Positive outlook for the construction plastics sector in 2025

In 2024, construction plastics companies continue to benefit from low PVC resin prices. It is forecasted that resin prices will remain stable at low levels throughout 2025.

Vietnam's construction plastics industry is expected to enjoy dual benefits in 2025.

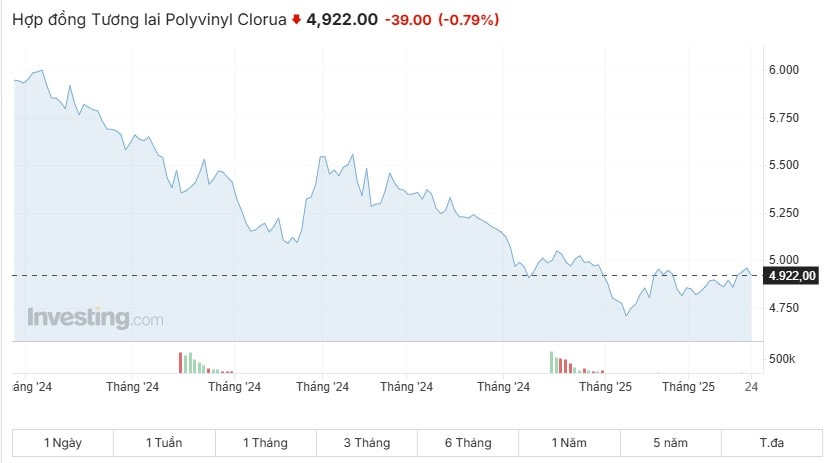

PVC Resin Prices Remain Low

According to Mordor Intelligence, the Vietnamese plastics market is expected to reach 16.36 million tons by 2029, up from 10.92 million tons in 2024, with a CAGR of 8.44% from 2024 to 2029. The plastics industry consists of 4,000 active manufacturing enterprises, generating revenue of up to $25 billion in 2023.

Despite global economic challenges, stimulus policies and business support measures have helped sustain the growth of Vietnam’s construction plastics industry. The recovery of the real estate market will drive higher demand for construction plastics in general and plastic pipes in particular in 2025.

Profits in the building plastic pipe industry are predicted to improve somewhat in 2025 due to a rebound in real estate and more government spending. According to Bao Viet Securities (BVSC), this segment's net profit is expected to increase by roughly 2.8% in comparison to 2024.

PVC resin prices are predicted to be low through 2025, according to Agriseco's research, which will enable plastic pipe producers like NTP and BMP increase their gross profit margins.

In a similar vein, FPTS Securities JSC projects that PVC resin prices will average about $810 per ton in 2025, staying steady at low levels. When China's real estate market improves in the second half of the year, prices might go up a little.

Additionally, consumption volume is expected to grow by 6.5% year-over-year as market demand recovers more clearly from Q2/2025, thanks to synchronized and effective legal reforms benefiting the domestic real estate market.

FPTS assumes that companies' sales policies will remain stable across quarters in 2025, with the highest growth expected in Q1/2025.

However, the construction plastics industry also faces significant challenges. Increasing demands for sustainability and digital transformation from the market, along with stricter environmental protection policies, are putting pressure on businesses. Furthermore, rising competition from foreign competitors and heavy reliance on imported raw materials make the industry vulnerable to supply chain disruptions.

Although Guotai Junan Vietnam Securities also expects PVC resin prices to remain low in 2025 and possibly into 2026, they believe this situation will not last long.

According to this securities firm, recent economic stimulus measures in China—such as a large-scale stimulus package worth about 10 trillion yuan ($1.4 trillion) in November and strong monetary easing in December—could help its construction and real estate sectors enter a recovery cycle starting in 2025.

Additionally, there is a risk of rising oil prices. PVC prices are strongly influenced by raw material costs, such as ethylene and chlorine, which are linked to crude oil prices. If oil prices rise in the near future—especially given the ongoing geopolitical risks in the Middle East—PVC production costs will increase, pushing up PVC prices.

Strong Business Performance

Amidst these market conditions, construction plastics companies have reported strong business performance.

For instance, Tien Phong Plastic JSC (HoSE: NTP) recorded VND 1.884 trillion in revenue in Q4/2024, up 37% year-over-year. Net profit reached VND 216 billion, increasing by 32%, just shy of the VND 238 billion peak set in Q2/2024.

According to company leadership, the strong performance was driven by a surge in sales during the final quarter, lower PVC resin costs, and the company’s ability to optimize idle cash for financial gains.

For the full year of 2024, NTP’s revenue exceeded VND 5.6 trillion, nearing its record-high revenue from two years ago. Net profit reached VND 736 billion, up 32% from the previous year and significantly surpassing its early-year target. This marks the second consecutive year (2023, 2024) of record-breaking profits for NTP.

At Hoa Sen Group (HoSE: HSG)—which operates in both steel and plastic pipe manufacturing—revenue in Q1 of the 2024-2025 fiscal year (October 1 - December 31, 2024) reached VND 10.221 trillion, up 13% year-over-year. Net profit after tax rose by more than 60% to VND 165.5 billion. Notably, gross profit margin improved from 10.5% to 11.8%.

However, in the previous quarter (Q4 of the 2023-2024 fiscal year, from July 1 - September 30, 2024), HSG reported a loss of VND 186 billion, compared to a profit of VND 438 billion in the same period the prior year. The loss was attributed to insufficient gross profit to cover financial, sales, and administrative expenses.

For the full fiscal year 2024 (October 1, 2023 - September 30, 2024), HSG’s revenue reached VND 39.272 trillion, a 24% increase year-over-year. Net profit after tax surged from VND 30 billion in the 2022-2023 fiscal year to VND 510 billion in 2023-2024, marking a 1,597% increase. The company achieved 109% of its revenue target and 102% of its profit target for the fiscal year.

Meanwhile, another major construction plastics company, Binh Minh Plastics JSC (HoSE: BMP), recorded nearly VND 1.053 trillion in net revenue in Q4/2024, down more than 27.5% year-over-year. Net profit for the final quarter of 2024 was nearly VND 231 billion, a decline of 10% compared to Q4/2023.

BMP's revenue for the entire year 2024 was VND 4.615 trillion, which was 10.5% less than the year before. Nearly VND 991 billion was the net profit after taxes, a 5% drop from 2023.

Despite the difficulties, Guotai Junan Vietnam Securities predicts that 2025 will bring BMP a number of advantages. The company's resurgent demand for plastic pipes, especially from the construction and real estate industries, is expected to propel its net income to VND 5.340 trillion, a 9% increase from 2024.

"The recovery of the domestic real estate market and fiscal policies such as accelerating public investment disbursement will create momentum for plastic pipe demand. However, there is still a risk that the real estate and construction sectors may recover more slowly than expected," Guotai Junan Vietnam Securities commented.