Vietnam’s securities sector builds a strong base for 2026

Vietnam’s securities sector posted an outstanding performance in Q3 2025, buoyed by vibrant trading activity and robust profit growth, reaching a total pre-tax profit milestone of USD 460 million.

.jpg)

Market Boom Drives Record Performance

With the stock market’s stronger-than-expected rebound in Q3, the brokerage industry experienced a surge in both cash and derivatives trading. The total value of cash market transactions reached USD 106 billion, while derivatives trading soared to USD 125 billion, nearly double the previous quarter—one of the most active periods in recent years.

According to SSI Research, revenue among eight tracked securities firms grew 123% year-on-year, driven by a broad recovery across brokerage and margin lending. Among the listed firms, VIX and VPBankS (expected code: VPX) saw the most impressive revenue jumps—481% and 512% year-on-year, respectively.

Growth drivers varied by strategic positioning: VIX, SHS, and VPX benefited mainly from proprietary trading, while VPS maintained its dominance in retail brokerage. Meanwhile, TCX and VPX reported substantial gains from investment banking and margin lending activities.

Overall, the sector’s pre-tax profit surged to USD 460 million, tripling year-on-year and doubling quarter-on-quarter, reflecting sustained market liquidity, expanded customer leverage, and solid proprietary portfolios.

Market share data for Q3 2025 highlights an increasingly concentrated landscape. Major players such as VPS (expected code: VCK), SSI, and TCX continued expanding their dominance, while smaller firms in the Top 10 lost ground. The trend underscores the importance of strong capital capacity in a market largely driven by retail investors—where robust funding is essential to maintain large margin balances and capture rapid trading demand.

Notably, VPX tripled its margin loan balance since the start of the year, raising its market share to 2.8%, nearly catching KIS (2.87%). The sharp rise reflects the company’s aggressive customer acquisition and expansion strategy, marking its emergence as a formidable new entrant.

According to SSI Research, trading momentum is expected to persist in upcoming quarters, though possibly at a slower pace as market liquidity normalizes and competition intensifies.

