What are the prospects for HPG?

HPG’s net profit growth could have a slow start for the year, but the turning point would be in 3Q23F following the low base effect, widening gross margin, and narrowing financial expense losses, said VNDirect.

HPG's new steel plant

>> Headwinds for Vietnam’s steel makers

Since mid-December 2022, HPG has adjusted its construction steel selling price six times, with a total increase of 9.1% (VND 1,360/kg). This was mainly driven by the rally of input materials and the higher Chinese steel price, rather than demand improvement. Thus, the steel selling price has been increasing significantly slower than input material (iron ore and coking coal) prices since the beginning of the year. According to spot commodity price movements, VNDirect estimated that HPG’s EBITDA margin in 1Q23F would be 1.8% pts lower than 4Q22.

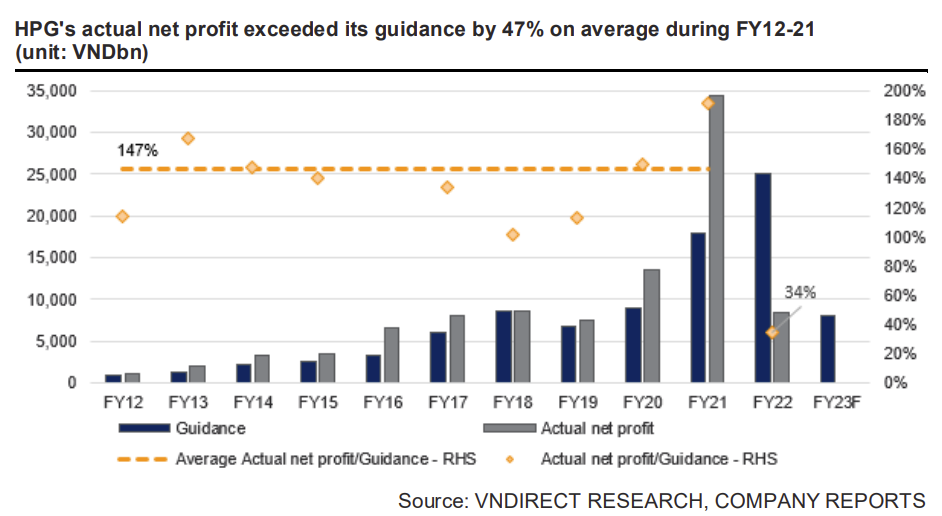

According to management’s guidance, FY23F revenue and net profit are expected to reach VND150,000bn (6.1% yoy) and VND8,000bn (-5.7% yoy), respectively. VNDirect believed that this plan would be made based on the conservative view of HPG's management amid the current volatile input material prices and weak steel demand. A poor result in FY22 coupled with huge capex for the Dung Quat Steel Complex (DQSC) phase 2 in the FY23–24 period implies that HPG will not pay any cash dividend for FY23F.

"We expect that the company's bottom line will remain sluggish in 1H23F; then the growth will return to positive territory in 3Q23F thanks to: (1) steel sales volume increasing from a low base in 2H22; (2) widening gross margin when input material prices fall and lower inventory provision; and (3) narrowing financial expense losses mainly on the sharp drop in forex losses. Thus, FY23–24F NP will increase 22.2%/41.9% yoy to VND10,366bn/VND14,711bn, according to our forecasts", said Mr. Tran Ba Trung, analyst at VNDirect.

HPG’s stock price has surged 67% in the past 4 months, outperforming the VNINDEX (12.4%), as steel selling prices rebound and China reopens its economy. HPG now trades at 12.0x/8.7x P/E for FY23–FY24, not attractive for short-term investment—though this is not unexpected given where we are in the cycle. Mr. Tran Ba Trung believes HPG is in the downcycle business, and the most recent data suggests that the recovery speed could be a bit slower than expected.

However, VNDirect still favors HPG for long-term investment thanks to: (1) the company's leading position in the Southeast Asian steel industry will help HPG to ride on the surge of domestic demand for both civil and transport infrastructure construction; (2) the company’s healthy balance sheet and cash-rich position will help HPG to grab more market share during the industry downcycle; and (3) DQSC 2 to increase HPG’s crude steel production capacity by 66% from now to 14.6 million tonnes per annum from 2025F on Besides, hot rolled coil (HRC), the main output product of DQSC 2, is still facing a shortage of supply in the domestic market and depends on exports, thus not putting pressure on HPG's steel oversupply in 2025–30F.

The upside catalyst for HPG includes new business plans (aluminum, real estate, and home appliance projects) to upgrade the value chain. Its downside risks include (1) tight monetary policy in Vietnam, which makes interest rates higher than expected, and (2) the USD appreciating stronger than expected.