no longer vary within the desired range.

Certain business sectors in Vietnam are projected to benefit from these exchange rate fluctuations.

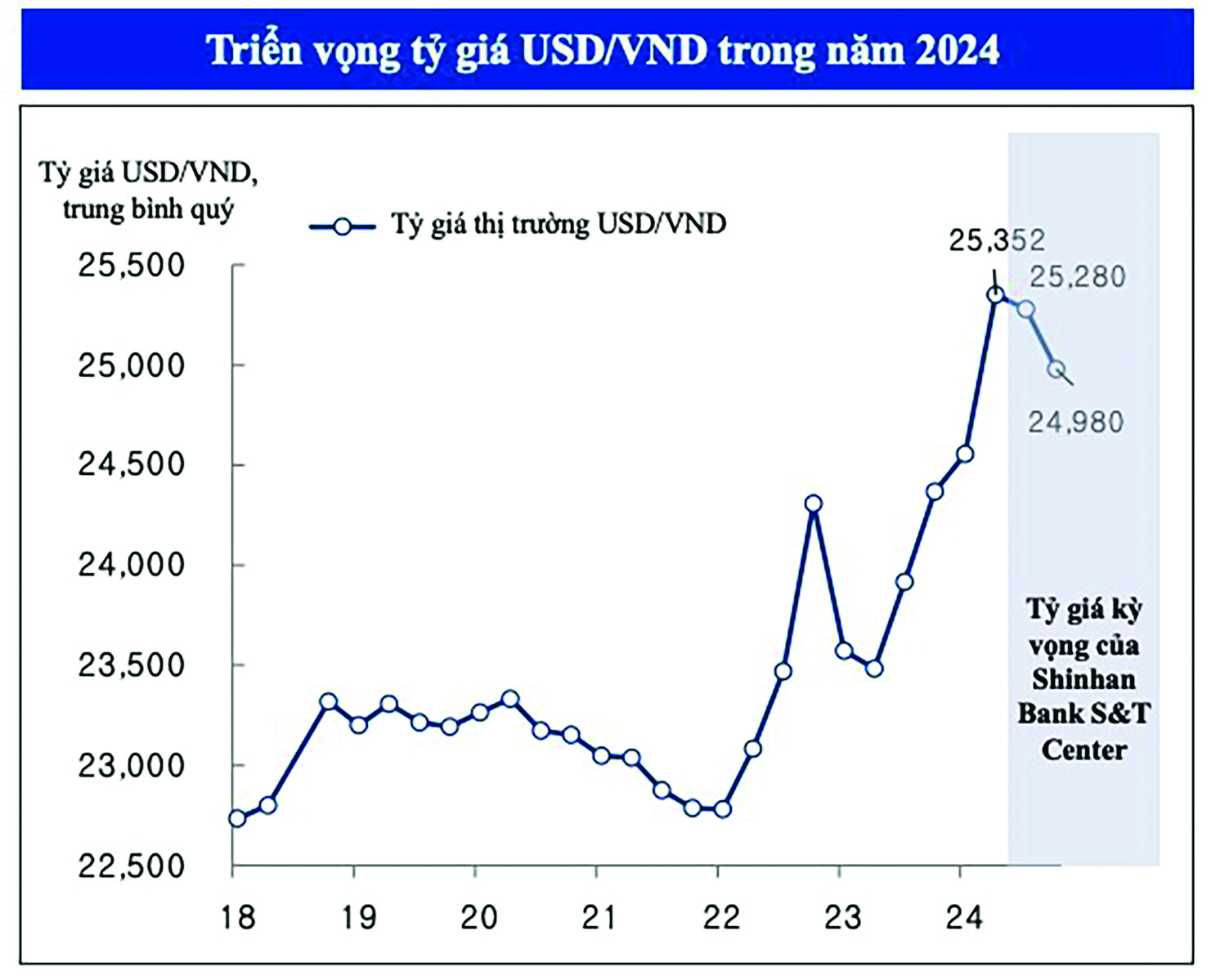

VND/USD Exchange Rate Outlook 2024

Trend of VND Recovery

On July 19, 2024, the State Bank of Vietnam (SBV) announced a central rate of 24,251 VND/USD, a 5 VND reduction. Meanwhile, USD purchasing and selling prices at commercial banks fluctuated between 25,084 and 25,143 VND/USD, which was lower than the previous trading week.

In the worldwide market, the USD Index (DXY) finished at 104.36 on July 20, up slightly. Suan Teck Kin, Head of Global Market and Economic Research at UOB Group, believes that the greenback's fast slide to about 104 is notable. Suan Teck Kin believes that the Federal Reserve (FED) will decrease interest rates by 0.25% each in September and December 2024.

“We see the possibility of the VND recovering in the second half of 2024 alongside the recovery of the Chinese Yuan (CNY) and the broad weakening of the USD as the FED's rate cuts take effect. We expect the VND to gradually strengthen against the USD to 25,200 VND/USD in Q3 2024 and 25,000 VND/USD in Q4 2024,” stated Suan Teck Kin.

Similarly, Lee Young Hwa, Senior Economist at Shinhan Bank, believes the USD/VND exchange rate may continue to face depreciation pressure in the short term due to negative external conditions such as the Middle East conflict, widening interest rate differentials with the US, and China's economic downturn.

Furthermore, the recovery of the manufacturing and export sectors, along with SBV's intervention in selling gold and foreign currency reserves, has helped mitigate the rise in the USD/VND exchange rate. However, the VND may experience slight depreciation and is expected to recover after the FED pivots its monetary policy, coupled with increased public investment spending and strong FDI inflows. Shinhan Bank forecasts that the USD/VND exchange rate will peak in Q3 2024 and then cool down. The average USD/VND exchange rate for 2024 is projected to be 25,040 VND.

Benefiting, but with Caution

If US inflation data continues to decline, the FED may implement an early rate cut to minimize risks and stabilize the macroeconomy. This would likely reduce the pressure on SBV to sell foreign exchange reserves. To date, SBV's foreign exchange reserve sales are estimated to have surpassed USD 6.5 billion to intervene and stabilize the foreign currency supply.

Expectation of Reduced Pressure on SBV to Sell Foreign Exchange by Year-End. (Illustrative Image)

With the anticipated cooling of the USD/VND exchange rate, sectors that could benefit from this include exports, steel, oil and gas, and industries related to FDI inflows (real estate, manufacturing, retail) or public investment spending (construction materials, monetary and fiscal policy support, growth promotion), and banks (foreign exchange business).

However, experts warn that beyond the exchange rate, the potential impact of the US presidential election results should not be overlooked. “If Donald Trump is re-elected as US President, there is a high likelihood of significant changes in trade policy with Vietnam as the US tightens its protectionist policies. A large trade surplus with the US could pose challenges for Vietnam,” according to Shinhan Bank experts.

Back in February 2024, Trump announced that he would consider imposing tariffs of up to 60% or higher on Chinese imports, as well as a 10% tariff on all imports into the US if re-elected. Suan Teck Kin believes this implies that Vietnamese enterprises with Chinese-origin products must exercise caution when exporting to the US.

Given this outlook, many experts advise businesses to diversify their export and import markets, choose advantageous payment currencies, engage with banks with strong trade finance capabilities, and use derivative financial instruments to hedge against exchange rate risks. Additionally, businesses should accelerate digitalization, reduce costs, enhance human resource management, and invest sustainably to optimize costs and offset potential tariff increases.