Deposit rates could remain stable

MBS expects the average 12-month deposit rates of large commercial banks to fluctuate around the range of 5% - 5.2% in 2025.

The State Bank of Vietnam (SBV) continued to conduct T-bill issuances and OMO operations in Jan to manage banking system liquidity. During the month, the SBV issued nearly VND 162.5tn T-bills at a 4% interest rate with tenors of 7- 14 days. At the same time, the central bank injected approximately VND 233.6 trillion through the OMO channel at interest rates of 4% for 7, 14 and 21-day tenors. In January 2025, the SBV increased the amount of liquidity support for the system, with a net injection of VND 67.5tn – rising fivefold compared to the previous month. This occurred amid easing pressure on the foreign exchange rate and a liquidity shortage as cash demand surged during the Lunar New Year at the end of the month.

Interbank interest rates remained relatively stable during the month. Starting at 4% at the beginning of Jan, the overnight rate gradually dropped to 3.6% on Jan 23rd before surging to 4.6% on Jan 24th. This development is attributed to seasonal factors, as system liquidity tends to decline as the Lunar New Year approaches due to rising consumer spending. Consequently, interbank interest rates surged again. By the end of the month, the overnight rate remained at 4.6%. Meanwhile, for tenures ranging from one week to one month, interest rates ranged between 4.7% and 4.8%.

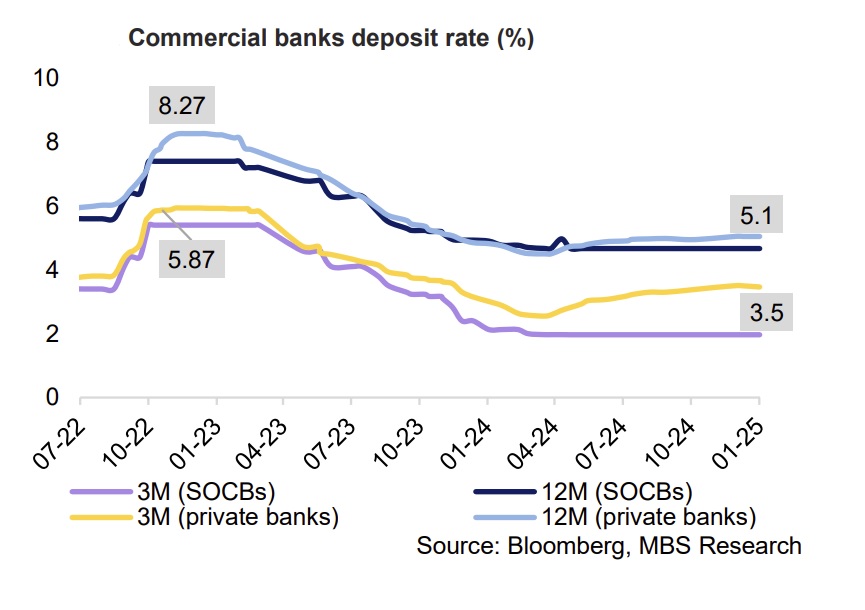

Even though 12 banks raised interest rates by 0.1%–0.9%/year in January 2025, 7 banks also lowered their deposit rates by 0.1%–0.75%/year. The upward trend in deposit rates was mainly observed among smaller commercial banks, which are preparing large capital reserves to support their lending plans for the year.

Recently, the SBV had set a credit growth target of approximately 16% to support an economic growth goal of 8% in 2025. By the end of January, the average 12-month deposit rate for commercial banks remained at 5.1%, unchanged from the previous month, while the rate for state-owned banks held steady at 4.7%.

Vietnam's monetary policy stance will be more constrained than previously anticipated, due to the strong USD and the risk of ongoing U.S. investigations into currency manipulation allegations. In such a scenario, MBS said the SBV would need to adopt a more cautious monetary policy stance to ensure exchange rate stability, thereby limiting the scope for further monetary easing. Thus, it does not expect any policy rate cut in 2025.

Meanwhile, the rebound of the manufacturing sector and the acceleration of public investment disbursement this year are expected to support a continued improvement in credit growth and will exert upward pressure on deposit rates. However, the SBV has requested credit institutions to stabilize deposit rates and further reduce lending rates. Therefore, MBS expects the average 12-month deposit rates of large commercial banks to fluctuate around the range of 5% - 5.2% in 2025.