A turning point in monetary policy

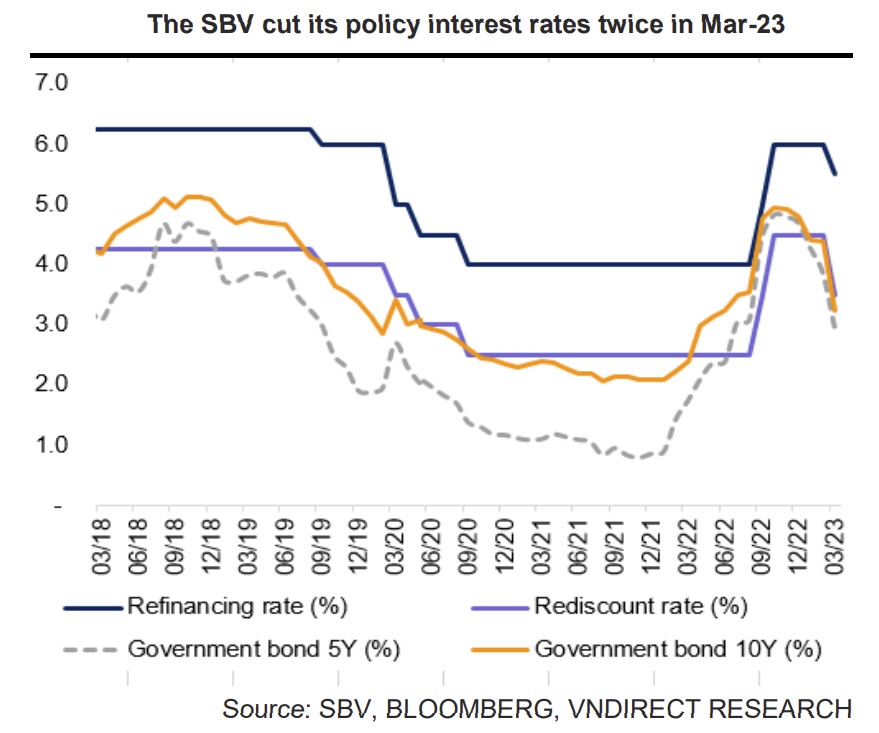

The State Bank of Vietnam (SBV) cut its policy rates twice in March 2023.

The 12-month deposit interest rates of commercial banks have decreased by 50 basis points compared to the peak in January 2023, ranging from 7.1% to 8.4%.

>> What changes will the FED make to its monetary policy? 0

FED’s less hawkish message

During its March meeting, the FED unanimously decided to raise the target range for the federal funds rate to between 4.75% and 5%. In addition, the recent turmoil in the banking system has caused the Fed to no longer declare "constantly raising interest rates" as appropriate. The Fed said it was open to the possibility of one more rate hike and no interest rate cut in 2023.

However, the market forecast is somewhat more aggressive on easing than the Fed's view. Specifically, markets now expect the Fed to pause rate hikes at its May meeting and also expect it to cut rates as early as 2H23 due to the possibility of a recession.

Less pressure on the USD/VND rate

Dollar Index (DXY) dropped sharply amid the banking crisis as the Fed delivered a less hawkish message on monetary policy. As of March 31, 2023, DXY fell to 102.5 points, down 2.7% before the Silicon Valley Bank (SVB) crash. The softer DXY has brought the US$/VND down 0.7% ytd to 23,471.

In addition, the SBV has increased foreign exchange reserves by $4.1 billion since the beginning of 2023.

"We see downward pressure on the US$/VND exchange rate in 2Q23F as the Fed could issue more dovish messages on monetary policy at its next meeting on May 23 due to the increased possibility of a recession. As a result, we expect the US$/VND exchange rate to fluctuate between 23,450 and 23,700 in 2Q23F", said Mr. Dinh Quang Hinh, an analyst at VNDirect.

>> Monetary policy must prioritize inflation control

According to VNDirect, upside risks to VND include (1) unexpectedly higher and longer-than-expected inflation pressure in the U.S. and (2) the stronger-than-expected decline in remittances and FDI inflows amid the global economic slowdown.

A reversal in SBV’s monetary policy

In March 2023, the SBV had two reductions in its policy interest rates: the rediscount rate was cut by 1 percentage point (% pts) to 3.5% per year, the refinancing interest rate was reduced by 0.5% pts to 5.5%, and the overnight lending rate of the SBV for credit institutions was also lowered to 6% per year from 7% per year. The SBV also lowered the ceiling interest rate for short-term loans in VND from credit institutions for some priority sectors by 1% point to 4.5% per year. They also reduced the maximum interest rate for deposits in VND with terms of less than 1 month and terms from 1 month to less than 6 months by 0.5% pts.

Meanwhile, the 12-month deposit interest rates of commercial banks have decreased by 50 basis points compared to the peak in January 2023, ranging from 7.1% to 8.4%.

Mr. Dinh Quang Hinh expects deposit rates to drop more until the end of 2023, based on the following reasons:

First, the Fed could end the policy rate hike cycle in 1H23, thereby reducing pressure on the VND exchange rate as well as Vietnam's interest rates in 2H23.

Second, weak lending demand is due to the economic slowdown and murky residential property market.

Third, the government promotes public investment, thereby injecting more money into the economy.

"We expect the average 12-month deposit rate (average of both private banks and state-owned banks) will drop another 50 basis points to 7.0% p.a. within 2023," said Mr. Dinh Quang Hinh.