Inflation pressure: Spilling into core

What matters for central banks is the degree of pass-through from non-core (energy and food) to core items.

Taiwan’s IHS Markit manufacturing PMI for March climbed to 60.8, its highest level in more than a decade, and PMIs from Vietnam and Indonesia remained in expansion.

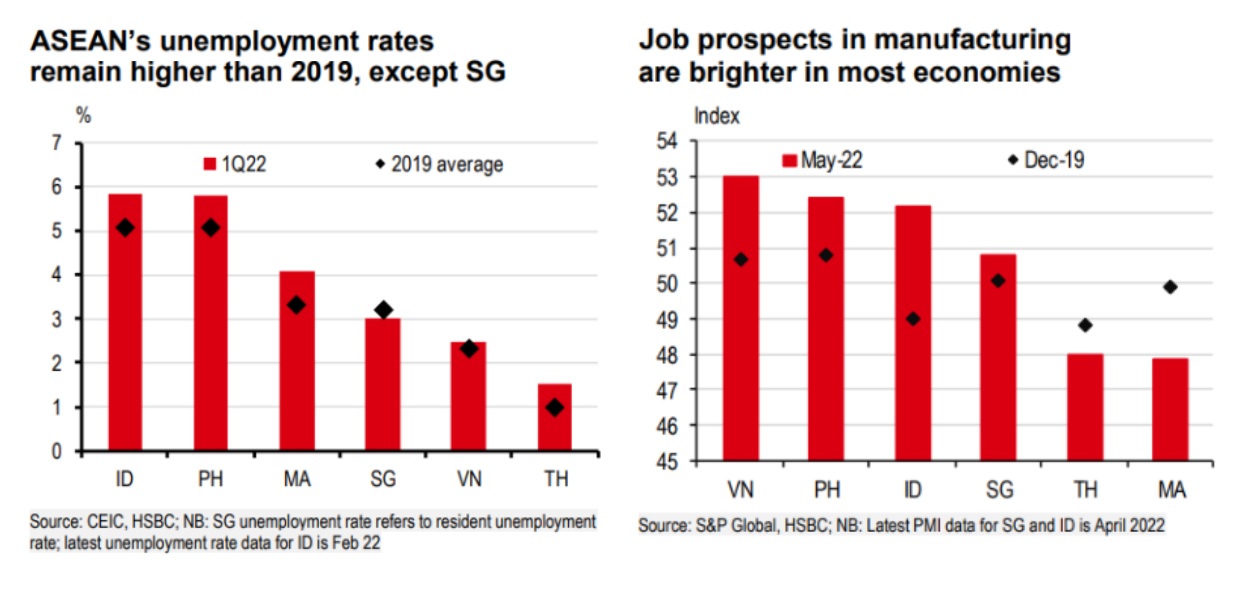

Thanks to its generous Jobs Support Scheme, which has provided direct support to save jobs, Singapore has been leading the region with an already tight labour market. Unemployment rates dropped below pre-pandemic levels in 1Q22, with wage growth trending at almost 8% yoy, significantly higher than historical levels. However, the rest of the region is still seeing a nascent recovery in job markets – their unemployment rates are still higher than pre-pandemic levels.

That said, this may quickly change, and the risk from tightening labour markets will likely materialise as ASEAN is poised to benefit from its grand re-openings. In Indonesia, Vietnam, Singapore and the Philippines, the latest employment measures of manufacturing PMIs reached the expansionary territory and exceeded their respective pre-pandemic levels. Meanwhile, as local restrictions are further dropped, services jobs, representing the lion’s share of jobs in ASEAN, will also see an ongoing improvement. This will likely translate into upward pressure on wages and core inflation for the coming quarters.

>> Inflation pressure: Energy is the main push

In short, ASEAN is not shielded from rising prices. "All things considered, we have made some tweaks to our inflation forecasts in Table 2, raising our 2022 forecasts for Thailand, Singapore, Indonesia and the Philippines. We have slightly revised down its 2022 forecast for Vietnam, as stable local food prices will likely keep a lid on headline prices", said HSBC.