New cycle for real estate stocks

According to Mr. Doan Minh Tuan, Head of Research & Analysis at FIDT, the accumulation investing strategy, which is based on yearly company outcomes and long-term projections, is still being favored, especially given the low stock values.

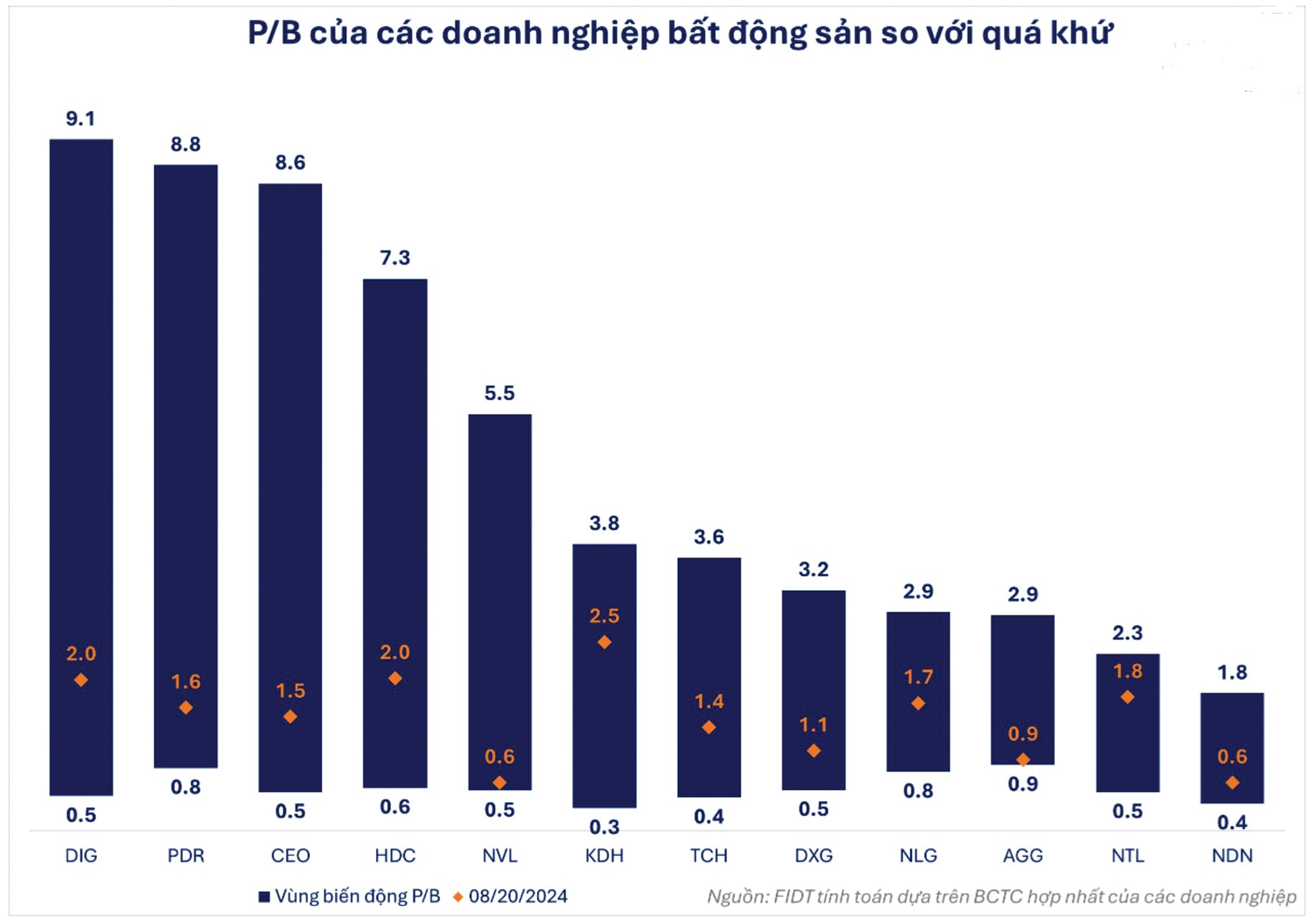

Chart: P/B ratios of several real estate companies

In Mr. Doan Minh Tuan's view, whether real estate stocks (RE stocks) meet these criteria depends on the factors below.

