Will Vietnam's monetary policy remain accommodative?

The State Bank of Vietnam (SBV) is expected to keep its supportive monetary policy in place for at least the next 3-6 months to help the economy recover.

In the second half of 2022, deposit interest rates (in VND) are expected to rise.

>> FED’s impacts on Vietnam’s economy

A strong USD, as a result of the FED's rate hike, puts pressure on Vietnam's currency rate and interest rates, as well as the government's and companies' foreign debt repayment obligations. VNDirect, on the other hand, continues to believe that the SBV would maintain its accommodative monetary policy until at least the end of 2Q22 for the following reasons:

First, despite rising inflationary pressures in the next months, the average consumer price index for the first half of 2022 is predicted to be 2.5 percent yoy, significantly below the government's aim of 4% yoy.

Second, domestic demand is still weak and has not fully recovered from the pandemic.

Third, the SBV continues to place a high priority on maintaining low lending rates to help businesses and the economy recover.

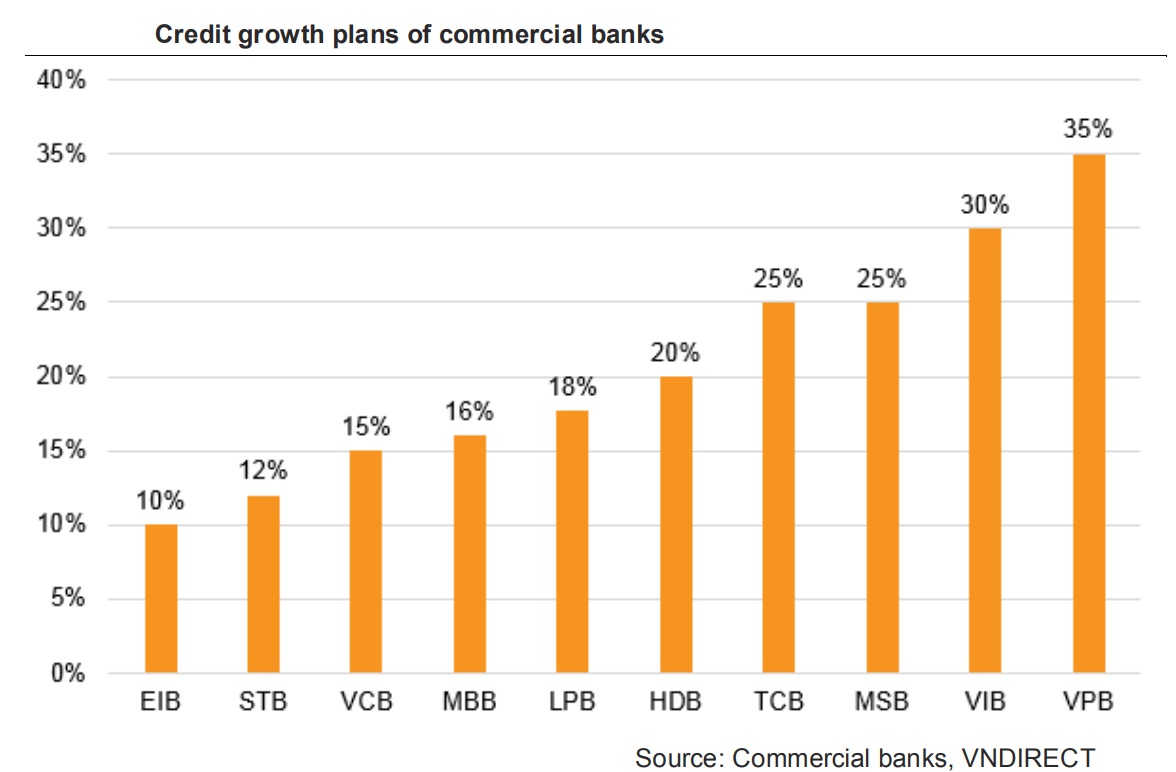

"Any monetary tightening would take place only in the second half of 2022 (more likely in 4Q22), and substantial rate hikes would be small, around 0.25-0.5 percent," VNDirect said, adding that the SBV would keep credit expansion high to help the economy recover. Manufacturing and services will be given precedence in credit capital flows, particularly in priority industries such as industry, export-import activity, agriculture, forestry, and fishing. Furthermore, the SBV will monitor credit flows into high-risk categories like real estate, securities, and BOT (Build-Operate-Transfer) projects. We continue to believe that Vietnam's credit will increase at a solid 14 percent yoy rate in 2022F.

In the second half of 2022, deposit interest rates (in VND) are expected to rise. State-owned banks' 3-month and 12-month term deposit rates were unchanged as of April 26, 2022, compared to the end of 2021, while private banks' 3-month and 12-month term deposit rates increased 14 basis points and 13 basis points, respectively.

In terms of lending interest rates, the SBV is undertaking a VND 3,000 billion interest rate compensation plan. For firms severely impacted by the COVID-19 pandemic, it offers credit rates of only 3-4 percent per year. Furthermore, the Government intends to increase the size of the interest rate compensation package for businesses to VND40,000 billion, with a focus on a number of priority audiences, including (1) small and medium-sized enterprises, (2) businesses involved in a number of key national projects, and (3) businesses in specific industries (tourism, aviation, transportation).

According to VNDirect, the interest compensation package might assist cut lending rates by 20-40 basis points in 2022F. However, if commercial banks raise lending rates on other traditional loans to balance the increase in deposit rates, the actual impact of the interest rate compensation package on businesses and the economy could be lessened.