Vietnam’s FDI inflows expected to recover from 2023

The decline in pledged FDI inflows into Vietnam will not last long and is expected to recover from 2023.

Xiaomi plans to invest in manufacturing smartphone components in Vietnam to compete with Samsung...

>> Forming the leading enterprises for Vietnam's industry

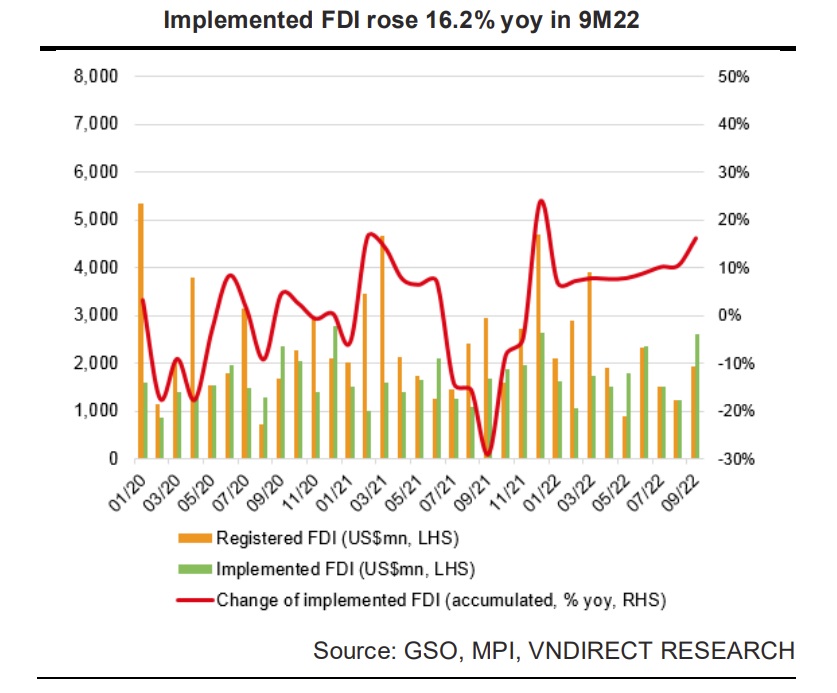

According to the Ministry of Planning and Investment (MPI), the implemented capital of FDI projects rose 55.4% yoy to US$2.6bn in September 2022, thus lifting the implemented capital of FDI projects in 9M22 to US$15.4bn, increasing 16.2% yoy (vs. a 3.7% decline in 9M21). Meanwhile, the pledged capital of FDI projects dropped 35.1% yoy to US$1.9bn in September 2022. For 9M22, registered capital of FDI projects declined 15.3% yoy to US$18.7bn.

To be more specific, 1,355 (11.8% yoy) newly licensed projects in 9M22 with a registered capital of US$7.1bn, a decline of 43.0% in terms of registered capital compared to the same period in 2021; 769 projects (13.4% yoy) licensed in the previous years approved to adjust investment capital (incremental FDI) with a total additional capital of US$8.3bn (29.9% yoy); 2,697 (-4.7% yoy) turns of capital contribution and share purchases of foreign investors with a total value of US$3.3bn (1.9% yoy).

The decrease of pledged FDI in 9M22 was mainly because in the same period last year, a very large-scale project was recorded, namely the Long An I, II liquefied natural gas (LNG) power plants worth US$3.1bn and the Omon II thermal power plant worth US$1.3bn. Meanwhile, the largest pledged FDI project in 8M22 is Lego's toy factory, worth US$1.3bn.

In addition, many large enterprises are also suspending new investment and production expansion plans in the context of the global economic uncertainty, including (1) slowing global growth, (2) high inflation weighing on consumers' wallets, (3) strong USD appreciation puts pressure on emerging market and frontier market exchange rates; and (4) financial market liquidity tightens due to the Fed's interest rate hike.

>> FDI inflows reach 22.46 billion USD in 10 months

However, Mr. Dinh Quang Hinh, Head of Macro & Market strategy at VNDirect, believes that the decline in pledged FDI inflows into Vietnam will not last long and is expected to recover from 2023.

"We believe that Vietnam possesses outstanding advantages compared to its competitors to attract international FDI inflows in the near future, including competitive labor costs, favorable geographical location (proximity to the production center in southern China), political stability, and incentives from many FTAs (Free-TradeAgreements). We see that recently, there have been a number of global technology giants intending to invest and expand production in Vietnam in the near future", said Mr. Dinh Quang Hinh.

Some of the world's largest technology firms intend to move part of their production lines to Vietnam in the near future. For example, Apple is planning to manufacture IPhone and IPad in Vietnam while GOOGLE is planning to move part of its mobile phone production line (GOOGLE Pixel 7) to Vietnam. Moreover, two Chinese technology giants, XIAOMI and OPPO, also intend to set up manufacturing activities in Vietnam.