What if either Donald Trump or Kamala Harris wins?

The election is happening in the US and, in the past we’ve spoken about what might happen to bond and currency markets if either Trump or Harris wins. But what if neither is declared a winner?

Presidential elections that are not close are usually called before the end of election day. That’s what happened in the 2012 election when Barack Obama was widely declared the winner just before midnight on election day. Obama trounced Mitt Romney in the electoral college by a majority of 126 electoral college votes. In 2020, it took four days until Biden was declared the winner over Trump. His electoral college win was by 306 votes to 232; a majority of 74. If we go back to 2000, the final result in favour of George W. Bush over Al Gore was not declared until December 12th, when Bush won the electoral college by just 5 votes.

In addition to the closeness of the election results in the key states that could delay the result, there is also the issue of how long it takes to count votes with more and more mail-in votes adding to the delay as these take longer to count than in-person votes. This alone could add a few days of uncertainty.

What will the market do at this time? Much clearly depends on whether one or other candidate seems very likely to take the victory even if the final outcome has not been declared. A hefty ‘lean’ towards a Trump win will presumably lift the US dollar and vice versa should Harris appear to be ahead as the count continues. We saw the most volatility in recent times during the 2000 election. That is because the market initially responded to one outcome (a Bush win) but then had to adjust because a recount could have tipped the result Gore’s way.

Initially, Bush’s apparent win on election day saw the US dollar rally, but when Democrat challenger Al Gore rescinded his concession, the US dollar fell back, and the early 2.5% rally on the DXY index in the US dollar gave way to a slide of near 5% as the market reasoned that the recounting of votes in Florida could swing the election Gore’s way.

In the end it did not, but the net result was that the US dollar had fallen between election day and the day that Bush was formerly declared the winner just over a month later. Biden’s four-day wait to be declared president in 2020 also saw the dollar decline, albeit modestly. Now whether the dollar’s decline then, and back in 2000 was due to the uncertainty of the outcome, or the fact that a Democrat won (in Biden’s case) or could have been handed victory on a recount (in Gore’s case), is difficult to say.

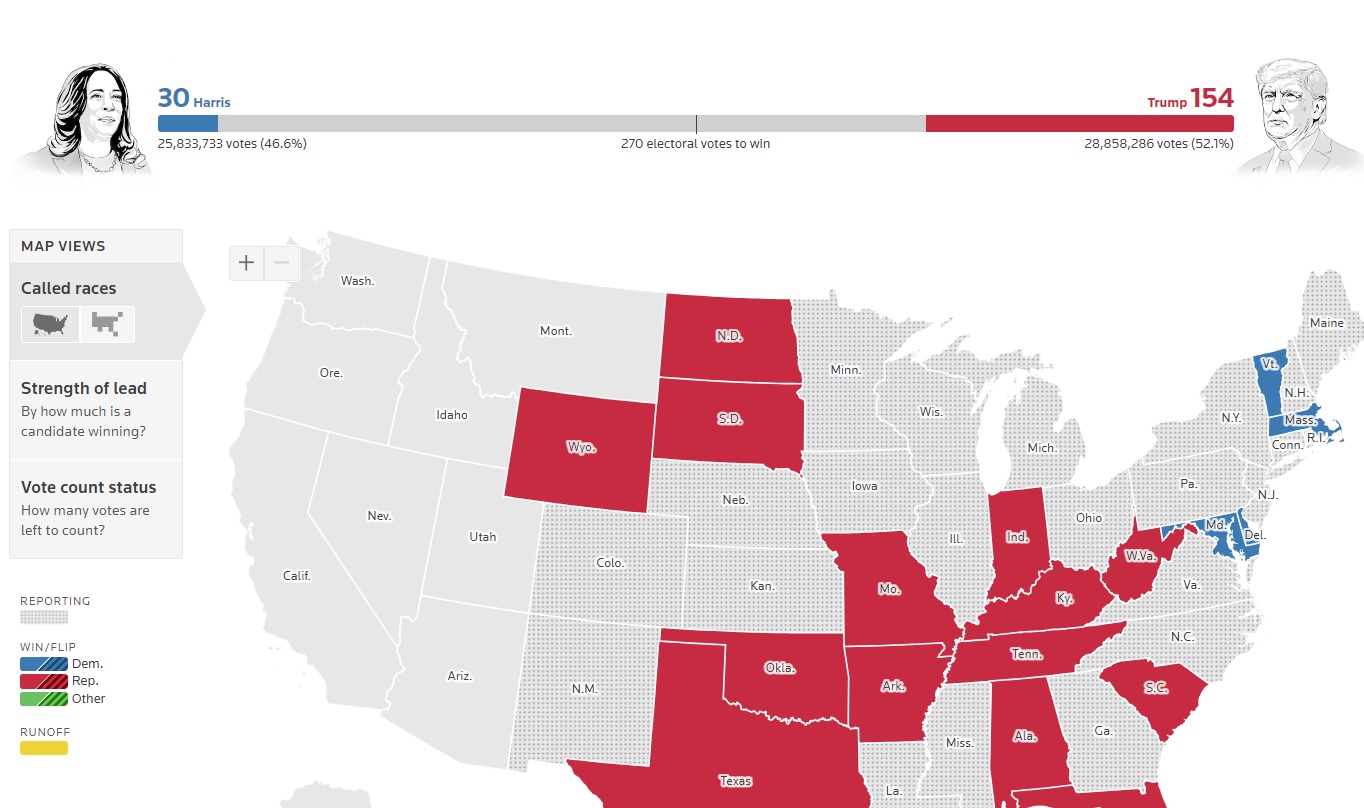

If we think about today’s election, the closeness of the polls would seem to suggest some delay before the outcome is known and, as we’ve said earlier, more mail-in votes can delay things as well. Of course, it is very possible that the polls are wrong and that one or other candidate will win easily with the declaration coming before the day is out. But the dangerous scenario is one in which either side loses narrowly and contests the outcome. While such a challenge would seem more likely if Trump ‘loses’, it could happen from the Democrat side, just as we saw with Gore in 2000.

In theory, at least, this puts the dollar in a difficult spot. The prospect of social upheaval, of the sort we saw in January 2021’s Capitol Hill riots, should Trump look to be heading for defeat may not go down well with the dollar bulls. But, by the same token, if there is any sense at all that the result could be overturned in Trump’s favour, then the greenback could find some solid support.

Steve Barrow, Head of Standard Bank G10 Strategy said that the US dollar would be more likely to slide if Trump loses narrowly and the atmosphere turns ugly. As mentioned, the US dollar was under modest pressure back in 2020 when Biden won but Trump claimed a “stolen” election. Indeed, the weakness in the US dollar continued right through to the early part of 2021 before recovering. This suggests that US dollar bulls have to pin their hopes on a clear win for Trump. “We still think that’s the most likely outcome, but it is a brave person that puts all their chips on red”, said Steve Barrow.