How will FX and rate hike impact export firms?

Different export firms are affected differently by FX volatility and an increase in interest rates.

Production activities at MSH

>> The basic chemical sector could look brighter

As a result of the FED's aggressive monetary policy in response to inflation that is out of control, the USD is on the rise. The VND had declined against the USD by about 8.3% by the end of October 2022.

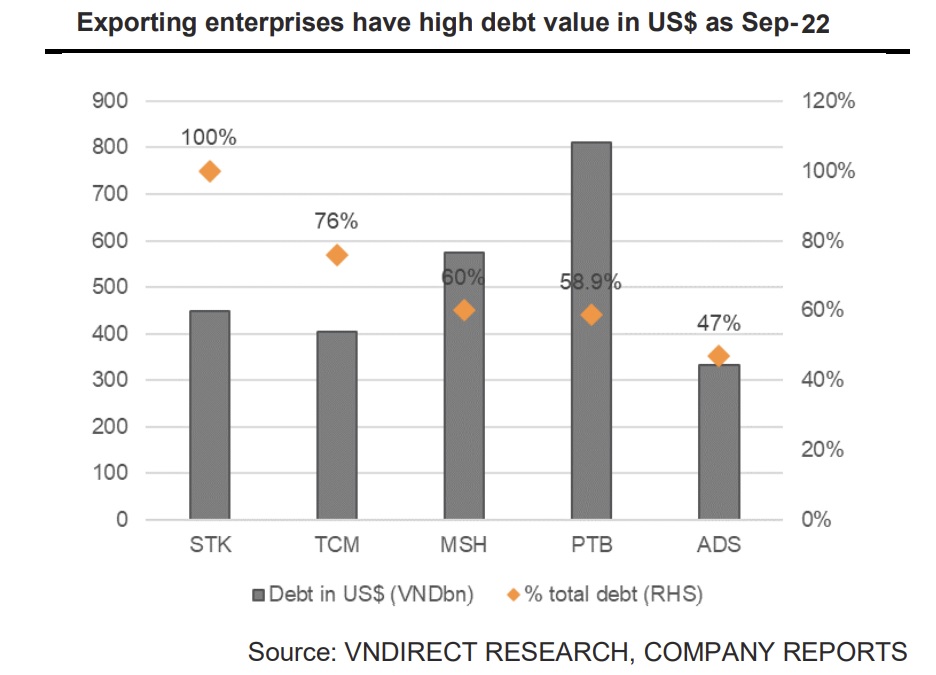

Businesses like DGC and GIL, which are net exporters and do not have any USD debt, would benefit from the strengthening of the USD, according to VNDirect. Businesses like PTB, MSH, and STK that have a large amount of USD debt may see exchange rate losses in FY23F.

In addition, compared to the start of the year, interest rates on multi-term deposits at banks have grown by an average of 1.5% to 2.0%/year. VNDirect said businesses like DGC, ACG, and VIF that have positive net cash and a low net debt/equity ratio will probably see an increase in interest income. Higher interest payments in FY23F will impact the bottom lines of VGT, TNG, and PTB.

As predicted, the FED increased the overnight borrowing rate by 0.5 percentage points, bringing it to the desired range of 4.25% to 4.5%. After four quarter-point hikes in a row, the most aggressive policy changes since the early 1980s, were put to an end by the rise. The demand for non-essential goods will decline as a result of longer-than-expected inflation in the US market. Additionally, changes in phosphorus import and export tariffs will have a negative impact on the gross margins of phosphorus producers in 2023.

"We choose stable businesses in the face of the current interest rate and currency headwinds. Additionally, we choose businesses that have a low net debt to equity ratio, little exposure to US currency, and input material independence. So, we approve with DGC's stock selection," said VNDirect.

In fact, DGC benefited from both higher deposit rates and the USD/VND exchange rate. DGC had no USD debt burden and a net cash/share of VND17,703/share as of 3Q22. DGC can fund its chlor-alkali-vinyl project in FY23F without debt. Moreover, 80% of DGC’s revenue is in USD, while only 40% of its COGS are in USD, which will support DGC’s gross margin in FY23F. Furthermore, the completion of phase 1 of the Chlor-alkali-Vinyl (CAV) project in 3Q24F will become the primary revenue growth driver, accounting for 25% of annual revenue and ranking DGC's sodium hydroxide factory first in commercial capacity in Vietnam.

Given that the majority of CAV manufacturers in Vietnam are small or non-commercial, and that large capital investments are required, VNDirect believes that DGC will maintain its industry leadership position in the FY25-FY28 period.

>> Sectoral applications of IoT: Optimizing processes for chemicals

In the stock market, DGC's stock price has dropped 33.2% since August 2022, following the market correction. Currently, DGC is traded at 4.6x FY23F P/E, which is a 54% discount to its 3-year average of 10.3x. VNDirect believes this valuation is relatively attractive for a leading producer of phosphorus and phosphorus-based products and is planning to expand into new products in the short term.

In addition, VNDirect saw ACG as a solid company against the current headwinds of interest rates and exchange rates. ACG’s balance sheet is quite solid, with a low D/E ratio of 36% and low exposure to USD as 70% of ACG’s material is purchased from domestic partners.

"We are optimistic about ACG's long-term export revenue prospects (FY23–25F) as in 2Q22, ACG signed a partnership with the U.S. property arm of Sumitomo, a strategic shareholder of ACG, which should help to bolster ACG’s exports going forward in FY23–24F," said VNDirect.

ACG's stock price has plunged 37.9% since October 2022. Currently, ACG is traded at 8.2x TTM PE, which is a 56.6% discount to its 3-year average of 18.9x. VNDirect believes this valuation is attractive for a leading company in engineered wood in the domestic market and is planning to fully cover 63 provinces in 3Q23F.