Vietnam’s rapid capital market reforms set to pay dividends in the coming decades

The long-awaited upgrade of Vietnam’s equity markets, though with a condition, is a sign that the country’s rising global profile can withstand near-term challenges.

As its stock market marked its 25th anniversary in July, Vietnam had much to celebrate.

The Vietnamese economy has defied naysayers, reaffirming its position as a standout performer across frontier and emerging markets, with GDP growth reported at 8.23% in Q3, the highest level since 2011 except for 2022 (14.38%) as the country started to emerge from the Covid pandemic.

We are pleased to see index provider FTSE Russell, a unit of the London Stock Exchange Group, announced the long-awaited reclassification on 7 October, after putting Vietnam on a watchlist since September 2018. The upgrade is effective from September 2026 and subject to an interim review in March 2026 to determine whether enough progress has been made in enabling access to global brokers, essential to support index replication.

Recognition with real implications

The new status, though with a condition, places Vietnam two steps below the top-ranked “developed” category and recognizes years of coordinated efforts from the government, regulators, and market participants. In the six months since the last FTSE Russell report, we have observed consistent and strong engagement among the Vietnamese authorities, foreign investors and market participants to remove the final hurdles for the secondary emerging market upgrade. Looking forward, the authorities have published a plan to reach the MSCI Emerging Market status by 2030, expected to unlock larger capital flows.

Such upgrades are not symbolic. They influence everything from how analysts and media frame a market to the asset allocation decisions of global investors. For Vietnam, shedding the frontier label brings both recognition and reassurance. It can profoundly reshape investors’ behavior and confidence, altering the trajectory of its continued long-term economic development and reducing dependence on any single trading partner.

Rapid progress

Vietnam’s capital markets have advanced on multiple fronts, both in terms of quantitative and qualitative measures. Market capitalisation and number of trading accounts have risen more than sevenfold over the past decade. The VN-Index is up by a third this year alone, surpassing its Covid-era highs, when optimism over Vietnam’s role in global supply chains was at its peak.

At HSBC, we have witnessed this growth firsthand, having supported market participants since the market’s inception 25 years ago. HSBC was the first foreign bank to receive a custody license and today serves as custodian for about half of all foreign institutional investors in Vietnam. These investors, with their long-term perspective, have worked closely with policymakers to shape reforms in areas such as market access and corporate disclosure. The Vietnamese authorities have been able to demonstrate to investors an ongoing willingness to listen to feedback and dynamically respond with clear and transparent plans; an example of this came with the State Bank of Vietnam issuing Circular 25. This provided amendments and supplements to existing regulation, so the legal framework could better reflect international practices of foreign institutional investors. The alignment between different ministries and the speed at which this action took place in response to feedback should help deepen investor confidence in the commitment to deliver reform.

This reclassification will only boost reform momentum. Global investors with confidence in Vietnam’s future will continue to demand greater alignment with international standards.

Keeping the development momentum

Vietnam’s stock market has come a long way – but it can go so much further. Greater participation from long-term institutional investors, such as pension funds, that play a large role in more developed markets, would provide more stability and enhance companies’ ability to access capital. So too would a deepening pool of retail investors. It is encouraging to see in September this year the Ministry of Finance published ambitious plans on developing the investment fund industry and reshaping the investor base. This includes specific policy measures and action plans to support broader objectives of improving institutional participation through policy and legal framework enhancements, broader-reaching public education initiatives, and strengthening management and supervision of the market to ensure integrity.

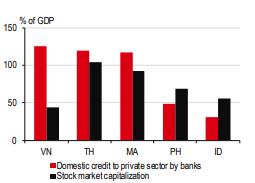

Despite recent improvements in the IPO outlook, the stock market has yet to be as significant a source of corporate funding as its regional peers. According to the World Bank, the Capital Market lags behind similarly sized rivals, leaving Vietnam’s economy heavily reliant on bank credit. According to HSBC Global Investment Research, bank lending to Vietnam’s private sector is more than double the stock market capitalisation. This gap makes it an outlier among major ASEAN economies and leaves the economy more exposed to the impact of inflation and higher interest rates. It is also encouraging to see coordinated capital market enhancements published in September to simplify the IPO and listing process, with important steps in administrative procedure reforms to enhance capital raising efficiency and protect investor rights in the securities market.

Reform momentum

Over the past year, reforms have addressed key obstacles to upgrading at pace. The State Securities Commission led the removal of the pre-funding requirement, streamlined market entry, upgraded trading infrastructure, and mandated English-language disclosures for listed companies, aligned to their own disclosures and reporting in both languages.

Further reforms are underway, additional significant streamlining of account opening processes is mandated, and more is being implemented. A proposal is already in place to improve global broker access per the FTSE assessment outcome, and a central counterparty clearing mechanism is in development; market development and reform momentum are sustained. The FTSE Russell upgrade marks an important milestone but is by no means the end goal, with action plans in progress to increase listings, support domestic institutions, and, of course, further market upgrades.

Looking forward

As its stock market marked its 25th anniversary in July, Vietnam had much to celebrate. Despite tariff-related turbulence across the region, its commitment to reform is clear. With continued strong policy support and the backing of global investors, the next 25 years promise even greater progress. Vietnam has proved doubters wrong before - and looks poised to do so again.