Will TCB remain a "bright spot"?

Vietnam Technological and Commercial Joint Stock Bank (Techcombank, HoSE: TCB) may remain a bright spot in the Vietnam banking industry in the future quarters.

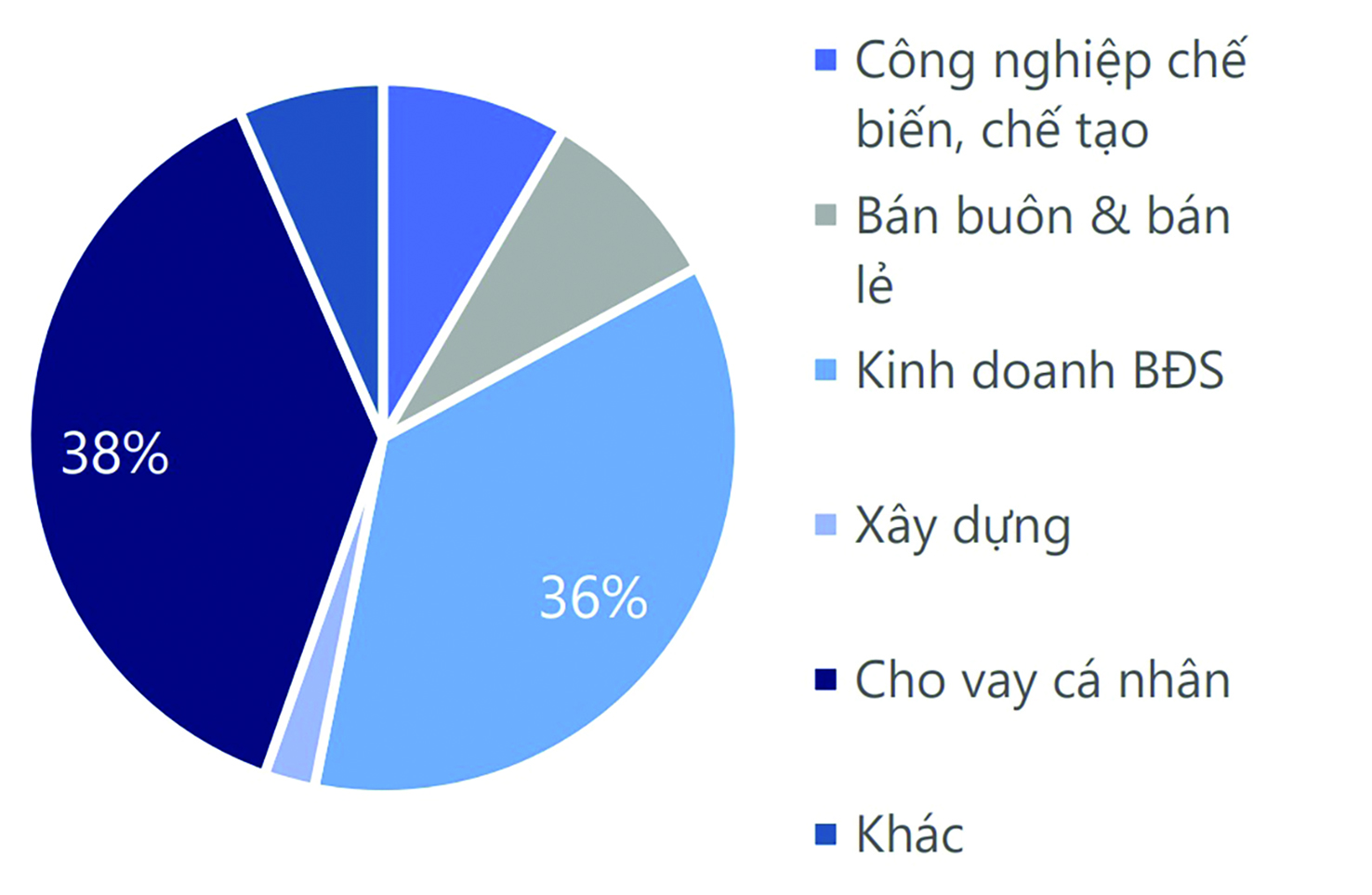

TCB's customer lending structure in Q1 2024. Source: TCB, DSC compilation

TCB's pre-tax profit for the first quarter of 2024 climbed by 38.7% compared to the same period previous year, owing to a 31.8% increase in operating income and a dramatic 26.5% drop in operating expenditures.

