China’s reopening: A boost for ASEAN trade

Despite some pockets of resilience, China’s re-opening is unlikely to provide a considerable boost to ASEAN’s overall exports.

China’s re-opening is unlikely to provide a considerable boost to ASEAN’s overall exports.

>> China’s re-opening: A boost for tourism

Another factor that cannot be ignored is the ASEAN-China trade relationship. Since 2020, ASEAN has surpassed the EU to become China’s largest trading partner. Indeed, thanks to the deepening trade relationship, China’s weight in ASEAN’s export exposure has jumped sharply in the last 15 years, becoming the largest exporting destination for most economies.

ASEAN’s export performance to China in 2022 shows a rather mixed picture, led by Indonesia whose exports have been in full swing, followed by Vietnam and Malaysia. However, Singapore, Thailand and the Philippines saw the opposite story, with their exports slumping as much as 30% y-o-y in most of 2H22. The devil is in the details: it is crucial to examine what kind of products each ASEAN market exports to understand the mixed picture.

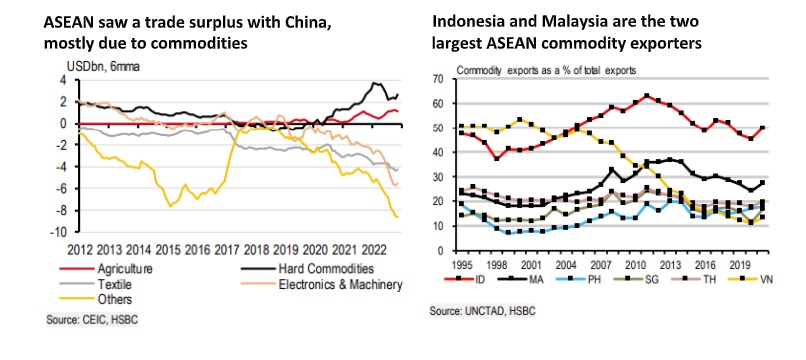

Clearly, ASEAN gained substantially in the space of agriculture and hard commodities, but saw a widening deficit in sectors such as textiles and electronics. Indeed, there is no better time to be a commodity exporter. In ASEAN, we have been flagging the impressive commodity stories of Indonesia and Malaysia.

“Despite falling from its peak, half of Indonesia’s exports are commodity products, topping the region. Indonesia’s export basket to China mostly consists of raw metals and minerals like coal, nickel, lignite and palm oil, with over 50% of industrial raw materials like those used in electronics products, machinery and auto-components being sourced from China”, said HSBC.

In 2021, Indonesia impressively doubled its share of China’s coal imports to 34%, partially benefiting from the latter’s trade restrictions on Australian coal. Similarly, Malaysia is one of Asia’s few net exporters of oil and gas, in addition to being deeply imbedded in the global tech supply chain. Despite a global slowdown, the supply-squeeze and China’s re-opening will likely keep commodity prices elevated in 2023.

In addition to commodities, in HSBC’s view, ASEAN’s agriculture trade is also worth highlighting. That said, almost the entire trade surplus came from palm oil, another sector where Indonesia (70% of China’s palm oil imports) and Malaysia (20%) dominate. Meanwhile, in traditional agriculture, Thailand and the Philippines will likely benefit from China’s booming pent-up demand in 2023, given the significance of agriculture in their exports.

>> China reopening will boost Vietnam’s GDP by 2% pts in 2023: Vinacapital

For example, 70% of China’s durian comes from Thailand and the Philippines dominates the Chinese market with a close to 40% share in bananas. Indeed, for the latter, almost 20% of non-electronics exports goes to China, whose growth rebound will offer a much-needed boost for the Philippines. Vietnam should also be another beneficiary, albeit to a lesser extent, as exports to China will no longer be required to undergo COVID-19 testing.

Despite some pockets of resilience, China’s re-opening is unlikely to provide a considerable boost to ASEAN’s overall exports. After all, much of ASEAN’s exports to China is integrated into the industrial sector, rather than its consumer cycle. Even in the case of the Philippines, whose manufacturing links with China is not as deep as its peers, the main drag on their exports was manufactured goods, a large part of which are electronics products. While the rebound in China’s growth can partially put a floor on global production, it is unlikely to reverse the already cooling trade cycle.

“The most notable drag came from weakening electronics exports, making Singapore and Vietnam particularly vulnerable. In Singapore, November semiconductor non-oil domestic exports (NODX) slumped by over 13% y-o-y, a magnitude similar to its most recent tech downturn in 2H18-2019. Vietnam’s phone and computer shipments saw an even more striking decline of close to 30% y-o-y in December”, said HSBC.

In particular, given the import-intensive nature of tech manufacturing, plunging electronics imports signals an uncertain outlook for tech exports. That said, Malaysia is an outlier, displaying some rare resilience in its electronics shipments, defying a cooling cycle. The resilience is in part due to Malaysia’s unique position as a large producer of automotive chips and its substantial market share gains in certain semiconductor products.