Major currencies remain locked in pretty tight ranges

While it might look as if the FX market will trade through to the end of the year in a very stable fashion, there are still a number of events that could generate significant volatility.

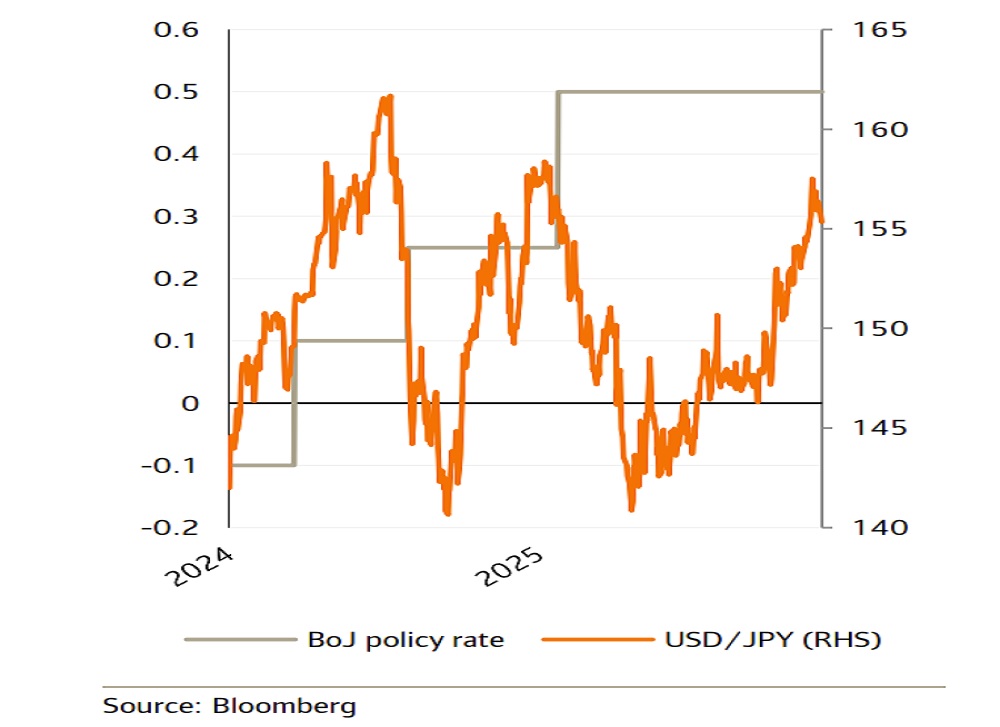

Yen surges when the BoJ hikes

The euro/US dollar is hardly straying from 1.15 and volatility across the G10 is still close to the lowest levels we have seen this year. It seems to have all the signs of a market that has given up for the year, content to play out the final month with minimal disturbance.

However, as far as we can see, there are still a number of events that could upset the stability, and all of them are skewed towards the possibility of a weaker US dollar. The first does not originate in the US at all, but in Japan. For the Bank of Japan’s policy rate decision on December 19th could provoke notable yen strength, including against the US dollar. That’s certainly been the theme when the BoJ has announced rate hikes in the past. The slump in dollar/yen in March 2024, when the BoJ first hiked rates might have proved modest and temporary, but the fall after the July 2024 and January 2025 rate hikes was deep and sustained.

Now clearly those experiences do not guarantee a slump in the US dollar/yen on December 19th should the BoJ hike. For a start, the July 2024 rate hike was not fully anticipated and occurred after the BoJ had been intervening to strengthen the yen, while the January 2025 BoJ rate hike occurred at a time when the US dollar was pressurized by the incoming Trump administration. Fast forward to today and a 25 bps rate hike has an 80% probability according to overnight interest swap prices, and the US dollar is generally stable. So, even though we do think that a rate hike is likely, the impact on the US dollar/yen seems likely to be more muted than we have seen in the past.

This being said, we need to bear in mind US-specific events that could occur before the year is out, as these could compound pressure on the US dollar. The first is the Supreme Court’s ruling on the legality of tariffs, and the second is President Trump’s nomination of a new Federal Reserve head.

On the first of these, it seems likely, but not certain, that the Supreme Court will give its ruling on the legality of country-specific tariffs before the end of the year. These tariffs are essentially illegal, as it is Congress’s remit to raise general taxation, not the president’s. Given that the tariffs are set to raise very substantial sums, it is clear that they reflect ‘general’ taxation and not some form of minor revenue-raising operation.

Steven Barrow, Head of Standard Bank G10 Strategy, expects the Court to rule the tariffs illegal. The extent of the impact of such a ruling on the US dollar could be tempered by a number of factors.

Firstly, betting markets see a high chance of the tariffs being ruled illegal, meaning that an adverse ruling is at least partially priced in.

Secondly, other tariff options are open to the Administration to claw back revenues should the Supreme Court rule that using the International Emergency Economic Powers Act (IEEPA) is illegal.

And thirdly, the ruling could come so late in the year that the FX market has essentially gone to sleep for the holiday period. But despite these caveats, we would be prepared for possible dollar weakness due to this issue. A third factor that Steven Barrow would note as he rolls down towards the end of the year is the nomination of a new Fed Chair to take over from Powell when he steps down next May. As things stand, five names are in the frame: Fed Governors Bowman and Waller, former Fed Governor Warsh, White House Chief Economist Hassett, and BlackRock Director Rick Reider. Speculation in the press points to Hassett, who we’d regard as the candidate that’s least likely to win the affection of the US dollar bulls.

One reason for this, and possibly a reason why he may get the job, is that Trump may put loyalty above all other attributes. It seems clear that Trump has felt let down by Powell who was arguably put forward back in 2017 due to his experience at the Fed rather than his loyalty to Trump. A second factor is Hassett’s enthusiasm for cryptocurrency. This is clearly very dear to Trump’s heart right now and could easily be the deciding factor when it comes to the choice of a new Fed chair. Like the Supreme Court decision, the nomination of a new Fed chair could come before the end of the year and, if it does it could make up a trifecta of wins for the dollar bears.