IPOs will trigger stronger foreign capital inflows

Following Vietnam’s market-upgrade announcement, foreign investors have continued to sell equities. Yet a series of IPOs is steadily adding high-quality “goods” to the stock market.

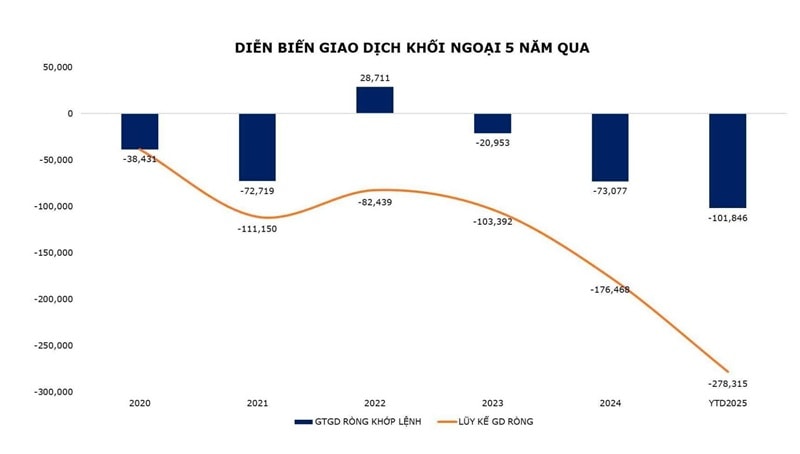

Positive Signals After a Selling Streak

After many consecutive sessions of net selling, foreign investors unexpectedly turned net buyers on 20 November, with a net purchase value of about VND 240 billion.

However, it remains difficult to determine whether this net-buying activity will form a sustained trend. The market expects that after the recent sell-off, valuations across many stocks and sectors have become attractive; at the same time, foreign investors may ease capital-rotation needs and be ready to increase buying.

Earlier, Huỳnh Minh Tuấn — founder of FIDT — estimated that as of mid-November 2025, foreign investors had sold a cumulative VND 270 trillion, equivalent to roughly USD 11 billion. From early September to mid-November alone, around USD 2 billion flowed out of the Vietnamese stock market.

Tuấn noted that this sell-off resulted from the convergence of multiple key factors — from changing expectations to domestic and global macro conditions — including exchange rates, interest-rate differentials, tariffs, and geopolitical instability.

In reality, foreign investors are simply following their strategic roadmap for restructuring capital flows and reallocating assets across markets given the current macro backdrop. Data shows that the U.S. has attracted the most capital this year, with over USD 600 billion, followed by Japan and China. Meanwhile, Southeast Asian markets have faced broad-based net selling.

“During Vietnam’s economic transition, the era of foreign capital functioning as ‘aid’ is over. It is now giving way to new foreign investment with a clear mindset of partnership and long-term equity contribution. The market-upgrade story is a turning point that draws international attention to Vietnam — a highly positive signal for the medium and long term,” Tuấn emphasized.

IPOs Unlock New Capital Flows

In addition to the upgrade factor, Tuấn highlighted that high-quality IPOs — both this year and into 2026 — will create renewed momentum, attracting new capital as global investors “re-evaluate” the Vietnamese market during year-end strategy meetings. Disbursement is considered highly feasible for the 2026–2030 period in terms of both scale and quality.

While the market waits for a reversal in foreign-capital flows after the upgrade effect, other developments also suggest that international funds are “reassessing” Vietnam with fresh eyes. A notable case is Vanguard, whose representatives recently held discussions with the State Securities Commission on cooperation opportunities and foreign-investment attraction.

ACB Securities (ACBS) estimates that Vanguard may become one of the most prominent global ETFs to inject capital into Vietnam once the market is officially reclassified to Secondary Emerging. The market could see an additional USD 435.4 million from these passive ETFs — though such funds will only disburse after the upgrade becomes official.

From now until then, companies continue pushing forward with IPOs and listings — an active preparation for a future basket of high-quality stocks. Several large-cap IPOs are expected to become strong candidates for inclusion in the future FTSE Emerging All Cap Index.

Following TCX, VPX and VPS, the market is preparing to welcome another notable newcomer: Hòa Phát Agricultural Development JSC (HPA), a subsidiary of steel tycoon Trần Đình Long’s Hòa Phát Group, which submitted its IPO application in September 2025.

According to Hòa Phát’s latest disclosure on 20 November, the State Securities Commission has granted the approval for HPA’s initial public offering. The company plans to issue 30 million shares at VND 41,900 per share. Proceeds will be used to restructure finances, repay loans, add working capital and expand livestock farms and feed-mill plants. Investor subscription runs from 24 November 2025 until 4:00 PM on 15 December 2025 via the Vietcap app.

Vietcap is the exclusive IPO advisor and lead distributor, committing that investors can complete the entire HPA IPO registration process conveniently and quickly on its app.

The minimum subscription is 100 shares, and the maximum is 14.25 million shares (equivalent to no more than 5% of post-IPO charter capital). Orders must be placed in multiples of 100 shares. Investors must place a 10% deposit upon registration. Detailed instructions will be published on the websites of HPA and Vietcap. Total expected proceeds amount to VND 1.257 trillion.

With its scale, competitive strength in agriculture, and the advantages of the Hòa Phát ecosystem — combined with Vietcap’s leading IB expertise — the HPA IPO is likely to become the largest non-financial IPO of the year. It is also expected to serve as a strong “finishing move” that sets the tone for an attractive 2026, helping channel substantial capital towards Vietnam’s market and its businesses.