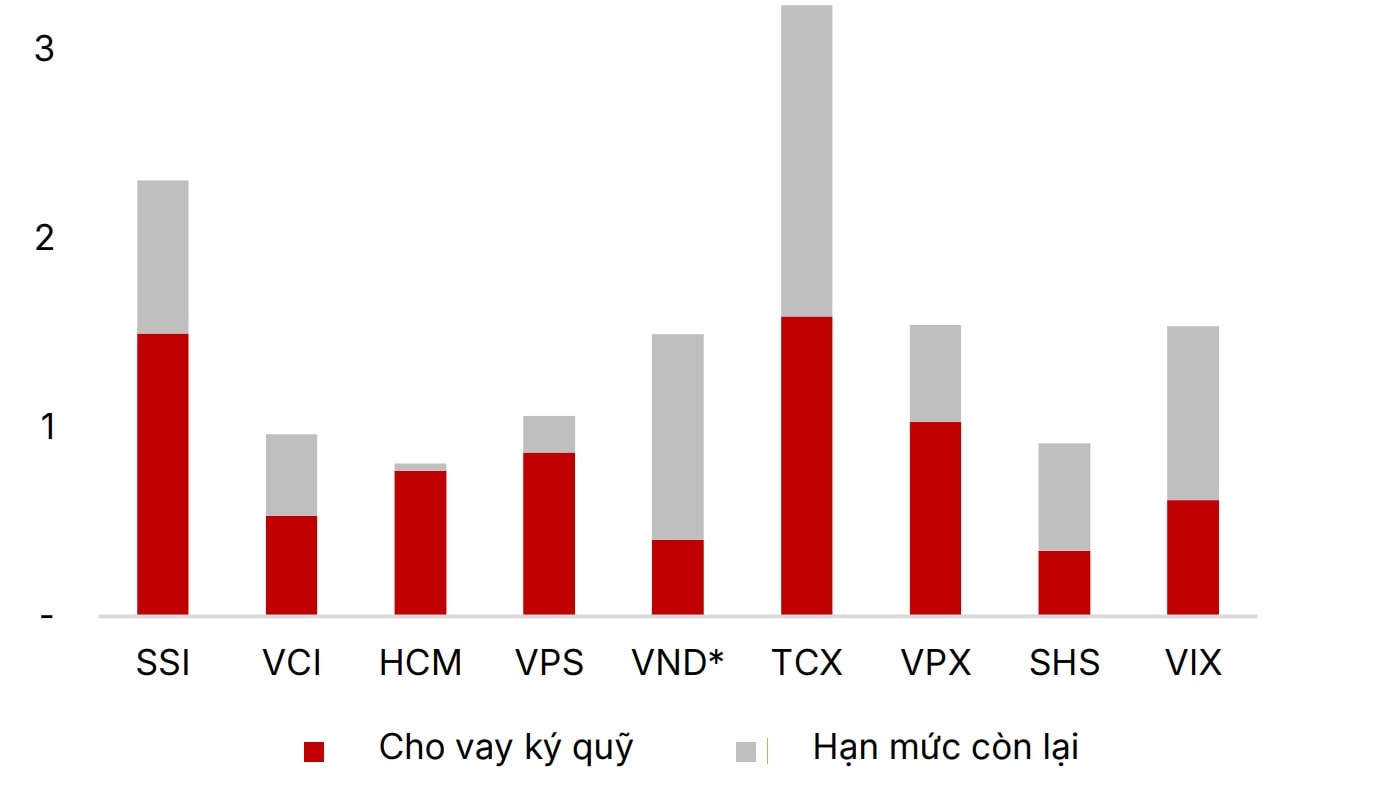

Margin lending—which provides liquidity to retail investors—has helped absorb foreign net selling pressure and remains a key revenue driver. By the end of Q3 2025, total margin loans at the eight tracked firms hit USD 7.8 billion (27% quarter-on-quarter, 84% year-on-year), raising the margin-to-equity ratio to 122% (from 87% at the end of 2024). Investor cash balances also climbed to USD 3 billion (87% year-to-date), indicating resilient domestic inflows offsetting persistent foreign outflows.

Interest income reached USD 200 million (69% year-on-year), becoming a core profit driver for many firms.

SSI Research notes that capital increases will remain a top priority as the industry prepares for FTSE Russell’s market upgrade. Financial strength will be crucial for firms to capture new growth opportunities.

A wave of capital-raising and IPOs is now reshaping the industry: HCM, VND, and VCI have announced new share issuances to strengthen equity and expand margin lending capacity. Techcom Securities (TCX)—a leader in corporate bond underwriting—went public on October 21, 2025, marking the start of a new IPO cycle.

Following that, VPBank Securities (VPX) is offering 375 million shares (25% of current capital) in its IPO from October 6 to 31, 2025, with listing expected in December 2025. Meanwhile, VPS, the leading brokerage, also plans to go public between Q4 2025 and Q1 2026.

“This capital-raising wave demonstrates clear strategic foresight and proactive expansion toward greater scale and stronger balance sheets—a foundation for broader product diversification,” analysts noted.

Building for 2026 and Beyond

With strong fundamentals, capital readiness, and growing competition, the securities sector is entering a promising new cycle heading into 2026. SSI Research expects sustained momentum supported by FTSE Russell’s upgrade in September 2026 and potential progress toward MSCI Emerging Market status.

“We remain optimistic for 2026,” SSI stated. “Following the FTSE Russell reclassification, market liquidity should remain high, fueled by both passive (ETF) and active funds, while retail participation stays strong under a low-interest-rate environment. Although much of this optimism was priced in during Q3 2025—when daily average trading value peaked near VND 45 trillion—we expect trading activity to recover from September’s brief cooldown and remain elevated compared with pre-2025 levels.”

Profit growth for securities firms will likely continue, supported by high trading volumes, expanded margin lending, and IPO-driven momentum. Firms with larger capital bases will hold a distinct advantage in this cycle, as higher equity enables greater margin capacity.

However, experts caution that brokerage stock prices tend to move in tandem with market liquidity. Thus, timing entry points remains critical for investors in this cyclical sector.