Favorable Conditions for a New Cycle

Following a protracted freeze in 2023 and the first half of 2024, the real estate market has begun to show indications of revival, aided by government measures and improved macroeconomic conditions. Despite ongoing obstacles, Tuan believes that the Vietnamese real estate sector is gaining traction and prepares to enter the next boom cycle, with more visible positive indications.

The economic recovery creates the framework for the real estate market's comeback, with growing salaries allowing consumers to make big expenditures like home purchases. Looking back at previous real estate cycles, when the economy moves from recovery to growth, real estate values begin to rise and transactions become more active. With Vietnam's economy likely to recover and develop in the second half of 2024 and into 2025, FIDT forecasts a significant increase in real estate investment demand.

Additionally, during this period of economic stimulus, government policies, especially maintaining low interest rates, are aimed at boosting the economy. Lower mortgage rates make home buying more accessible and attractive. Combined with various incentives from real estate companies, demand from actual buyers has improved in recent times.

Domestic home-buying demand is likely to increase dramatically, while real estate supply remains low, generating potential for future developments, notwithstanding differences among segments and key markets. Notably, shortages in specific places, such as Hanoi and Ho Chi Minh City, provide excellent consumption prospects for developers with houses available for sale in the near future.

Furthermore, three real estate laws, along with new regulations on land prices and compensation for resettlement, which took effect in August, are expected to propel a new real estate cycle.

Ready for the Recovery Phase

Overall, the first half of this year has been a difficult moment for real estate firms, with business results not particularly positive, especially since the real estate market has been slowly improving.

Looking at several large firms in the sector, FIDT can observe that the majority of their earnings have come from partial project handovers or investment liquidation through the sale of subsidiaries.

"Companies such as VHM, NVL, PDR, and NLG had large increases in financial revenue in the last quarter. This drive to increase financial revenue is a good strategy for firms to maintain cash flow, establishing the groundwork for breakthroughs in the next phase of the real estate market," said Mr. Doan Minh Tuan.

KDH and DXG achieved more positive business results in the first half of 2024. With well-performing projects launched in previous periods, the core business revenue of KDH and DXG has been steady without needing to rely on subsidiary sales or asset liquidations.

Leaving behind the bleak year of 2023 and the first part of 2024, real estate developers are now gearing up for recovery, with a slew of attractive pipeline projects. Mr. Doan Minh Tuan predicts that domestic real estate developers will become more active in the second half of 2024, boosting profit growth prospects in 2025 and subsequent years. Furthermore, financial soundness and legal frameworks will be critical differentiators for real estate enterprises in the next cycle.

Projections, Valuations, and Recommendations

Based on the sales plans of real estate companies' projects, along with assessments of their ability to accelerate legal, financial, construction, and sales progress, we estimate that real estate companies' profits will remain low in 2024 but will return to strong growth in 2025 and 2026.

"PDR and KDH are two real estate equities that are recommended for future acquisitions. PDR, in particular, with its important projects Bac Ha Thanh, Thuan An 1&2, and Cadia Ngo May, is expected to do well in the second half of 2024 and 2025. The company's efficient management of legal processes is likely to speed up these projects, particularly with the introduction of three new real estate laws. In the long run, PDR's varied land bank is likely to prosper during the sector's expansion cycle. On September 25, PDR's market price was VND 22,900/share, with a P/B ratio of 1.63 and a target price of VND 39,600/share," said Mr. Doan Minh Tuan.

Meanwhile, KDH has a land bank in key sites around Ho Chi Minh city. In the short to medium term, KDH is counting on the handover of Privia, a project started with a 100% absorption rate in Q4 2023 and Q1 2024. Furthermore, KDH will launch the Clarita and Emeria projects, and given its excellent reputation and the scarcity of supplies in Ho Chi Minh City, Mr. Doan Minh Tuan predicts absorption rates to be 70-90%. As of September 25, KDH had a market price of VND 38,850/share, a P/B ratio of 2.50, and a target price of VND 46,200.

Mr. Doan Minh Tuan also suggests keeping an eye on DXG and NLG stocks. DXG is facing legal hurdles with present projects, while NLG is projected to experience difficulty in gathering land for the next cycle, which he will continue to monitor in the near future.