Prospects for consumer credit growth in the coming period

Consumer credit is making a positive contribution to overall credit expansion, helping to stimulate production, business activities, services, and economic growth.

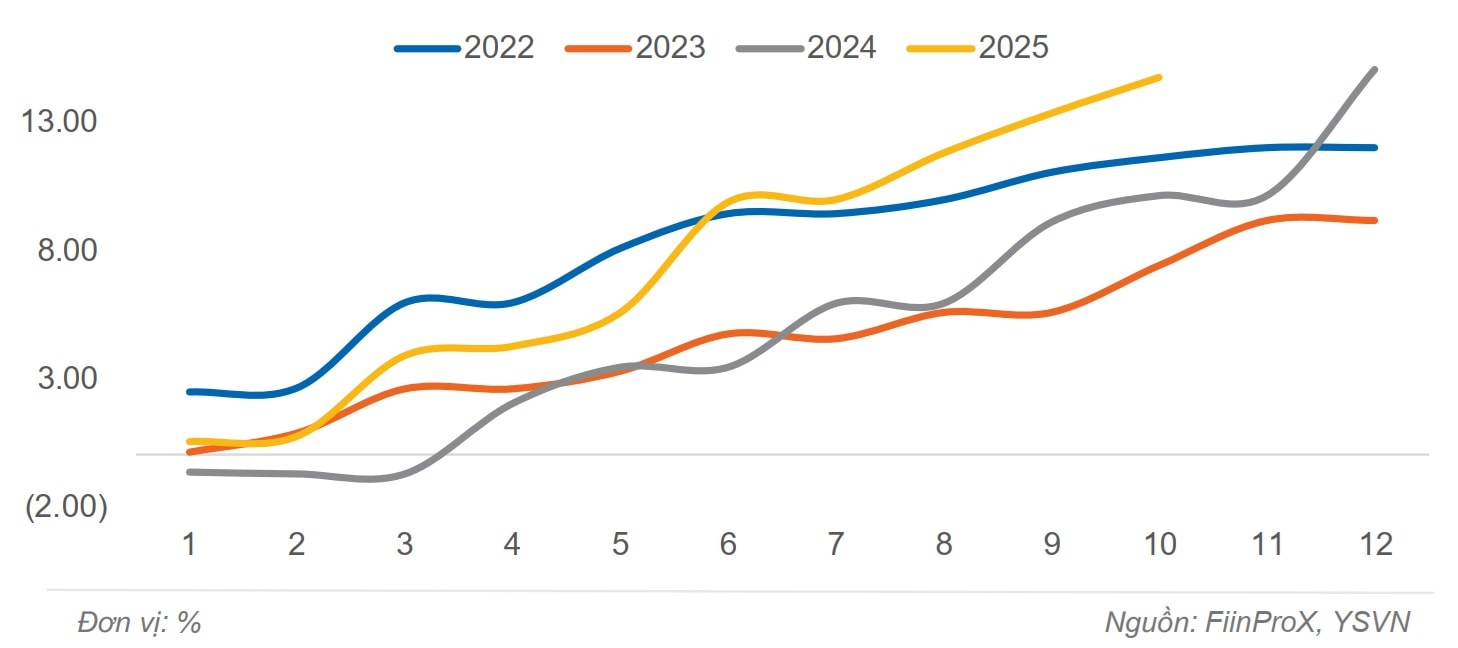

According to the State Bank of Viet Nam (SBV), by the end of October 2025, credit growth had reached 15.1% compared with the beginning of the year—its highest increase in five years.

Experts note that the strong flow of credit into the economy has been supported by the positive effects of public investment. At the same time, growth in consumer real estate credit has accelerated, alongside capital flowing into the securities market. However, the SBV emphasizes that although growth in these areas is higher than the system-wide average, it remains aligned with the policy orientation of removing bottlenecks in the real estate market. Once legal obstacles are resolved, capital needs for project implementation naturally rise. The SBV continues to closely monitor and control risks.

