Outlook for 2025: Uneven profitability among banks

Quan Trong Thanh, Head of Research at Maybank Investment Bank (MSVN), predicts that loan growth would reach roughly 15% in 2025 in a scenario of 6.7–7% GDP growth. Furthermore, the growth of the banking industry will be supported by the stability of credit cost ratios and net interest margins (NIM).

Uneven Recovery Among Banks

Despite market concerns and misconceptions, optimism about the banking sector remained high during the 2020–2023 period.

The banking sector continues to recover unevenly, with growth concentrated in a few established names

Vietnam's solid economic structure and banks' substantial provisioning buffers, in Thanh's opinion, would support profit growth and preserve a high return on equity (ROE). But since Q2 2024, more cautious sentiments have taken hold as credit risk buffers have shrunk.

Depending on a number of variables, including the strength of the customer base, the quality of the assets, and the commitment of shareholders to returns, the rate of recovery and profitability in 2025 is anticipated to differ substantially throughout banks.

Dependent on Economic Recovery

Despite macroeconomic challenges such as COVID-19 and fluctuations in the bond and real estate markets in 2022, Vietnamese banks maintained solid profit growth during 2019–2023, with a compound annual growth rate (CAGR) of 21% and an average ROE of 18.3%.

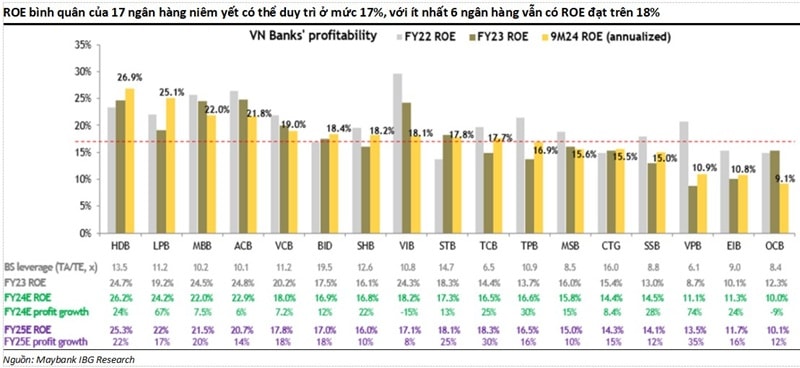

The projected ROE for 2025 exceeds 18% for banks such as HDB, LPB, MBB, ACB, STB, and TCB.

Strong loan loss provisions from 2020 to H1 2022 created room to manage profits through 2023 and the first nine months of 2024, despite stricter credit growth, shrinking NIMs, and rising non-performing loans (NPLs).

As of Q3 2024, the average loan loss coverage ratio (LLCR) of listed banks had dropped from a peak of 150% in Q2 2022 to 83%, with many banks reporting LLCRs below 50%. This underscores that current profit prospects are closely tied to the pace of economic recovery.

Uneven Profitability

Thanh anticipates that domestic factors including governmental investment and a boost from the real estate industry will help Vietnam's GDP grow by 6.7–7% in 2025, with corporate lending and high-end retail segments driving sector-wide credit growth of about 15%.

Twelve listed banks fell into the 'Stress' category in Q3 2024, according to Maybank's risk buffer study, which was four times higher than at the end of 2023. Going forward, Vietnam's banking industry will depend more and more on economic recovery, especially in the real estate sector.

Only a small number of high-performing banks with robust client bases and cost competitiveness are anticipated to increase their net interest margins (NIMs), and pressure on NIMs is predicted to continue until H1 2025.

Experts predict that total profits for listed banks will grow by approximately 16% in 2024 and 19% in 2025, maintaining an average ROE of over 17%. The best-performing banks in terms of profit growth in 2025 are expected to include VPB, TCB, HDB, MBB, and STB. However, TCB, VCB, and CTG are anticipated to outperform their targets.

After market corrections in November 2024, the price-to-book value (P/BV) ratio has returned to reasonable and attractive levels. However, given the likelihood of uneven recovery in 2025, selecting stocks with fair valuations and clear profitability recovery potential is critical.

The moment has come, Thanh underlined, to give banks with robust development prospects precedence over those with cautious expansion. Effective data analysis, a strong customer base, ambitious and competent leadership teams, and acceptable LLCRs to reduce risks are all necessary for this. As a result, CTG, HDB, and VPB are suggested for active trading tactics, while names like TCB, VCB, and MBB are taken into consideration for investment positions.