Lending rates may drop even lower

Deposit interest rates are expected to remain unchanged in 4Q23, while loan interest rates are expected to fall further 0.25%.

Transactions at MB

>> Borrowers struggle to benefit from new lending policy

Following the SBV's four policy interest rate decreases, which resulted in a 0.5% to 1.5% drop, interest rate developments for 9M23 were much lower in both the deposit and interbank markets. Concurrently, the SBV issued a number of circulars, including circulars 02, 03, and 06, which KB Securities finds to be quite advantageous. Given the global economic slowdown caused by high interest rates and persistently rising inflation, the SBV's action tries to instruct and reward commercial banks to lower interest lending rates, therefore fostering economic development.

Mr. Tran Duc Anh, Head of Macro and Strategy at KB Securities, predicts that deposit interest rates will remain flat until the end of 2023, with the average 12-month deposit interest rate hovering at 5.45% (-2.8% YTD). Lending interest rates fell more rapidly in 3Q23 as high-cost term deposits matured; however, the NPL ratio increased slightly in 3Q23, as the SBV reduced the short-term capital ratio for medium- and long-term loans from 34% to 30%, and inflation and exchange rate pressures prevented further declines. We anticipate that loan interest rates will continue to fall by 0.25% in 4Q23, bringing the year-to-date rate to 1.75%-2.25%.

Factors supporting interest rate reduction

First, easing measures have a lag reaction, which is the primary driver of interest rate declines. Customer deposits account for 70-80% of bank deposits, with maturities ranging from 6 to 12 months, resulting in significant financing costs for banks in the first half. As a result, the cost of money will fall after these term deposits mature, enabling banks to drop lending interest rates.

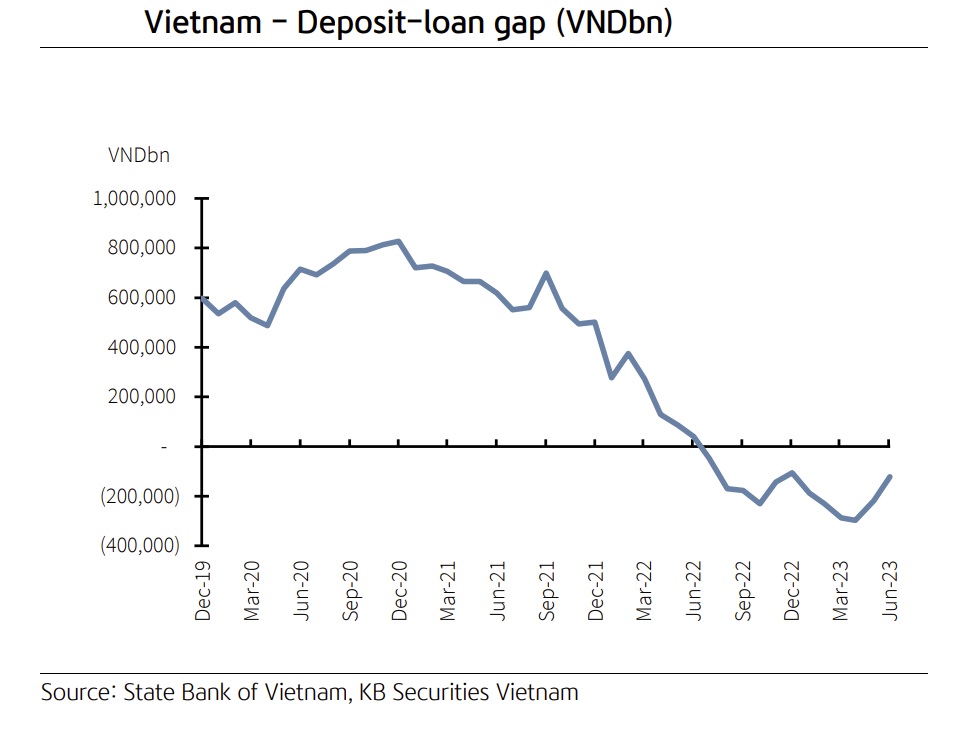

Second, loan growth has lately increased but remains much below the desired range of 14%-15%. When the loan-to-deposit ratio (LDR) reaches 76.7% in August 2023, there is plenty of opportunity for loan growth, yet credit growth remains well below the allocated objective.

Third, Circular 06/2023 permits debtors to obtain loans from several institutions in order to payback current loans. Circular 06, which went into force on September 1, urged banks to employ incentive programs such as lower lending interest rates in order to meet allocated credit objectives. However, we believe that the impact of Circular 06 will be gradual, because borrowing from other banks to settle current debts necessitates several procedures, not to mention early prepayment penalties.

>> Property market expects money inflows following lending rate cuts

Factors hindering rate cuts

First, there is inflationary pressure. Headline and core CPI increased by 1.08% and 0.26% MoM in September, respectively, and by 3.16% and 4.49% monthly in the first nine months of 2023. Although the target of keeping inflation far below 4.5% is achievable, the government and the SBV should not take it for granted, given the recent substantial increases in prices. "If the inflation trend flares up. Monetary policy has the task of preventing and preparing for a tightening trend", stated SBV Governor Nguyen Thi Hong.

Second, the USD/VND exchange rate was under pressure in 4Q23 as a result of (1) the broad interest rate differential between USD and VND, (2) the stronger USD, and (3) higher imports resulting from the economic recovery.

Third, there is liquidity pressure. If the exchange rate does not fall quickly, the SBV may continue to withdraw funds in larger quantities through treasury bills, which it may combine with foreign exchange forward/spot agreements. This can help diminish bank liquidity and raise interbank interest rates, raising interbank financing costs, particularly among small and medium-sized banks with little liquidity. This makes it difficult for small and medium-sized banks to cut interest rates and may possibly lead deposit interest rates to rise significantly at these institutions.

However, Mr. Tran Duc Anh believes that bank liquidity will be under pressure in 4Q23 even if interbank interest rates rise slightly because: (1) the acceleration of public spending disbursement allows deposits made by the State Treasury at the SBV to be released and flow into the mobilization channel; and (2) USD/VND exchange rate pressure will not be strong enough to force the SBV to sell foreign exchange reserves, despite cash withdrawal.