Gold prices for next week: "Launchpad" from Trump's inauguration

Many analysts predicted that if Trump implements his tariff pledges following his inauguration on January 20, 2025, gold prices would spike higher.

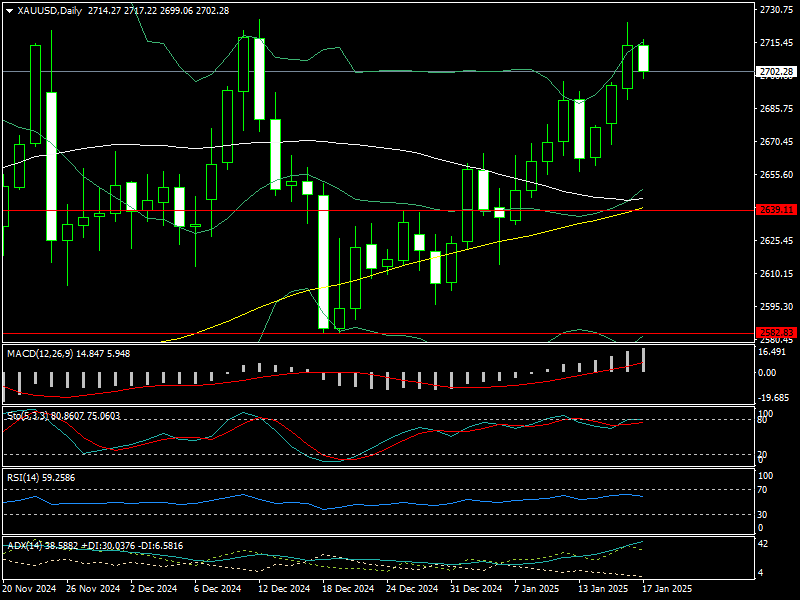

Gold prices increased sharply this week, rising from USD 2,656/oz to USD 2,724/oz before falling and closing at USD 2,702/oz.

Additionally, the price of SJC gold bars rose from VND 86.4 million per tael to VND 87.3 million per tael in the Vietnamese gold market before falling to VND 86.9 million per tael.

Due to investor expectations that Donald Trump may carry out his tariff pledges right after his inauguration, gold prices have increased significantly this week. As long as the FED keeps the interest rate at its current level, this could lead to a sharp rise in inflation. Gold prices will rise as a result of lower real interest rates.

A trade war, particularly the 2.0 US-China trade war, is also a possibility if Trump's pledge to impose tariffs is implemented after he takes office. There is a chance that this will cause volatility or perhaps stagflation in the world economy. Additionally, this will serve as a springboard for further increases in gold prices the following week.

It is also not surprising, according to Mr. Jesse Colombo, an independent precious metals analyst at BubbleBubble, that gold prices have increased before Trump's inauguration. "The world economy will suffer if President-elect Donald Trump's proposed tariffs spark a trade war. since a stagflationary climate will be created as a result of consumers worldwide having to deal with increased prices and slower economic activity. This is good for gold prices,” Jesse Colombo said.

Furthermore, Trump might step up his expansionary fiscal policies, which would result in a sharp increase in the national debt. This increases the safe-haven value of gold by posing a risk of financial instability, both domestically in the United States and internationally.

"Trump will not control expenditures. The budget will not be balanced by him. He will not be an austerity president. Investors are paying more attention to gold because they anticipate a degree of monetary dilution in domestic and international currencies,” said James Stanley, Senior Market Strategist at Forex.com.

The impact of Trump's aforementioned initiatives may cause gold prices to rise in tandem with the USD in the short term, instead of having an opposite relationship as previously.

That is how gold prices are expected to develop in the near future. However, the FED will eventually have to reverse its current monetary policy if inflation increases enough. The long-term price of gold will suffer as a result.

Technical analysis suggests that if gold prices break through USD 2,750/oz next week, they may continue to overcome the USD 2,750-2,790/oz strong resistance zone. If Trump's tariff pledges are fulfilled after his inauguration, gold prices may even surpass USD 2,800/oz next week. In the meantime, USD 2,639/oz (MA100) is the key support level for gold prices the following week.

The U.S. will release the S&P Flash PMI data, weekly jobless claims, and current home sales next week, in addition to Trump's inauguration. The path of the gold price next week, however, might not be greatly impacted by these economic data.