Interest rate trends in Vietnam: Signs of a reversal?

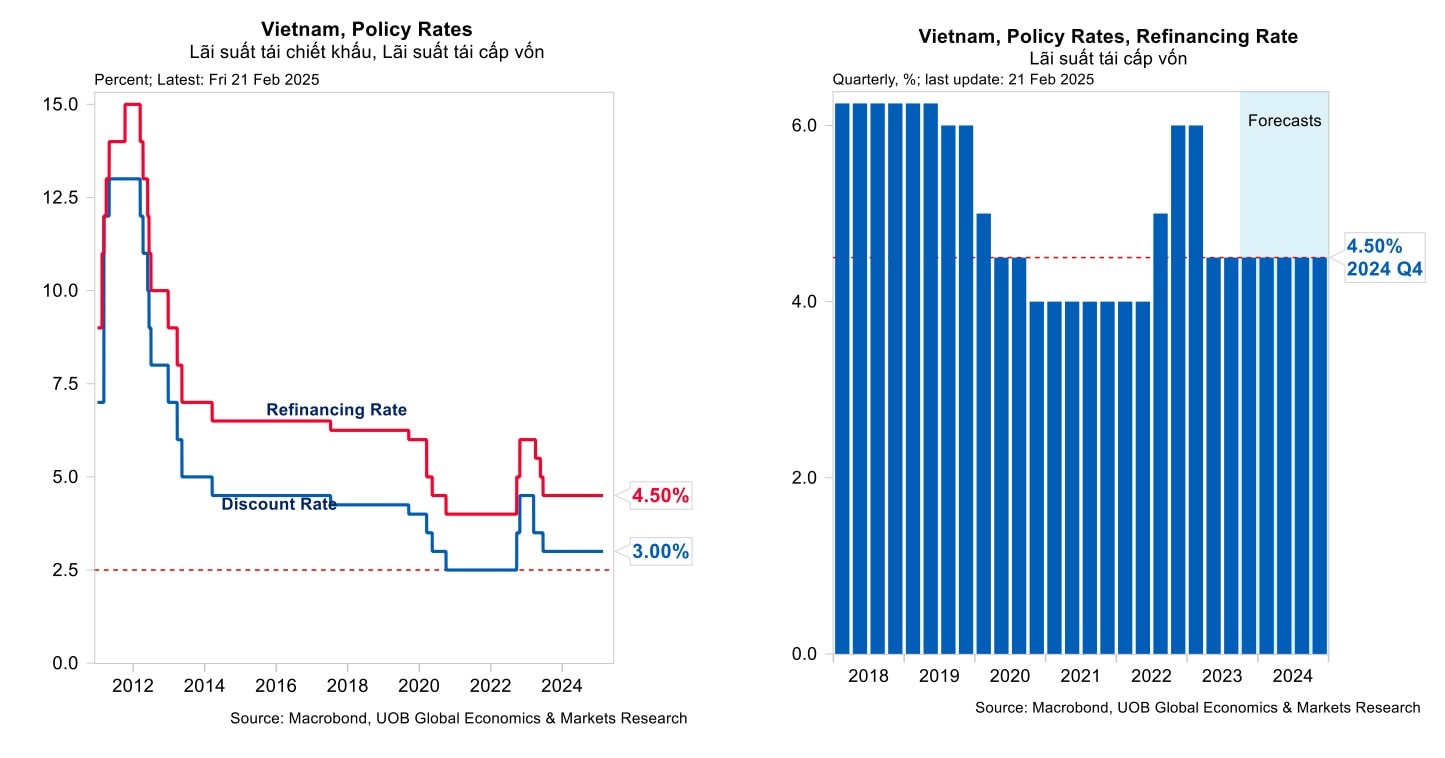

The State Bank of Vietnam (SBV) has made it apparent where its policy rates are headed. Additionally, UOB Bank experts say there is no foundation for the SBV's possible rate hike.

While continuing to monitor inflation and exchange rates, UOB Vietnam experts predict that the SBV will maintain its key policy interest rates at current levels.

A possible policy rate increase of the SBV between now and the end of 2025 is suggested by some recent long-term interest rate forecasts. These forecasts are contingent on a number of factors, including high tariff policies from Trump administration, persistently high U.S. inflation, a slower-than-expected rate-cutting process by the Fed, and growing exchange rate pressures on Vietnam.

