Phuoc Hoa Rubber JSC faces setbacks

Phuoc Hoa Rubber Joint Stock Company (HoSE: PHR) is pulling back owing to several challenges. The corporation has considerably cut its business plan for 2024 compared to 2023.

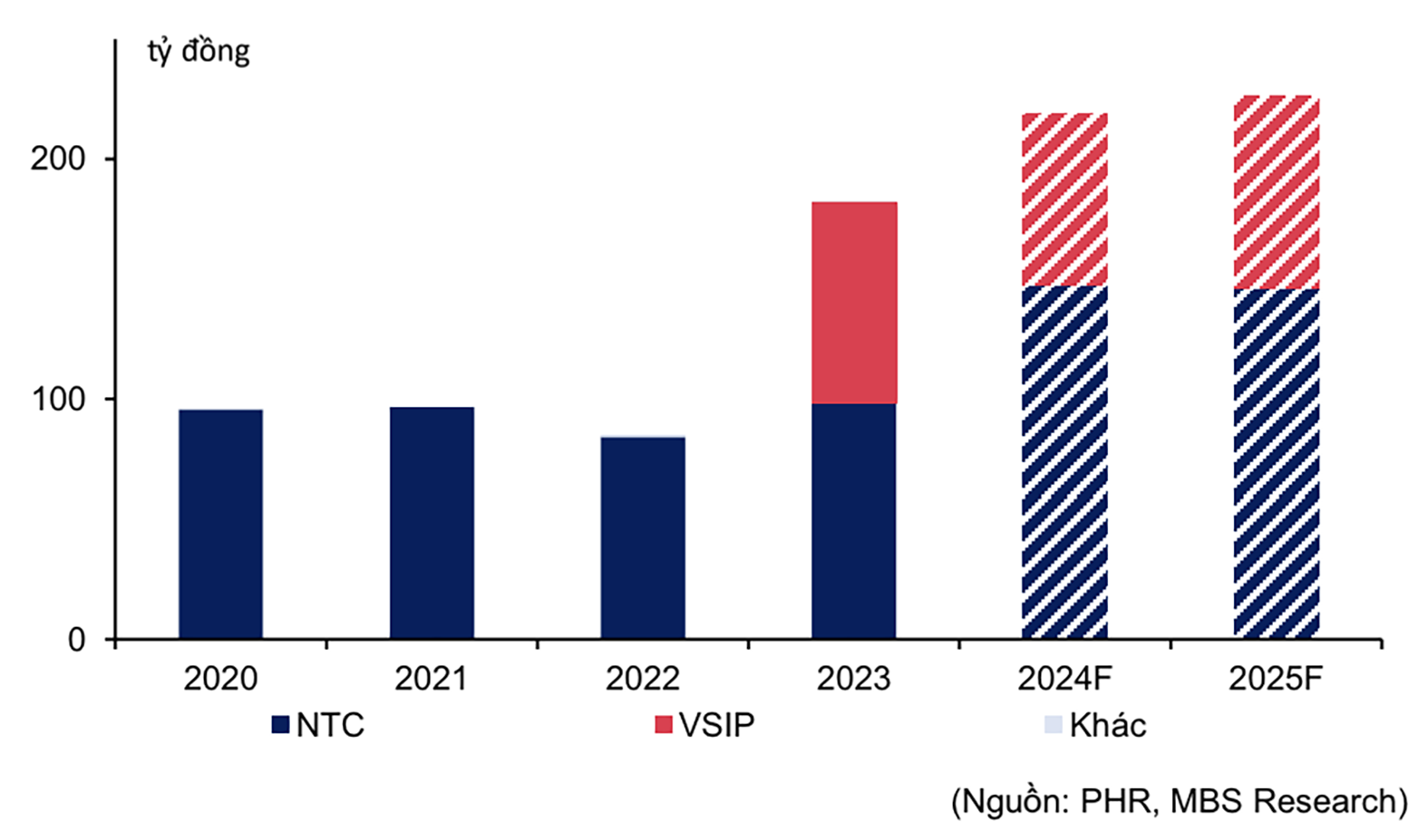

Profits from the company, projects in PHR’s industrial zone sector.

With an unfavorable business projection, PHR intends to pay a cash dividend of at least 12.35% in 2024, which is equivalent to more than 167 billion VND.

