What are the prospects for Vietnam stock in 2023?

VN-Index could reach 1,300-1,350 points within 2023, following a P/E target of 12-12.5x, said VNDirect.

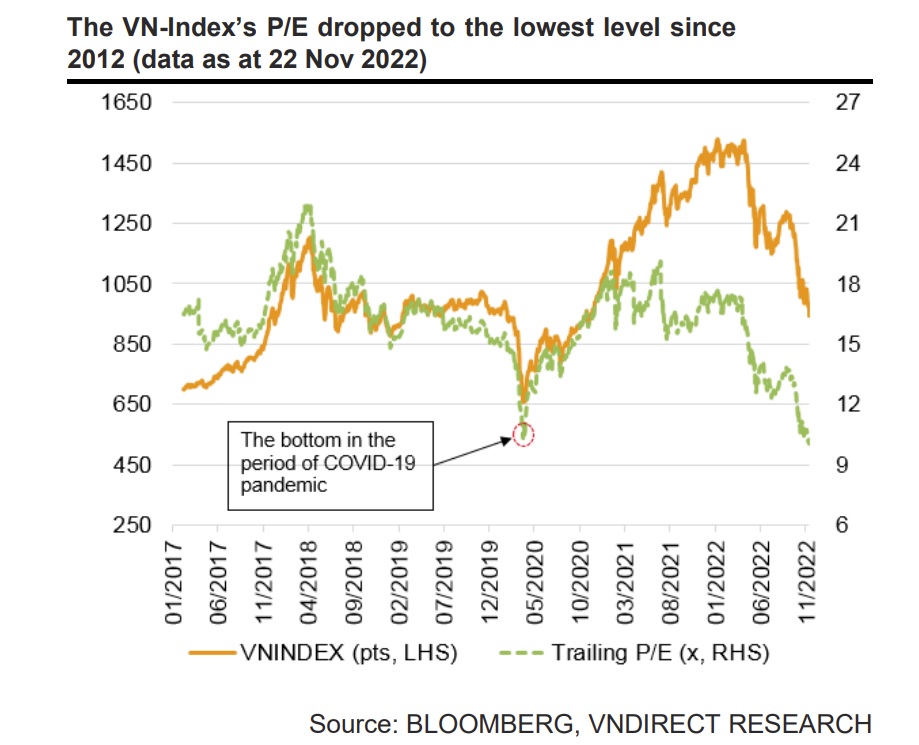

Since September 2022, the VN-Index has continued its downward trend, falling further and reaching a low of 952.1 points on November 22, 2022.

>> Fall in interest rates and inflation expected to help stock market restore strongly

Ups and downs

Following the strong sentiment in 2021, the Vietnam stock market began 2022 by achieving an all-time high. In the first week of the year, the VN-Index rose 2.0% to 1,528.6 points. The Vietnam stock market remained stable and varied in the 1,450–1,550 area even when external dangers like the Fed signaling rate increases and Russia starting its military action in Ukraine arose.

However, when several top executives from large firms were detained for manipulating the bond and stock markets, things started to get worse. Following those events, the VN-Index fell 23.1% to 1,172 points in just one month as a result of panic selling momentum and widespread "margin call" trading.

Since September 2022, the VN-Index has continued its downward trend, falling further and reaching a low of 952.1 points on November 22, 2022. The HNX-Index and UPCOM-Index both fell by 58.9% and 39.3% year on year, respectively.

The VN-Index fell 36.5% year on year in 2022, trailing all Southeast Asian stock markets, including Indonesia (JCI Index: 6.8% ytd. ), Singapore (STI Index: 4.3% ytd. ), Thailand (SET Index: - 2.6% ytd. ), Malaysia (FBMKL CI Index: -8.1% ytd. ), and the Philippines (PCOMP Index: -9.7% ytd.

In VNDirect’s view, there are three key issues that have distressed Vietnam’s stock market in 2022, namely: (1) the rising of interest rates; (2) the tightening of credit to riskier segments, i.e., property and securities investment; and (3) the corporate bond market, which witnessed a crisis in investor confidence after the incidents of Tan Hoang Minh and Van Thinh Phat, leading to difficulties in raising capital in the corporate bond market.

>> Bank stocks to flourish in 2023

Expectations for 2023

Despite market aggregate earnings growing 21.4% yoy in 9M22, more headwinds are arising due to weak export demand, margin compression, rising debt payment burden, and FX losses. Thus, VNDirect expects market earnings to expand 17% for FY22F. For FY23F, market earnings are expected to grow modestly (5% yoy) in 1H23F, then improve significantly in 2H23F, bringing the whole year growth to 14%.

Aviation will stand out in terms of earning growth on the back of a nearly full recovery of international flights. Construction materials will see significant earnings growth, supported by a drop in input material prices (coal, ore iron).On the other hand, O&G and Chemicals may see bottom-line growth slow in FY23F after a strong start in FY22F.

"We believe 2023F could be a year of two halves for both the macro and equity markets. For the 1H23F, the market is still under stress from uncomfortable levels of inflation, high interest rates, liquidity constraints, and rising corporate bond default risks. As a result, any market recovery from a trough valuation may be volatile due to low liquidity," said VNDirect.

VNDirect is more confident and expects an inflection in the market to materialize in 2H23F.

First, as previously stated, it does not anticipate any FED fund rate cuts in 2023F, but rather in 1Q24F at the earliest.It believes that if central banks' hawkish stances soften, the equity market will re-rate in the 4-6 months before the first rate cut is implemented.

Second, earnings will increase in 2H23F as a result of: declining interest rates, strengthening VND, a drop in material input prices, and even China's reopening.Positive corporate earnings growth momentum will bode well for equity market expansion.

Third, VNDirect believes that the signal of a peak in US interest rates may increase foreign investors' risk appetite for emerging markets.Additionally, the current downgrade of technology-related stocks amid the global economic recession could shift investors’ interests into value stocks, which is a key lift for the Vietnam equity market, which is dominated by banks, property, and consumer stocks.

Overall, this stock company expects the VN-Index to reach 1,300-1,350 points within 2023, following a P/E target of 12-12.5x.

As of November 2022, the VN-Index was trading at 10.0x trailing 12-month P/E (the lowest level since 2012), which is a 43% discount to the peak this year and a 36% discount to the 5-year average P/E (15.6x). In comparison to other peers, the Vietnam market valuation appears attractive in terms of F22-24 earnings growth potential.

"Potential re-rating catalysts include: (1) the inclusion of Vietnam’s stock market into the FTSE Secondary Emerging Market in the annual country reclassification in September 2023; and (2) the government loosening issuance conditions on the corporate bond market. Downside risks include: (1) slower-than-expected global economic recovery; and (2) slower-than-expected growth in the earnings of listed companies," said VNDirect.