Growth Driven by Credit Expansion

TCB enjoyed positive growth in the first quarter of 2024. Total operating income increased by 31.8% to VND 12,261 billion, with a pre-tax profit of VND 7,801 billion, up 38.7%. Notably, net interest income surged by 30.2% as credit growth accelerated.

TCB's loan growth in the first quarter of 2024 was the second largest in the system, and the Net Interest Margin (NIM) continued to recover, contributing to ongoing improvement in business performance. The quality of TCB's assets was also adequately managed, with a consistent non-performing loan ratio and loan loss reserve (LLR).

Despite possible dangers from the corporate bond and real estate (RE) markets, which play an important role in the bank's operations, it is clear that TCB is a "bright light" in the banking industry's recovery trend.

Since the beginning of 2024, TCB has been launching several potential new products, such as the two-year Bao Loc deposit certificates, helping TCB mobilize low-cost capital for its operations.

Maintaining Asset Quality

According to analysts, the RE sector might drive the bank's lending expansion in the remaining months of 2024. At the conclusion of the first quarter of 2024, TCB's credit balance had increased by 7.1% to VND 561,150 billion. In instance, lending for real estate company activities increased by 10.2%, reaching about VND 18,000 billion.

Thus, TCB's loans for real estate continue to account for the biggest share, at 36%. Regarding the debt structure by term, TCB mostly increased short-term loans in 2024 due to the high capital turnover demands of RE enterprises, notwithstanding bond maturity constraints, while the RE market recovery remained uncertain.

Experts believe that the structure of capital mobilization supporting the NIM recovery at TCB indicates a recovery pace that stands out from the industry. Specifically, NIM improved to nearly 4.4% in Q1 2024 (up 20 basis points). This rate was optimized through the structure of deposits, including leveraging the interbank interest rate environment at a low to medium level of 1% in Q1, to increase mobilization from the secondary market (up 12.4%) and issuing Bao Loc deposit certificates (up 35%).

Notably, the quality of TCB's assets remained stable compared to the previous quarter. Currently, the bad debt ratio of TCB slightly decreased from 1.16% to 1.13%, among the banks with the lowest bad debt ratios, while the trend of bad debts across the industry has begun to increase again. The LLR also improved from 102% to 106%, the highest among private commercial banks. TCB's customer base is focused on the middle-income segment, which is one of the advantages that help TCB maintain asset quality.

TCB's outstanding NIM recovery compared to the industry

Potential Challenges

Maintaining a NIM of 4.4% in Q1 2024 (2023: 4%), along with a forecasted rise in credit growth to 22.4%, helped interest income climb in comparison to 2023.

Furthermore, the majority of TCB's non-interest revenue operations are expected to expand significantly in 2024. Fee revenue climbed by 21.3% during the same time, while securities investment operations surged by 41% due to the revival of the corporate bond market. Bancassurance operations are unlikely to restore growth pace because borrowers' cash flows are still recovering.

TCB's pre-tax profit for Q1 2024 is VND 7,801 billion, up 38.7% from the same period in 2023.

MBS predicts that TCB's expenses for operations will revert to 30% for the whole year of 2024, notwithstanding a highly favorable level recorded in Q1 2024. Increased credit in the context of poor demand, as well as non-interest revenue operations such as bond distribution, cross-selling insurance, and so on, are projected to incur additional expenses in order to meet the objective.

Furthermore, the provision expenditure at TCB is projected to rise this year as the pressure from bad loans remains high. However, MBS anticipates TCB's provisioning costs to fall by 2025.

Given the foregoing, MBS has increased TCB's post-tax profit (PTP) for 2024 by 3% in response to Q1 2024 results that exceeded expectations. The projected PTP also surpasses the TCB's 2024 goal by 10%.

However, MBS believes that pressures on exchange rates in the next quarters may result in higher deposit interest rates. The prospect of a minor rise in the central bank's policy rate to stabilize the exchange currency should not be dismissed, since this might prevent NIM at TCB from rising as expected. In addition, an increase in interest rates may have an impact on TCB's value, preventing it from achieving the predicted P/B level.