Why have foreign capital flows into Vietnam’s real estate fallen drastically?

Foreign capital flows into Vietnam's real estate sector in 1H23 has decreased significantly compared to the same period last year.

According to data from the General Statistics Office, in the first 6 months of 2023, the real estate business activities accounted for 3.38% of Vietnam's GDP (compared to 3.32% in the same period last year).

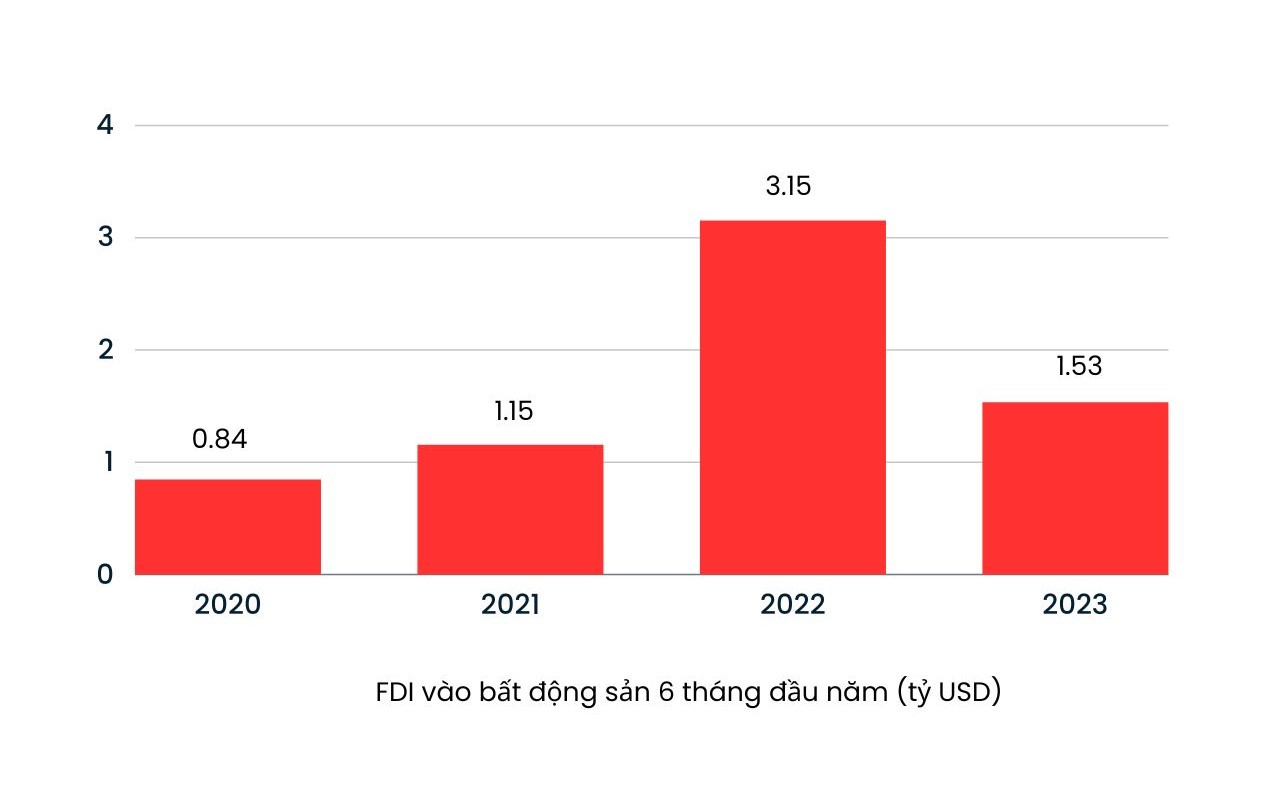

In terms of FDI capital, as of June 20, total registered investment capital from foreign sources in Vietnam (including newly registered capital, adjusted registered capital, and capital contribution value, as well as share purchases by foreign investors) totaled $13.43 billion, a drop of 4.3% from the same time last year. With a total registered capital of $1.53 billion, down 51.5% from the same time last year ($3.15 billion), the real estate industry sector in particular kept its third-place ranking.

Foreign direct investment in real estate totalled $592.1 million (accounting for 6.3%) in terms of new registered capital and adjusted registered capital of projects. Foreign investors contributed $938.6 million in capital and share acquisitions, accounting for 23.4% of total investment in real estate industry operations.

Foreign direct investment in Vietnam was anticipated to be $10.02 billion in the first six months of the year, a 0.5% rise over the same time previous year. Real estate business activity accounted for $502.1 million (5%), a 43% reduction from the same time previous year ($881.3 million).

According to Savills Vietnam, there are three impediments that make it difficult for foreign capital to join the real estate market, as well as making FDI enterprises more cautious and stifling the growth of the M&A market.

First, the legal structure in Vietnam addressing land is still rather complicated. Many sections of the Housing Law, Land Law, and Real Estate Business Law remain uncoordinated, making it difficult to identify solutions. Despite the government's recent institutional improvements, these flaws will stymie the development of M&A transactions.

Second, Vietnamese SMEs now lack sufficient preparations for the process of purchasing, selling, and combining real estate, resulting in numerous challenges in mobilizing investment funds or transferring assets.

Third, in the Vietnamese real estate market, buyers and sellers approach property valuation differently, resulting in disparities in predicted price levels for high-value properties.

"In reality, M&A transactions are complex commodities, and evaluating asset values in the short term is insufficient." "The M&A market requires negotiating parties to make detailed plans in order to target long-term value in the future," stated a Savills spokesperson.

Foreign cash is projected to continue flowing into Vietnam in the coming months, according to the Vietnam Association of Realtors (VARs). To prevent risks, the majority of these investors seek projects with reasonably thorough legal frameworks. This is a chance for developers with "clean" projects to sell or collaborate, producing value and advantages for both sides. It is a path that assists firms in managing cash flow, recovering production and commercial activities, and bringing items to market.

VARs recommend that relevant authorities continue to develop the legislative framework and adopt measures to stimulate foreign investment in Vietnam to ensure a robust flow of foreign money and become a "boost" for the market. In the meanwhile, the government must continue to adopt measures to overcome problems and legal hurdles for projects that have not satisfied the standards, prioritizing vital projects that are market-ready.