UK's inflation pressure and impacts on GBP

UK CPI inflation hit its highest in 40 years in July and the country has the rather unwelcome accolade of being among the first developed countries to reach double figures in this upswing.

UK CPI inflation hit its highest in 40 years in July

>> Could the pound prove vulnerable?

Worse still, the upside surprise to yesterday’s data could help put an inflation rate as high as 15% in the frame by early next year. It is a truly awful performance, and yet the pound has hardly reacted. Should we be surprised?

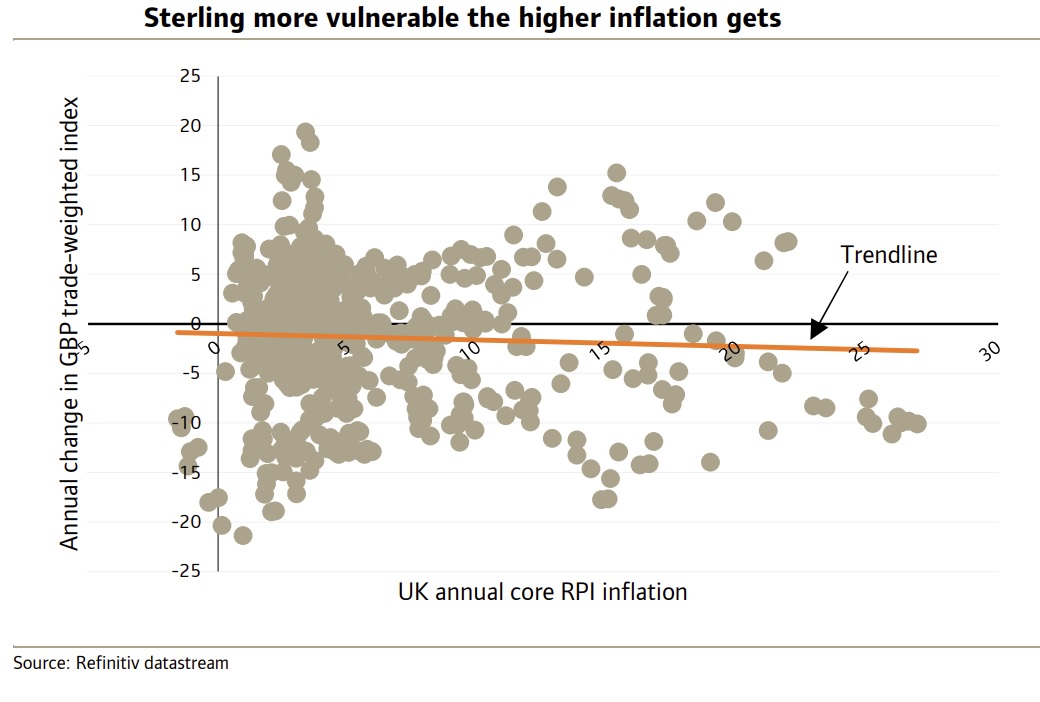

The issue of whether high inflation is good or bad for currencies has not really been resolved. Indeed, if we look at a chart of inflation and sterling performance in the UK, we see that there seems to be no predictable relationship. In some ways this seems understandable right now.

For a start, it is not as if the UK is experiencing high inflation alone. The vast bulk of the price pressure has come externally from soaring energy and food prices, and these same factors have lifted inflation just about everywhere. Hence, in relative terms, the UK is not much worse off than its peers, and sterling’s stability in the face of such high inflation appears justified.

Another point is that if traders and investors think that high inflation should undermine the pound, they only need to look at the worst performing G10 currency over the past year – the yen – to see that a country that has maintained very low inflation can still see its currency slump.

This, of course, brings in the dynamic of the monetary policy response, for it seems that the yen has fallen because the BoJ has not reacted to even the modest rise in inflation with rate hikes, while other central banks, like the BoE, have been tightening for some time. Put another way, high inflation is not bad for a currency provided that the central bank is tightening policy and seems to be on top of the problem.

While all these arguments might seem to justify a relatively steady performance from the pound or other high-inflation currencies, we still have some concerns. For one thing, we’d argue that if there is only one rule that works in currency forecasting, it is that countries with substantially higher inflation than others will experience currency depreciation over time. For, if they did not, competitive pressures would become too intense and they would experience a balance of payments crisis.

>> What impact has Brexit had on the UK economy?

Mr. Steve Barrow, Head of Standard Bank G10 Strategy said this would be a "rule" that we usually apply only to countries that are seeing dramatically higher inflation. Here we might point to a number of African currencies or some of those in Latin America. It is certainly not something that we would usually apply to the likes of the pound.

However, we can see that low levels of inflation in the UK seem to be associated with an equivocal currency response, while the higher inflation gets, the more likely it is that the pound will weaken. This should not come as a surprise because, essentially, what we are saying here is that as UK inflation rises into the double digits and beyond, the UK becomes more like an emerging market country (at least in terms of inflation), and thus we should not be surprised if the currency reacts similarly.

For a start, as inflation gets to very high levels, the greater the chance that the central bank won’t be prepared to engineer positive real rates, and, at the end of the day, it is real rates that matter, not nominal rates. Another issue is that as inflation reaches really stratospheric levels, it increases social tension, as we are seeing in terms of UK strike activity at the moment. And a third issue is simply that, as inflation reaches very high levels, traders and investors become more aware that the loss of competitiveness could be substantial, even if a balance of payments crisis is less likely than in an emerging market country with the same inflation dynamics.

"The bottom line is that 10%-plus inflation rates in the UK push the country into a dangerous region where price increases turn from being broadly neutral for the pound to being something that could undermine the currency quite significantly," said Mr. Steve Barrow.