Asset allocation into gold: From gold exchange to a reserve asset

Vietnam is considering preparations for establishing a national gold exchange. Will this help narrow the domestic–international gold price gap? And how are investors viewing opportunities in gold?

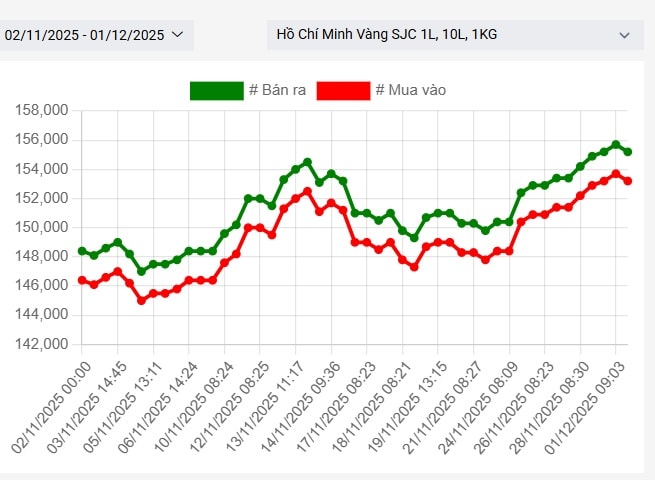

SJC gold bar bid-ask prices over the past 30 days, as of December 1, 2025 (Source: SJC).

At the start of the week and the beginning of December, domestic bullion prices once again climbed to a new record high.

Around 9 A.M, SJC gold bars surged to a record selling price of VND 155.7 million per tael. Prices later eased slightly, but major retailers such as Bao Tin Minh Chau, Doji, Phu Quy, and SJC continued to list bid-ask sell prices above VND 152–155 million per tael.

The rebound in bullion prices comes at a time when new supply remains only a near-term expectation, pending applications for importing, producing, and distributing non-SJC gold bars by businesses and banks. International market moves also played a significant role, with global gold trading at USD 4,251.4 per ounce in the morning session — up USD 33 from the previous day.

Experts say that unpredictable developments in the global economy and geopolitical tensions continue to support gold’s upward trajectory.

How significant is the planned national gold exchange in helping “stabilize” the market? According to Nguyễn Minh Hạnh of SHS Securities, establishing a gold exchange could improve the way gold is traded in Vietnam by increasing liquidity and transparency, narrowing the bid–ask spread, and enabling part of the “gold in vaults” held by households to enter the financial system. However, a gold exchange will not be able to address the root cause of the domestic–international price disparity. In other words, it can fix how gold is traded, not how much it costs.

What a gold exchange can do

First, a national gold exchange would improve liquidity and transparency. When transactions are centralized on a regulated exchange with licensed members, real-time price and volume information becomes available, enabling investors to trade in a transparent environment. Electronic price listing and order matching would also standardize tick sizes and trading methods, reducing arbitrary pricing on the informal market.

Second, a gold exchange could help narrow the bid–ask spread. Currently, the spread for SJC bullion often hovers around VND 20 million per tael (roughly 1–1.3%), and for jewelry gold, the spread can reach 2.6–3 million per tael—significantly wider than the global average of 0.1–0.2%. With more participants and competition, the exchange would naturally produce a lower market bid–ask spread, reducing hidden transaction costs for investors.

Third, the exchange could serve as a channel to monetize part of the gold held by the public—converting idle gold into capital within the financial system instead of leaving it dormant.

“Physical bullion supply remains tight—circulating almost entirely within the SJC brand—which keeps domestic SJC prices persistently higher than global prices. This situation is ‘rational’ within the current policy framework. A gold exchange cannot create additional physical supply. Without changes to gold import regulations, the exchange will only trade the gold that already exists; the underlying price gap will remain,” Hạnh noted.

In the long run, the value of gold and other financial assets tends to rise in tandem with the depreciation of fiat currencies

Gold as a reserve asset—not a monetary anchor

In the long run, the value of gold and other financial assets tends to rise in tandem with the depreciation of fiat currencies. Experts point out that strict gold anchoring—a rigid gold standard—sacrifices domestic financial stability in exchange for currency stability and inflation control, a trade-off ill-suited to today’s complex economy.

A more balanced approach is to view gold as a reserve asset, not the sole “savior.” According to Nguyễn Minh Hạnh, gold should be treated as an important reserve and investment asset for diversification and risk hedging, rather than a fixed benchmark for monetary value.

For both retail and institutional investors, this means allocating a reasonable portion of gold in their portfolios to hedge against extreme scenarios such as hyperinflation, financial crises, or war.

Many experts recommend a 5–10% gold allocation for long-term portfolios with conservative risk profiles. Empirical studies show that adding a small amount of gold (a few percent) to the traditional 60/40 stock–bond portfolio can significantly improve risk-adjusted returns. For example, analysis from 2005–2025 indicates that a portfolio with 5% gold delivered an annual return roughly 1% higher than a gold-free portfolio; with 15% gold, annual returns were about 3.4% higher, albeit with greater volatility.

According to Hạnh, gold typically has a low correlation with stocks and bonds, helping reduce overall portfolio volatility over the long term. Moreover, during periods of high inflation or crisis, gold tends to surge while traditional financial assets decline, acting as a shock absorber. Thus, a cautious investor may treat gold as “insurance,” willing to hold a small portion of assets in gold to guard against systemic risk. This portion may not always yield high returns in normal conditions but will prove valuable during turbulence.