China’s reopening: A boost to FDI

Despite the immediate trade headwinds, continued positive FDI prospects offer some optimism for ASEAN’s trade outlook.

Some of mainland China’s FDI projects in ASEAN, most of which fall into sectors where recipient countries have a competitive advantage.

>> China’s reopening: A boost for ASEAN trade

Over the past 30 years, ASEAN has seen a bounty of FDI, thanks to the region’s sound fundamentals, rising cost effectiveness and ongoing structural transformation. While the Asian Financial Crisis (AFC) had a deleterious effect on ASEAN’s FDI climate, FDI flows into the region as a percentage of total world flows rose in the decade post-Global Financial Crisis (GFC), jumping to a record high of 11% in 2021, almost on par with China.

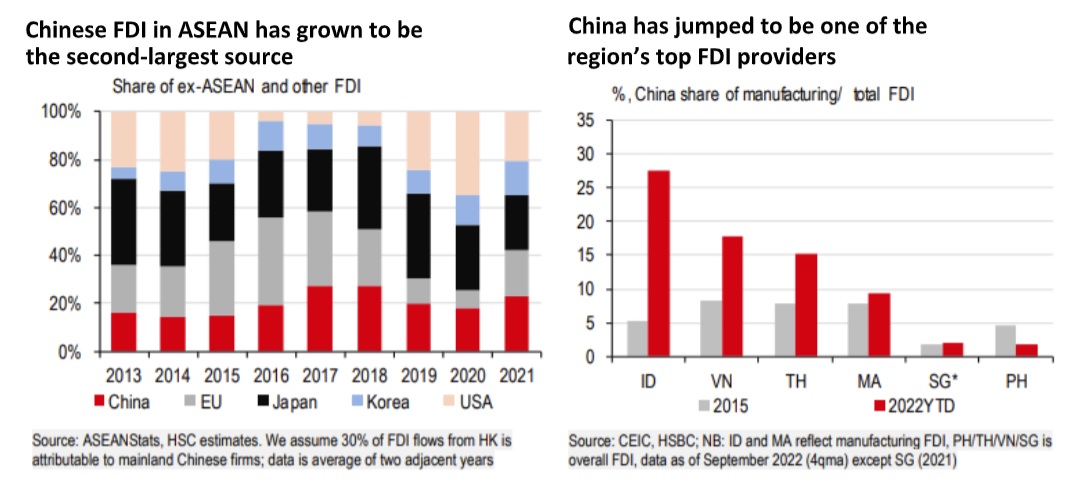

That said, the FDI picture is uneven across the region, with the lion’s share going to Singapore, Vietnam and Malaysia, whose manufacturing sector is a key growth pillar (Chart 16). Indeed, manufacturing continues to be the backbone of FDI to ASEAN, a sector that China has been catching up with other Asian peers in recent years.

Japan and Korea are early movers into ASEAN’s manufacturing, with the former heavily investing in Thailand’s auto industry and the latter successfully turning Vietnam into one of its major global production hubs for smartphones. But China has been catching up quickly, and has become the joint largest source country for FDI into ASEAN (not counting intra-ASEAN) in 2021, on par with Japan. “If we look at manufacturing, Indonesia, Vietnam and Thailand have seen a sharp increase in China’s FDI share (Chart 18), whose investment was previously concentrated in real estate. While the process was partially disrupted by the pandemic, after the re-opening, China’s investment push into ASEAN will continue to thrive”, said HSBC.

HSBC highlights some of mainland China’s FDI projects in ASEAN, most of which fall into sectors where recipient countries have a competitive advantage. In the case of Vietnam, Goertek and Luxshare, two of Apple’s three major suppliers (in addition to Taiwan’s Foxconn), have poured additional funds worth USD400m and USD306, respectively, to expand their production of consumer electronics and multimedia equipment. This is part of Apple’s ongoing expansion plans into Vietnam, with the most recent relocation being for its relatively complicated MacBook supply chain, which is expected to start producing in mid-2023.

>> China’s re-opening: A boost for tourism

While FDI to Indonesia fell amid the global uncertainties, its medium-term outlook remains bright. In particular, Chinese investment has been key in facilitating Indonesia’s nickel smelter boom, a key input for producing EV batteries. For example, China-based CATL signed an agreement with Indonesia’s SOE ANTAM and IBI to jointly develop an almost USD6bn mining to-batteries ecosystem.

That said, Indonesia is not the only candidate for China’s FDI along the EV supply chain. In fact, BYD, China’s top EV producer, is planning to build a production centre in Thailand, with a capacity of production of 150k EVs per annum. This will make Thailand its first production hub in ASEAN, partly thanks to the country’s generous subsidy which is as much as THB150k per EV. And BYD is not the only one getting incentives as Thai industrial estate developer WHA Group was in discussions with another of China’s top five EV makers. Elsewhere, China’s investment in Malaysia is equally important. Risen Energy, China’s solar energy firm, announced its first facility investment in Southeast Asia, worth USD10bn over 15 years, to manufacture high-efficiency photovoltaic modules.

While China is not a dominant investor in Singapore, some Chinese firms have also made a move. Recently, two Chinese firms, WuXi Biologics and WuXi AppTec, have announced a SGD4bn investment into the country’s pharmaceutical manufacturing, the second-largest sub-sector after electronics. Unlike its trade-dependent peers, the Philippines as a domestically-driven economy should also benefit from China’s re-opening but not to the same extent. Instead, recent FDI projects from China is in the metal space.