Reduced Business Plan

In the first quarter of 2024, PHR's cost of goods sold fell by 10.4% compared to the same time previous year, reaching 250 billion VND. Gross profit for this quarter was 72.4 billion VND, 1.5 times more than the 46.2 billion VND reported in the same period last year. However, the company's financial income fell from 39.4 billion to 29.5 billion VND. Sale expenses rose by 0.02% to 8.31 billion VND, while administrative expenses dropped by 1.7% to 20.6 billion VND.

As a result, PHR's net profit for the first quarter was 78.4 billion VND, a 66% decline from the same time last year, when PHR received 200 billion VND in compensation for losses caused during the Vietnam-Singapore Industrial Park III project. In contrast, in the first quarter of current year, PHR did not get similar pay.

The business plan for 2024, presented by PHR's Board of Directors to the Annual General Meeting of Shareholders, forecasts an extraction output of 23.9 thousand tons, with 12.4 thousand tons coming from the company's own plantations and 11.5 thousand tons coming from Phuoc Hoa - Kamphong Thom. Additionally, the firm intends to buy 10 tons of raw rubber and sell 33.1 thousand tons, with Phuoc Hoa - Kamphong Thom accounting for 10.7 thousand tons.

PHR expects the parent company's sales to be over 1,455 billion VND, a 10% fall from 2023; pre-tax and post-tax earnings are predicted to be over 277 billion VND and over 245 billion VND, down 49% and 47%, respectively. As a result, the corporation expects a regressive business strategy this year following several years of lucrative operations.

Continuing to Restructure Subsidiaries

MBS predicts a 20.4% decline in PHR's net profit in 2024 owing to a lack of land compensation, followed by a 4.8% recovery in 2025 because to the industrial zone (IZ) and rubber sectors. PHR's profits for 2024-2025 may increase, excluding land compensation revenue. PHR's net profit expectations for 2024-2025 are likely to fall owing to an adjustment in the timing of cash flow recognition from the Tan Lap 1 and Tan Binh expansion projects from 2024-2025 to 2026-2027 due to slower-than-expected legal development.

Despite the bleak commercial picture, PHR's management has continued to reorganize its subsidiaries. As a result, Truong Phat Rubber Joint Stock business will continue to address its limit ations and conduct reorganization as ordered by the leadership of the parent business and the Vietnam Rubber Industry Group. Tan Binh Industrial Park Joint Stock Company will continue to resolve its limit ations following the completion of the examination by the Binh Duong Department of Construction. Phuoc Hoa - Dak Lak Rubber and Forestry Limited Liability Company is still working on completing legal procedures in order to get the project's land use right certificate.

Phuoc Hoa - Kampong Thom Rubber Development Co., Ltd will continue to manage the technical process effectively, optimize extraction output, and guarantee that final goods meet requirements, with the goal of exceeding the set production target for 2024.

PHR benefits from rising rubber prices and its IZ sector with a land conversion fund.

Looking Forward to the Land Fund

Rubber is undergoing a new price increase cycle as a result of poor weather conditions in key manufacturing countries, which have reduced supply. As a result, increased rubber prices will increase PHR's gross profit margin.

In the IZ sector, Tan Binh's industrial area is presently entirely leased, and PHR will focus on completing legal procedures for the Tan Lap 1 industrial area, which is projected to be operational in 2025.

Furthermore, PHR possesses a substantial land fund that is awaiting conversion from projects such as the 1055-hectare Tan Binh Industrial Park development, other industrial parks such as Hoi Nghia (715 hectares), Binh My (1,002 hectares), and numerous industrial clusters. The IZs are likely to be significant drivers of PHR's industrial zone sector in the future.

PHR has additional sources of revenue. First, for NTC (of which PHR owns 32.8%), the NTC Industrial Park Project 3 (344 hectares) is planned to be leased between 2024 and 2025, serving as a major contributor to PHR's revenues. Second, in 2023, PHR completed the recovery of the remaining compensation from the VSIP 3 project, recording 83 billion VND from 44 hectares of leased VSIP land. VSIP is anticipated to continue delivering projects through 2024.

Thus, PHR's revenue is mostly derived from its IZ land fund. This source of revenue is unreliable since it is based on leasing IZ land.