Higher ECB rates won't save the euro

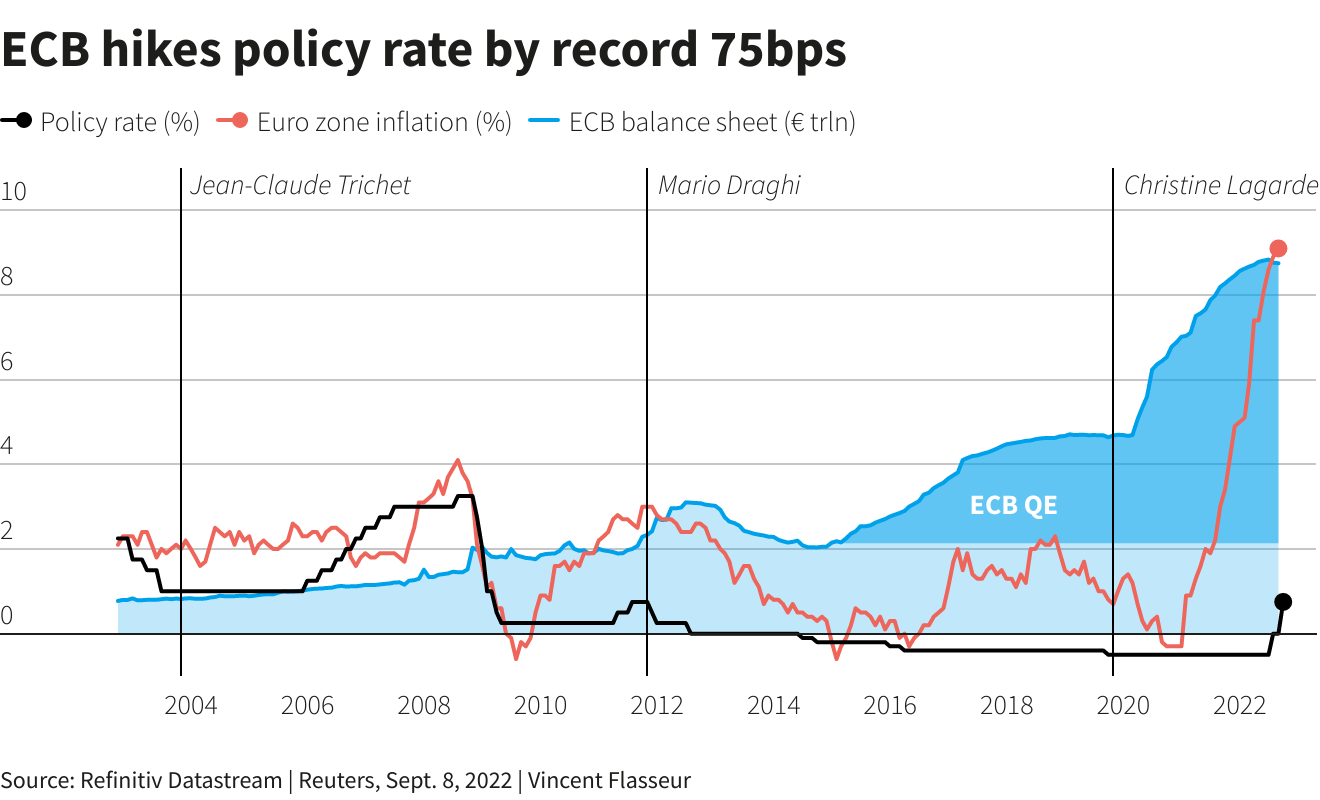

The European Central Bank (ECB) announced a 75 basis point rate hike, taking its benchmark rate to 0.75%. However, such rate hike won’t save the euro.

ECB announced a 75 basis point rate hike, taking its benchmark rate to 0.75%.

This major step frontloads the transition from the prevailing highly accommodative level of policy rates towards levels that will ensure the timely return of inflation to the ECB’s 2% medium-term target.

However, many question whether such large rate hikes could save the euro from even more weakness against the dollar?

Mr. Steve Barrow, Head of Standard Bank G10 Strategy doubt it. In his view, there are a number of reasons why he take this view. The first is simply that this is what we’ve seen already. The ECB hiked rates for the first time since 2011 in July, but this has failed to alter the euro’s trajectory against the dollar.

But to be fair, it is only less than two months since that hike and perhaps euro strength will develop over the long haul even if it has failed to show in the short-term. There could be some support for this idea if we look at longer-term flows in debt purchases.

During the first decade or so of EMU when ECB rates were generally quite high, there were net inflows into euro zone bonds. But the second decade, or so, when the ECB’s key rate has mostly been set at zero, has seen hefty net purchases of foreign bonds by yield-hungry euro zone investors.

If ECB rates really are going to rise much further, there could be a case made for euro zone investors to sell their foreign debt while overseas investors become more attracted to the higher euro zone rates on offer. These things could theoretically help lift the euro.

But there’s one caveat here which is that the change in the tide of bond flows in and out of the euro zone also coincided with the euro zone debt crisis between 2010 and 2012. So, it could be the case that this has been the factor that turned net inflows into euro zone bonds into outflows over the last decade, or so.

What’s more, with continued question marks now about euro zone bond market safety; something that has forced the ECB to introduce a new anti-fragmentation tool in July, the case for hefty inflows into euro zone bonds and a stronger euro is a weak one right now.

A third factor is that rate hikes from the ECB are simply not worth as much to the euro as Fed rate hikes are to the dollar. That’s because US rate hikes tend to create a safety premium for the dollar as financial markets are much more likely to enter a risk-off psyche when the ECB starts to hike.

Of course, there’s still some 20%, or so of international loans and debt finance that is denominated in the euro, so higher ECB rates can tighten financial conditions just like the Fed and conceivably create a stronger euro. But that 20% or so is only a third of dollar lending and hence global financial strains rise much more when the Fed is lifting rates and that just plays into the hands of a stronger dollar.

Mr. Steve Barrow would venture to suggest that this safety premium for the dollar when US rates rise is the primary driver of resultant greenback strength, not the improvement in interest rate differentials. If all this does not seal the case for more euro weakness ahead, we can come back to the very familiar story that we’ve been telling since Russia invaded Ukraine in February. It is that rate differentials and monetary policy are not the drivers of the euro right now as central banks are moving in the same direction, albeit at different speeds.

Hence there’s some degree of symmetry in their actions and this reduces the scope for currencies to move. Instead, the asymmetries are in things like energy dependency and gas price increases where Europe is being hit massively compared to the US, as shown only too clearly in the terms of trade. Until this situation moves in the euro zone’s favour, no amount of ECB rate hikes are likely to lift the euro against the dollar.