Seafood companies will still face risks in 2026

Although Vietnam’s seafood exporters continued to record positive growth amid tariff pressures, analysts warn that the sector will face significant risks in 2026.

The industry’s performance through the end of the third quarter stands out due to proactive adjustments in production and export structures, helping fill global supply gaps amid the ongoing trade war, according to Phu Hung Securities (PHS). A typical example is Nam Viet Corporation (HoSE: ANV), whose after-tax profit surged 915% year-on-year thanks to shifting its export mix toward tilapia bound for high-value markets such as the United States.

However, only a handful of companies can clearly benefit (such as ANV with tilapia). For instance, the majority of Vinh Hoan Corporation’s (HoSE: VHC) Q3 2025 profit growth came from foreign-exchange gains and financial investments. Meanwhile, Sao Ta Foods (HoSE: FMC), despite being eroded by retaliatory tariffs and various trade-remedy measures, still managed to post solid growth. PHS notes FMC could see even stronger profit expansion should tariff outcomes turn favorable.

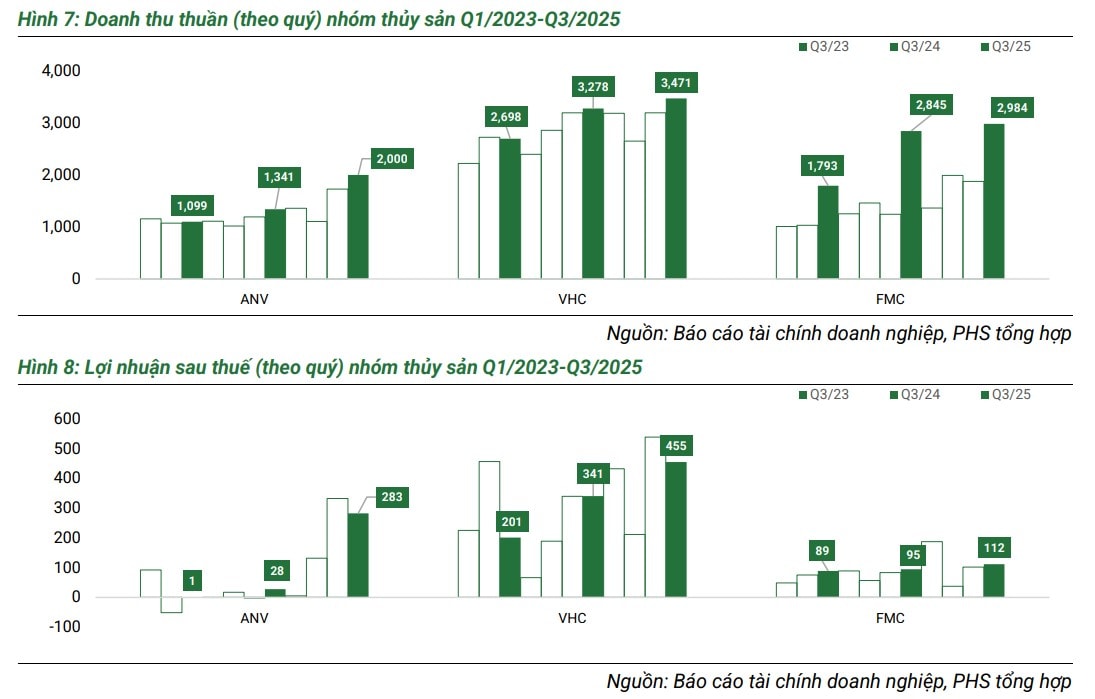

A closer look at each company’s performance shows ANV recorded a 49% year-on-year increase in Q3 revenue, while after-tax profit jumped 915%. These strong results stem from: the removal of the $2.39/kg anti-dumping duty on pangasius in the US, improved price competitiveness; strong preparation enabling leadership in tilapia exports to high-value markets such as the US; and, notably, the sharp rise in US tariffs on Chinese tilapia to 55% (consisting of 25% Section 301, 10% retaliatory duties, and 20% Fentanyl-related tariffs).

For VHC, Q3 2025 revenue reached VND 3.471 trillion, up 5.89% year-on-year. However, its core pangasius segment fell 7.9% (to VND 1.760 trillion), while by-products and the Collagen & Gelatin segment saw double-digit growth. After-tax profit rose 35.05% year-on-year to VND 455 billion, but more than 80% of this growth came from FX gains and reversals of financial investment provisions. The pangasius segment continues to face pricing pressures following POR 20 and slowing demand in its key market, the US.

For FMC, Q3 2025 net revenue increased 4.87% year-on-year, while after-tax profit rose 18%. Gross profit climbed 36.4% (thanks mainly to gross margin widening from 9.8% to 10.85%, reaching VND 743 billion), but 26% of gross profit was eroded by retaliatory tariffs, resulting in more modest net-profit growth. The US—accounting for over 40% of revenue—continues to exert heavy tariff pressure (retaliatory duties, anti-dumping, and anti-circumvention). The company is currently facing significant risk from an anti-dumping margin that could reach 35.29% (preliminary). This rate is expected to be adjusted favorably by December 2025.

Assessing sector prospects, PHS maintains a cautious outlook for seafood (pending further updates on tariff measures and the Marine Mammal Protection Act—MMPA—later this year), yet remains optimistic about firms with strong structural advantages. These include ANV, which leads US tilapia exports at a time when tariffs remain a major barrier for Chinese tilapia, and FMC, supported by a solid profit buffer as Vietnam’s shrimp industry enters a favorable cycle. According to VASEP, Vietnam’s shrimp exports reached USD 3.4 billion in the first nine months of 2025, up 22% year-on-year—the fastest growth in three years.

VASEP also notes that seafood exports in Q4 2025 will slow sharply due to the 20% baseline retaliatory tariff (applying to goods cleared for US export after October 5, 2025) and potential anti-dumping duties on shrimp entering the US. This will intensify competition among exporters when negotiating with distributors. VHC previously stated that it would pass all tariff costs directly to customers.

For FMC, the company has proactively provisioned for costs related to US anti-dumping duties. Should the final POR 19 ruling be favorable, it could unlock a major reversal gain and significantly boost earnings.

“In general, the seafood sector will continue to face risks from 2026 onward as the Marine Mammal Protection Act (MMPA) may assign a ‘not equivalent’ rating to fisheries involving grouper, crab, mackerel, tuna, lobster, and several other species. Products from such ‘non-equivalent’ fisheries could be banned from entering the US starting January 1, 2026,” PHS assessed.

However, the firm also noted that these risks do not apply to pangasius, tilapia, or whiteleg-shrimp producers such as VHC, ANV, and FMC.