What outlook for VCB stock?

With a smaller increase compared to many peers, but positive profit prospects, Vietcombank’s VCB stock is expected to be re-rated with a higher target price.

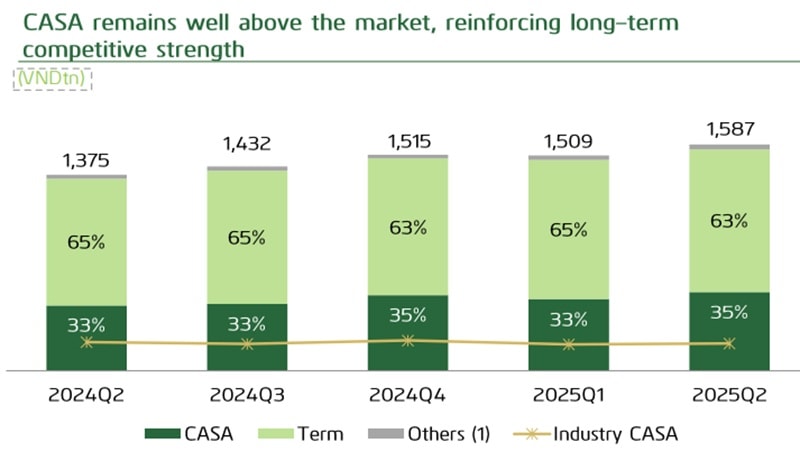

CASA ratio remains above the market average, strengthening long-term competitiveness. Source: VCB Q2/2024 update

From July 20 to August 21, VCB traded mostly in the range of VND 60,000 – 64,500 per share. At times, it spiked to VND 65,000 during trading sessions but then corrected back, moving sideways in this range.

On August 20, VCB disclosed a related-party transaction: Mr. Nguyễn Mạnh Hùng, Chairman of the Members’ Council of VCBNEO (a subsidiary), registered to sell 58,757 VCB shares for portfolio restructuring purposes. The transaction will be executed via order matching from August 28 to September 26, 2025.

Overall, VCB’s rise has lagged behind the banking sector average, let alone stocks with long “bull runs” such as SHB, HDB, MBB, or TCB. Since the beginning of the year, VCB has gained only 38%. This modest increase leaves room for further upside, backed by attractive valuation metrics, earnings prospects, and market opportunities.

Following strong H1 2025 earnings across the banking sector, and with VCB’s management highlighting profit growth potential during its 2025 analyst briefing, Maybank Research (MIBG) expects stronger earnings growth from FY2026 onward, driven by improved ROE.

In addition, Vietnam’s stock market is on the verge of being upgraded by FTSE to Emerging Market status, a key catalyst for re-rating leading banks like VCB. ROE and valuations thus have further upside over the next 12 months.

Specifically, VCB’s H1 2025 results came without major surprises. Q2 2025 net profit rose 9% y/y but fell 5% q/q, bringing annualized ROE to 16.7% (vs. 19.3% in H1 2024).

According to MIBG, core operating indicators were largely in line: moderate credit growth (7.4% YTD), NIM down slightly (-30bps to 2.7%) weighing on revenues, while lower provisions supported net profit. VCB retains a top-tier position with low NPL ratio (1%) and high loan loss coverage (214%), reflecting strong risk management and profit buffer.

State-owned banks like VCB have faced profit growth constraints in recent years due to SBV’s tighter oversight. However, after strong H1 2025 results from CTG and TCB (net profit up 79% y/y), analysts expect VCB also has room for stronger profit recognition to support ROE.

MIBG forecasts VCB’s 2025 net profit to grow 6.5% and 15% y/y, with ROE at 15%. Upside mainly stems from lower provisioning. Given the stock’s subdued performance in H1, improving market sentiment, and the likely upgrade to Emerging Market status, MIBG sees valuations as more attractive. A target P/B of 2.7x (–1SD below 5-year average) is deemed reasonable, especially with projected ROE of 15% and VCB’s flagship position.

“VCB’s share price has risen only 5% YTD, compared with 29% for the overall market and 40% for the banking sector. We raise our target P/B for VCB from –2SD to –1SD below the 5-year average, equivalent to 2.7x. This is fair for a representative bank like VCB, considering its re-rating drivers and ROE profile versus regional peers. Updating BVPS through end-FY26E, we set a 12-month target price of VND 85,300 per share, implying 33% upside. We therefore upgrade our recommendation from HOLD to BUY,” Maybank Research stated.

They also noted that after a long consolidation, current VCB prices already reflect concerns on earnings visibility; higher ROE trends will be the key driver for further re-rating. The forthcoming FTSE market upgrade is another trigger to lift valuations of leading banks like VCB.

At VCB’s Q2 2025 results call, Board Member Mr. Đỗ Việt Hùng said Vietnam’s GDP grew 7.96% in Q2 2025 — the highest for Q2 and H1 since 2021 — thanks to strong trade and investment from both state and FDI sectors. CPI inflation was 3.27% in H1, well below the national target.

In banking, credit and deposit growth in H1 outpaced 2023 and 2024, reflecting robust economic recovery. Vietcombank achieved solid results: pre-tax profit rose 5.1% y/y to VND 21.894 trillion, with non-interest income contributing 21% of operating income. Credit growth remained strong, asset quality stable (NPL 1%), loan loss coverage above 200%, and capital adequacy improved to 12%.

“Despite emerging global challenges, Vietnam’s economy continues to show resilience. Vietcombank is well-positioned to sustain growth, monitor market shifts closely, and adapt quickly, unlocking further business opportunities in 2025,” the bank representative said.