How positive did 3Q21 earnings of listed companies look?

As of 03 November 2021, 717 listed companies on three Vietnam bourses have released 3Q21 results. 3Q21 aggregate earnings increased 17.8% YoY despite stricter social distancing protocol.

3Q21 aggregate earnings increased 17.8% YoY despite stricter social distancing protocol.

Many surprises

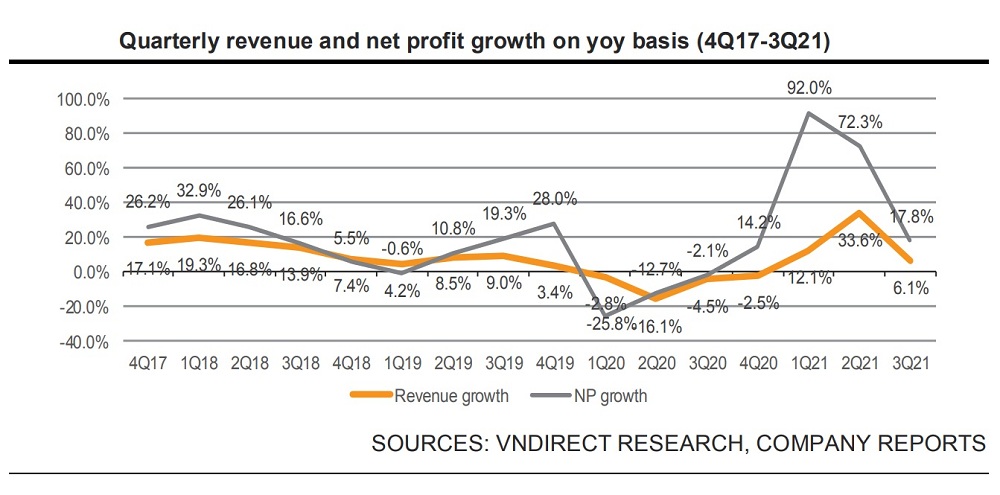

Based on VNDirect’s estimates, 3Q21 aggregate earnings of listed companies on three bourses (HOSE, HNX, UPCOM) increased 17.8% YoY, lower than that of 1Q21 and 2Q21, 92.0% YoY and 72.3% YoY respectively. The results have surprised us as 3Q21 GDP slumped 6.2% YoY amid stricter nationwide social distancing. 9M21 aggregate earnings grew robustly 54.6% YoY. Out of the 51 companies under VNDirect’s coverage that have reported their 3Q21 results, 53% were in line with its expectations while 18% beat its forecasts and 29% missed its estimates.

Banking lose some glister

Steel manufacturers delivered 17.21% YoY growth in 3Q21 NP following higher average selling price (ASP) and stronger sale volume. Among the financial sector, securities brokerage firms recorded 119.3% YoY in NP growth as 3Q21 was another good quarter with both indexes and market liquidity surge.

On the other hand, 3Q21 earnings growth of listed banks decelerated to 13.1% YoY from 79.0%/34.3 YoY of 1Q21/2Q21 since lower credit growth and heavy provisioning. The property sector’s 3Q21 earnings grew modestly 6% YoY, lower than that of 96% YoY in 2Q21 and 18% in 3Q20.

Consumer space get harder hit by COVID-19

As stricter lockdown and movement control during Aug - Sep, Beverage, Automobile, Retail, Transportation witnessed the sharp drop in 3Q21 earnings with -65%, -54%, -53%, -18% YoY, respectively. Other sectors experienced negative 3Q21 earnings growth including Construction and Material (-32% YoY), Mining (-37%).

The mixed impact of commodity prices hike

At end-3Q21, S&P GSCI rallied 44.7% YTD and 73.8% YoY, fueling for the earnings growth of some certain sectors, including Chemical (172.1% YoY), Forestry, and Paper. Food producers show mixed performance: rice exporters and sugar producers are riding on the rice and sugar prices spike, while dairy, animal feed, edible oil, and meat producers’ earnings growth is under pressure from higher material input costs.

At all, VNDirect saw that food producers posted a soft recovery of 5.1% YoY 3Q21 earnings growth, slightly higher than that of 18.2% YoY of 2Q21.

Large caps show outperformed earnings

Based on VNDirect’s estimates, 3Q21 aggregate earnings of listed companies on three bourses (HOSE, HNX, UPCOM) grew 17.0% YoY. 3Q21 HOSE earnings have a better performance with 22.6% YoY. VN30 and large caps companies recorded 21.3%/20.2% YoY NP growth, outpaced mid-caps, and small caps (12.2% yoy/-24.0% YoY, respectively).

3Q21 VN30 earnings rose 21.3% YoY

14 corporates out of VN30 had shown positive growth, led by POW (360% YoY), HPG (174% YoY), VHM (84.3% YoY). The stellar growth of POW camp from the strong earnings growth of its subsidiary NT2 (350%) thanks to higher ASP. HPG enjoyed stronger volume and ASP of steel. Among banks, TPB and TCB recorded the highest earnings growth of 40.2%/40.0% YoY, respectively. On the other hand, the laggards named PNJ (-178% YoY), VIC (-123% YoY) and VRE (-96% YoY), PLX (-91% YoY), NVL (-74% YoY). All these companies were affected by the social distancing period and transport restriction in 3Q21.