But the SBV's recent actions—like continuously cutting interest rates on treasury bills and injecting liquidity with longer maturities—show that the SBV is working to maintain low capital costs in accordance with the government's directive to keep interest rates at a reasonable level, in addition to making sure there is enough liquidity for credit expansion and promoting strong economic growth through the banking system.

Statistical data shows that in the last two weeks of February, the SBV reduced the treasury bill interest rate from 4% per annum to 3.3% per annum, and last week, it further lowered this rate to 3.2%. Additionally, on March 3, the SBV made a new move by suspending the provision of 7-day collateralized loans (OMO) and shifting to using 28-day contracts while maintaining 14-day contracts. This indicates a clear policy shift toward long-term liquidity support for the banking system.

According to Mr. Trần Ngọc Báu, CEO of WiGroup Data Company, the SBV had already started lowering interest rates in mid-February. A series of moves in the foreign exchange and interbank markets have revealed this intention.

By reducing the treasury bill rate to 3.2%, the SBV has effectively lowered the floor for interbank rates, signaling an acceptance of lower interest levels. This also lays the groundwork for a potential reduction in the Reverse Repo Rate (OMO Rate). If exchange rate conditions remain favorable, further cuts could follow in discount rates and refinancing rates, Mr. Báu noted.

These actions go hand-in-hand with strong directives for commercial banks to lower deposit interest rates for the public. Following a meeting with the SBV and strict instructions from the Prime Minister, ten banks have already cut interest rates, including Maritime Bank (MSB), VietBank, Saigon Commercial Bank (Saigonbank), Vietnam International Bank (VIB), Bao Viet Bank (BaovietBank), Viet Capital Bank (BVBank), Bac A Bank (BacABank), Viet A Bank (VietABank), PGBank, and Kienlongbank.

Additionally, the SBV has allowed exchange rate fluctuations from the beginning of the year, continuously adjusting the central exchange rate and the buying/selling rates. According to Mr. Báu, these adjustments are setting the stage for an era of lower interest rates.

Looking at regional markets, Mr. Đinh Đức Quang, Head of Treasury Business at UOB Vietnam, shared during a roundtable discussion on March 4 that some central banks in the region have already started cutting interest rates, albeit by a modest 0.25 percentage points. This indicates that central banks are preparing to lower rates to support economic recovery and growth.

Mr. Đinh Đức Quang, Head of Treasury Business at UOB Vietnam. Source: UOB

For Vietnam, Mr. Quang affirmed that UOB’s short-term forecast is that the SBV will keep its policy rates unchanged.

Externally, market movements suggest that the Fed may not cut rates as aggressively as previously expected.

Domestically, UOB's data shows that VND interest rates rose by about 0.5-1% in 2024 due to higher capital demand, supporting economic growth of 7%. While some commercial banks have recently raised deposit rates significantly, this trend has been limited to only a few institutions.

"We observe that the first group of major commercial banks continues to offer 12-month VND deposit rates around 4.8-5%, while the second group has maintained stable 12-month rates at around 5.5% in recent months. These rates remain appropriate, given that the VND has depreciated by about 5% against the USD in 2024."

With a higher growth target of 8% for 2025, combined with measures to accelerate public investment disbursement, expand export markets, and attract strategic FDI in technology, the authorities are also considering more aggressive credit expansion. This could put slight upward pressure on VND interest rates in 2025. However, if global USD interest rates decline, the world economy improves with reduced geopolitical conflicts, and investment capital returns to emerging markets, this pressure could be mitigated.

"We remain confident that Vietnam is among the few emerging markets with strong advantages in demographics, macroeconomic stability, and diversified international trade, making it an attractive destination for long-term foreign investment. These factors provide a solid foundation for stable interest rates and exchange rates," Mr. Quang commented.

He further noted that in recent times, the Prime Minister and the SBV have strictly directed commercial banks not to raise interest rates. However, looking at policy rates, the recent Treasury bill rate cut indicates that whenever there is an opportunity to lower interest rates, the regulators will seize it.

"The overarching goal is to stabilize exchange rates, interest rates, macroeconomic conditions, and economic growth. Vietnam achieved this in 2024, and the target is even higher this year. Maintaining policy interest rates while utilizing flexible regulatory tools remains a well-suited approach," emphasized the UOB Vietnam expert.