According to economist Nguyen Duc Kien, Member of the National Monetary and Financial Policy Advisory Council, credit growth in the real estate sector is currently very high—around 24%, with some banks even reaching 28%.

Dr. Kien added that, to ensure stability, the SBV will conduct inspections of credit balances at selected banks from now until the end of the year. Credit growth of up to 28% at several smaller banks is a worrying sign.

However, overall consumer credit growth does not revolve solely around real estate. The role of consumer credit in directly supporting production, business activities, services, and economic growth continues to be affirmed by regulators and experts.

Analyzing credit balances by purpose of use is essential for assessing credit effectiveness and shaping appropriate policy measures, as well as implementing the Central Bank’s credit policies to support socio-economic development. In this context, monitoring and classifying consumer credit is not only vital for management and risk control, but also plays an important role in supporting and stimulating economic growth by leveraging consumption as a core driver, said Mr. Nguyen Duc Lenh, Deputy Director of SBV Region 2.

Based on the results of consumer credit activities in Ho Chi Minh City and Dong Nai in recent years, Mr. Lenh noted that it is possible to identify and forecast growth trends for the coming period, serving management needs and supporting the effective expansion of consumer credit.

According to Mr. Lenh, statistical data show that total consumer credit in Ho Chi Minh City and Dong Nai (as of September 2025) reached VND 1.481 quadrillion, accounting for 27.1% of total outstanding credit and rising 8.65% compared with end-2024. Ho Chi Minh City accounts for 92.8% of this amount; Dong Nai accounts for 7.2%.

By purpose of use, loans for home purchase or lease-purchase, home construction or renovation, and the transfer of land-use rights for homebuilding continue to make up the largest share. By the end of September 2025, outstanding loans in this category reached VND 906.1 trillion, accounting for 61.2% of total consumer credit—up 7% compared with end-2024.

The data also highlight strong growth in consumer credit for household goods, home equipment, and daily living expenses of individuals and families—two categories that, together, account for 27% of total consumer credit, the second-largest share after housing-related loans. This growth positively supports production and business activities in essential goods, home appliances, and services.

In particular, loans for household goods and home equipment reached VND 251.8 trillion, accounting for 17% of total consumer credit—up 27% from end-2024.

“These results in Ho Chi Minh City and Dong Nai over the first nine months of 2025 reflect clear growth trends and positive spillover effects on production, business activities, commercial services, and overall economic growth,” the SBV regional leadership emphasized.

Mr. Lenh added that innovations and applications of technology in consumer lending, as well as increased use of digital payment services, will continue to drive consumer credit growth. Market potential remains considerable, supported by expanding socio-economic space and the restructuring of provinces and cities under the current two-tier local government model.

On this basis, he affirmed that consumer credit will continue to grow and yield effective outcomes.

Credit growth in 2025 is expected to reach 18–20% by year-end

With less than a month left in 2025, economist Dr. Dinh The Hien noted that this is a critical period for boosting consumption and accelerating business activity toward year-end targets. In real estate consumer credit, strong credit growth in the first three quarters indicates that capital inflows into real estate remained higher than in other sectors and above the system average. However, despite abundant capital, several market segments remain subdued—suggesting the issue lies not in the quantity of money, but in how it is used.

Extending the discussion to consumer credit more broadly—and consumer real estate credit specifically—interest rates may become a barrier to realizing the full economic impact of credit expansion. Although the Government and SBV continue to encourage cost reductions and lower lending rates, and the SBV has effectively supported system liquidity, funding costs are rising. Twenty-one banks adjusted deposit rates across certain tenors and deposit forms in November.

Potential adjustments to lending rates—particularly credit card rates, consumer loan rates, and real estate loan rates—could have adverse effects on the market by raising business costs or increasing retail prices and reducing purchasing power, experts warn. This presents a difficult trade-off for efforts to expand credit and help the economy reach 8% growth, setting a foundation for 2026.