How to pick consumer stocks

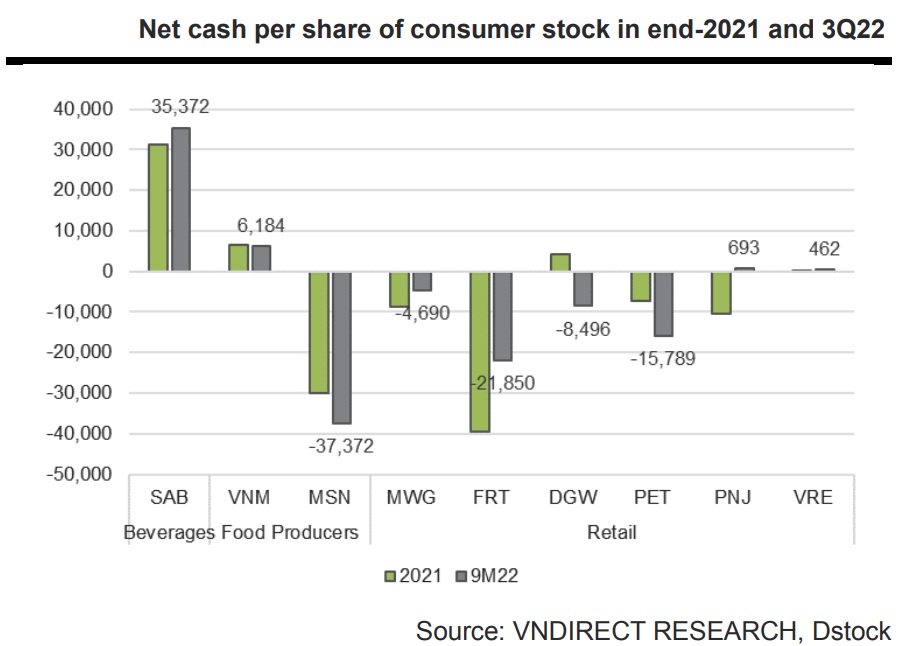

Consumer businesses would be more stable while coping with macroeconomic swings if they had a net cash position and little debt.

Investors may be interested in a variety of consumer stocks.

>> Luxury items could be less risky

"Due to the fact that businesses are heavily reliant on luxury spending, we choose stocks with a net cash position since they are less hazardous than other stocks in an unpredictable market and less vulnerable to a decline in demand. As a result, we think PNJ and VRE are appealing to include in the portfolio. We also added MWG and VNM to our watchlist because Bach Hoa Xanh for MWG might produce positive results in 2023F and VNM is a desirable defensive investment in case of a significant market correction", said Mr. Phan Nhu Bach.

For PNJ, a remarkable increase of 132.6% yoy in 9M22 net profit has demonstrated the company's stability. In keeping with this trend, VNDirect chooses PNJ as it has a strong mid- to high-end consumer base and a statistically dominant market share of more than 50% in the jewelry industry. As long as customers continue to gravitate toward modern chains and the non-statistical jewelry sector in Vietnam maintains its market share of up to 80%, PNJ will continue to have solid growth prospects.

In the long run, Mr. Phan Nhu Bach anticipates that PNJ's strategies (creating appealing concepts like Style by PNJ, launching more successful ad campaigns, working with Pandora to become "multi-branded stores," speeding up digitization, and aiming for omnichannel sales) will support PNJ's net profit to maintain 2-digit growth, at a CAGR of 24.3% from FY22-26F.

Vincom Retail JSC (VRE), the largest retail property developer in Vietnam with 1.75 million square meters of gross floor area at the end of 3Q22, is picked because it will see strong long-term growth due to the country's boom in modern retail and rising incomes for its citizens. COVID-19 spreads widely as a result of the rising immunization rate in Vietnam and the recovery of retail spending, which allows VRE to increase GFA and rental prices to increase revenue and net profit. Mr. Phan Nhu Bach said Vietnam's GDP growth would likely cause a 62%/26% increase in net profit for VRE's FY23/24F.

VNDirect picks MWG because it holds a dominant position in the retail of consumer electronics and mobile phones. As a result, it benefits from the expansion of this market, particularly from the anticipated rapid rise of high-end items like Apple. Additionally, as BHX has undergone renovations since 2Q22, monthly sales at each of its outlets have increased, and BHX is approaching a profitable period.

>> Consumer spending may face a pullback

"From 2023F on, we anticipate BHX to be profitable and serve as the primary contributor to MWG's net profit. We anticipate MWG's net profit to expand significantly in FY23F to reach 43.9% yoy due to BHX's breakeven point", said Mr. Phan Nhu Bach.

However, in VNDirect’s view, when choosing consumer stocks, investors will face a number of investment risks, including: overstocking of outdated inventory due to peaking demand in pandemics, driving up inventory clearance costs; a longer-than-expected drop in Vietnam consumption due to global recession and macroeconomic fluctuations in Vietnam; a higher-than-expected borrowing cost due to rising FX and interest rates;The revenue of ICT retailers and distributors would be impacted if supply chains in China are disrupted for longer than anticipated, particularly for Apple items.

In the meantime, VNM's topline showed indications of improvement with a 7.5% qoq increase in 3Q22 sales. VNM may increase its gross profit margin in FY23-24F to help FY23-24F earnings growth return to positive territory at 9.9% yoy/11.4% yoy if raw material costs continue to decline. With a net cash position of VND6,184 per share as of 3Q22, VNM has solid financial health despite being under pressure from recent exchange rate swings. This makes VNM less vulnerable to rising interest rates and numerous macro fluctuations. According to Mr. Phan Nhu Bach, with a market share of 55% and a core business in necessary items, VNM is an attractive defensive stock in case of a significant market correction.