Deposit rates are at "unimaginably low" levels

The other banks in the Big 4 group have altered their interest rates in response to Vietcombank's lead in setting the lowest deposit rates across all terms.

BIDV enacted three consecutive interest rate reduction over three days, from December 11th to December 13th. BIDV announced the greatest online savings interest rate cut on December 13th, hitting 0.4% per annum. The following are the rates for various terms: The 1-2 month period declined by 0.4% to 2.7% per year; the 3-5 month period decreased by 0.3% to 3.1% per year; and the 6-11 month period is presently at 4.1% each year. The annual deposit rates for the 12-18 month period is 5%.

VietinBank also decreased deposit interest rates by up to 0.6% per year for maturities less than six months. As a result, the rates for this bank are currently 2.6% for 1-2 months and 3% for 3-5 months. The 6-11 month term was reduced by 0.5% per year to 4% per year, while the 12-18 month term was reduced by 0.3% to 5% per year. Rates for durations of 24 months or longer remained steady at 5.5% per annum, indicating VietinBank's highest current deposit interest rate.

Agribank also chose to reduce online savings interest rates by 0.5% each year. The following are the interest rates for Agribank deposits as of December 13th: 1-2 months declined by 0.5% to 2.7% per year, 3-5 months fell by 0.3% to 3.3% per year, 6-11 months decreased by 0.3% to 5% per year, and 12-18 months decreased by 0.3% to 5% per year.

Vietcombank has already taken the lead in cutting interest rates across the board at the beginning of December. However, the bank recently decreased the 1-2 month term by an extra 0.2% each year, bringing it to 2.2% per year. Other periods saw rate reductions as well: the 3-month term dropped by 0.2% to 2.5% per year, the 6-month term dropped by 0.2%, and the 12-month term stayed steady at 4.8% per year. As a result, the 4.8% annual rate for a 12-month deposit is now the highest at Vietcombank and the lowest across the system.

With these changes, all of the Big Four banks have decreased interest rates, notably for medium to long-term deposits, to below or equal 5% per annum. This decision is significant because the lower the cost of capital for medium to long-term deposits, the better banks can manage expenses over the medium to long term, making short- to medium-term lending capital more sustainable and less expensive.

Despite the dramatic fall in savings interest rates, the latest State Bank of Vietnam (SBV) figures show that people's bank savings have increased over the previous 13 months. Individual deposits in banks totaled more than VND 6.44 quadrillion as of the end of September 2023.

In a market where real estate is still not appealing enough for people to invest in; the stock market is fluctuating, with recent red sessions affecting investor sentiment; and the possibility of savings interest rates falling further is expected to not diminish the psychological inclination towards preserving and waiting for investment opportunities. According to an analyst, big banks have decided to lower online savings interest rates—a type of deposit that is not as cheap as CASA (Current Account Savings Account) capital but can swiftly modify and move conditions out of the system, making transactions more simple.

Predicting that deposit interest rates have reached a low point by the end of 2023, VNDirect Securities Company suggests that the average 12-month deposit interest rate may continue to hover around 5-5.2% per annum throughout 2024. "Investors' money may shift partially to other investment channels to enjoy higher returns. This trend will become more pronounced in the late stages of 2023 and early 2024 onwards," forecasts VNDirect.

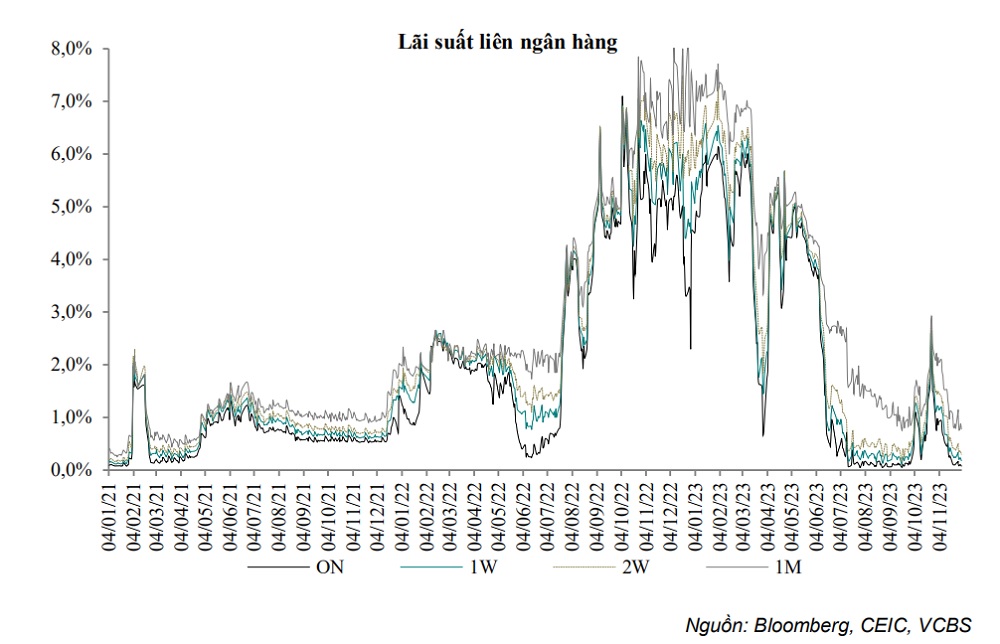

According to Associate Professor Pham The Anh of the National Economics University's Faculty of Economics, the SBV has reduced the operating interest rate four times since the beginning of the year, and liquidity injections have helped the 12-month fixed-term deposit interest rate fall rapidly from 8%-10% in Q1/2023 to around 6-7% per annum at the moment. The interest rate on short-term deposits less than six months is presently merely 4-5% each year.

However, Associate Professor Pham The Anh believes that the use of interest rate tools has reached its limit , and Vietnam has little room to lower rates further due to constraints such as: major central banks around the world maintaining high interest rates; real interest rates in the country (short-term deposit interest rates are nearly equal to core inflation); and stable commitments to exchange rates and foreign capital flows.

As a result, it is understandable that commercial banks' reductions in lending rates are both an effort to decrease costs through different solutions and a reaction to the problem of optimizing cost of capital efficiency in the lending area. This action is likely to assist banks in accelerating credit distribution and avoiding a "liquidity trap."

Pham, Associate Professor According to the Anh, current monetary policies should aim on decreasing lending rates, removing unnecessary barriers to loan availability for enterprises, and improving monitoring and system risk management.