Investment strategy in Vietnam’s corporate bond market in 2026

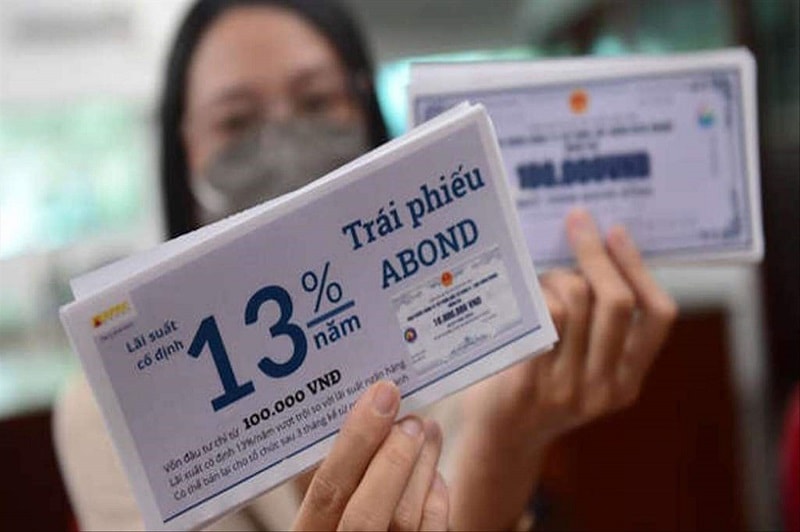

Participation in the corporate bond market is no longer a form of “disguised savings” offering high interest rates. Instead, it has become an investment product that requires genuine risk-assessment capability.

Market sentiment continues to show a preference for safe havens in highly transparent institutions.

The need for mechanisms to channel capital more effectively

According to data from the Vietnam Bond Market Association (VBMA), in 2025 the value of privately placed corporate bond issuance reached VND 534,980 billion, while public issuance amounted to only VND 54,354 billion.

By sector, divergence remains pronounced. Banks continue to dominate, accounting for around 60% of total issuance and playing a leading role in the market. This reflects the need to compensate for slowing deposit growth while strengthening capital adequacy ratios to support credit expansion in a new cycle. At the same time, investors tend to gravitate toward issuers with high levels of transparency.

By contrast, the real estate sector, which accounts for roughly 30% of issuance, shows sharp polarization. Capital flows are concentrated in a small number of leading developers with clean land banks, proven project execution capability, and relatively stable cash flows, while the resort and hospitality real estate segment remains almost “frozen” in terms of liquidity.

Looking ahead to 2026, VBMA estimates that the market will face bond maturities totaling VND 206,294 billion. The combination of a gradually rising interest rate environment and a large volume of maturing debt creates significant refinancing risks, particularly for issuers with weak financial structures or heavy reliance on borrowing.

To enable the corporate bond market to transition into a sustainable growth cycle in 2026, experts argue that more effective mechanisms are needed to channel capital into manufacturing, infrastructure, and the real economy. At the same time, completing the overall market ecosystem is a prerequisite.

Mr. Vu Duy Khanh, Director of the Analysis Center at SmartInvest Securities, notes that the first priority lies in trading infrastructure and information disclosure. A realistic target for 2026 would be to raise average daily market trading value to VND 10,000–20,000 billion. In parallel, mandatory bilingual (Vietnamese–English) disclosure for large issuers would be a necessary step, enabling foreign investment funds to access data simultaneously and on an equal footing with domestic investors.

Another notable issue is the absence of a benchmark yield curve for corporate bonds. Without a pricing reference, the distinction between risk and return becomes subjective, increasing the likelihood of mispricing. Strengthening the role of domestic credit rating agencies would therefore help the market clearly differentiate between investment-grade and high-risk bonds, reinforce market discipline, and reduce systemic risk.

“In a context of substantial capital demand for infrastructure and national priority projects, diversifying bond products has become essential. Instruments such as green bonds, ESG bonds, and PPP bonds not only meet long-term funding needs but also help Vietnam capture global ESG capital flows. At the same time, developing hedging instruments such as bond derivatives and allowing the prudent use of leverage would enhance liquidity absorption and risk management capacity among financial institutions.

“From the perspective of foreign capital, the market is facing a paradox. Vietnam’s 10-year government bond yield, at around 3.94%, is currently lower than the US equivalent (4.1–4.2%), creating an unfavorable interest-rate differential and prompting carry-trade flows to reverse. To address this, in addition to improving transparency, specific incentives related to taxes and transaction fees are needed, along with simpler procedures for opening custody accounts, to offset the disadvantage in absolute yields,” Mr. Khanh said.

Strategy for investors

In the current environment, investment strategies must also become more flexible. Mr. Vu Duy Khanh suggests that fund managers consider shortening the average duration of their portfolios or adopting a barbell allocation strategy, combining safe short-term bonds with new issues from highly rated issuers. This approach helps control interest rate risk while taking advantage of more attractive yield levels on new issuance.

For individual investors, the coming period requires a fundamental shift in mindset. First, bonds are no longer “high-interest savings in disguise” but investment products that demand proper risk evaluation. Understanding the credit-rating system—from A ratings with strong repayment capacity to B, C, and D ratings with progressively higher risk—is the first step in protecting capital.

Second, assessing issuers through a basic checklist should be treated as a non-negotiable principle before investing. This includes a current ratio above 1 (indicating the ability to meet short-term liabilities with available current assets), financial leverage not exceeding the industry average, and collateral that has been independently valued.

Within this framework, the role of financial intermediaries is becoming increasingly important. Participating in the market through open-ended bond funds or asset management companies allows individual investors to benefit from professional credit analysis, collateral management expertise, and portfolio diversification—advantages that are difficult for retail investors to achieve on their own.

“Looking ahead to 2026, the overarching strategic message is clear: bond investing is not about eliminating risk, but about pricing and accepting risk on the basis of transparency. Priority should be given to issuers with bank underwriting guarantees or publicly available credit ratings from professional agencies, thereby achieving a reasonable balance between yield and safety,” the expert advised.

Overall, Vietnam’s corporate bond market is gradually converging toward the conditions needed to enter a new growth cycle. If challenges related to trading infrastructure and market confidence are addressed through greater transparency and effective credit-rating systems, corporate bonds can become an efficient medium- and long-term capital channel, playing an important role in realizing Vietnam’s ambition of double-digit GDP growth in the coming period.