What prospects for Vietnam’s pharmaceutical industry?

As Vietnam’s pharmaceutical industry shows immense potential, with the generic drug market forecast to grow strongly, many companies are reporting robust business results.

Vietnam’s pharmaceutical industry shows strong potential, with the generic drug market expected to expand significantly – illustrative image.

Among the industry leaders, Traphaco JSC (HoSE: TRA) recorded VND 676 billion in net revenue in the third quarter of 2025, up 20% year-on-year. With the cost of goods sold rising only 4%, gross profit increased by 34% to nearly VND 400 billion. After deducting expenses, the company reported a post-tax profit of VND 78.2 billion, up 79% compared to the same period last year.

According to the company, the surge in profits came from stronger product sales, an optimized product portfolio, and the expansion of its pharmacy network. For the first nine months of 2025, TRA achieved VND 1.935 trillion in revenue, an increase of 12%, and VND 201 billion in post-tax profit, up 14%, completing 76% of its annual revenue target and 75% of its profit plan.

Hau Giang Pharmaceutical JSC (HoSE: DHG) also reported strong performance, with net revenue of VND 1.146 trillion in the third quarter, up 8% from a year earlier. Cost of goods sold declined slightly to VND 584 billion, boosting gross profit by 21.7% to nearly VND 562 billion. Post-tax profit rose 34.3% to VND 210 billion. DHG attributed the positive results to a strong recovery of the pharmacy channel, cost optimization, and improved operational efficiency.

In the first nine months of the year, the company posted revenue of more than VND 5.524 trillion and post-tax profit of nearly VND 713 billion, up 25% year-on-year. This means DHG has achieved 106% of its annual revenue plan and 85% of its pre-tax profit target.

OPC Pharmaceutical JSC (HoSE: OPC) recorded net revenue of nearly VND 273 billion in the third quarter, up 40.6% from a year earlier. Gross profit reached more than VND 115 billion, up 48.5%, while post-tax profit rose 44.5% to nearly VND 33 billion. For the first nine months of 2025, OPC reported over VND 720 billion in net revenue, up 14%, and nearly VND 79 billion in post-tax profit, up 4.3% year-on-year.

Another standout, CPC1 Hanoi Pharmaceutical JSC (UpCOM: DTP), recorded its highest-ever quarterly profit at VND 99 billion, up 41% compared to last year, while revenue rose 35% to VND 410 billion. Its gross margin improved sharply from 50% to more than 59%. The company said the strong results were driven by increased sales, effective cash flow management, and lower market interest rates. The sharp increase in profit margin demonstrated enhanced business efficiency.

Imexpharm Pharmaceutical JSC (HoSE: IMP), after setting a record profit in the second quarter, continued to post its highest-ever third-quarter profit of VND 77 billion, up 6% year-on-year. Net revenue increased 5%, while cost of goods sold rose 3%. The company reported steady growth across both OTC and ETC channels, supported by effective production planning, optimized factory utilization, and cost-saving measures implemented at its four production clusters.

Despite the overall positive trend, several major companies experienced profit declines. Binh Dinh Pharmaceutical JSC (HoSE: DBD) ended its six-quarter profit growth streak, with net profit falling 20% to VND 60 billion in the third quarter of 2025. The company attributed this to VND 15 billion in provisions for new product R&D and rising sales and marketing costs. Similarly, Ha Tay Pharmaceutical JSC (HNX: DHT) reported its second consecutive quarterly profit drop, down 33% year-on-year to VND 13 billion, mainly due to higher input costs.

According to the report “The Future Value of Vietnam’s Generic Drug Market” by KPMG, out of 33 pharmaceutical firms that have released third-quarter results for 2025, 19 reported profit growth, 11 saw declines, and only three incurred losses. This indicates that Vietnam’s pharmaceutical sector is maintaining stable and resilient growth momentum.

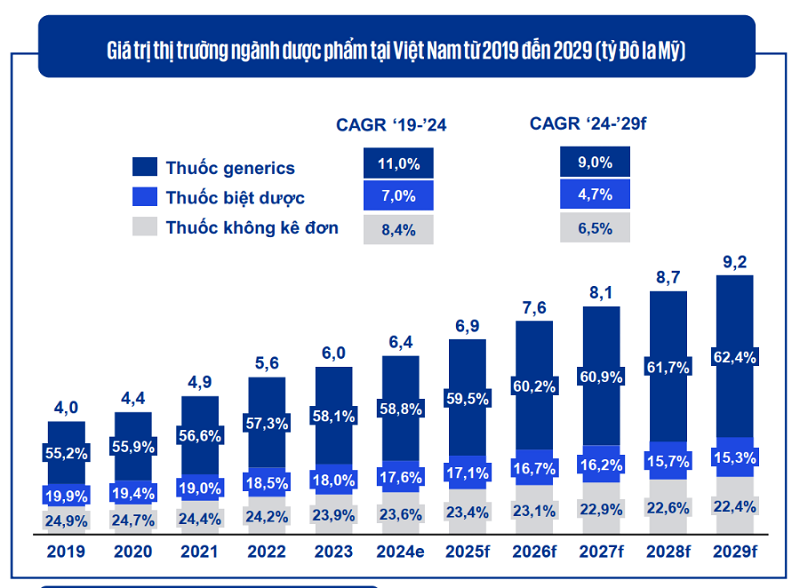

Vietnam’s pharmaceutical industry holds immense potential, with the generic drug market expected to expand rapidly in the coming years. The KPMG report projects the sector to grow from USD 4 billion in 2019 to USD 9.2 billion by 2029, with the share of generics increasing from 55.2% to 62.4% during the same period. Between 2024 and 2029, Vietnam’s generic drug market is forecast to grow at an average annual rate of 9.7%, making it the fastest-growing market in Southeast Asia.

However, the industry still faces several challenges. As of 2024, Vietnam had 288 pharmaceutical manufacturing facilities, but only 20 met EU-GMP (European Good Manufacturing Practice) standards, including 12 domestic and eight foreign-owned plants. Major barriers include high investment costs, as upgrading and maintaining EU-GMP production lines require substantial capital; complex registration procedures; and strict pricing policies that limit profit margins and reduce incentives for companies to invest in high-quality production.

Despite these challenges, the industry’s overall trajectory suggests that Vietnam’s pharmaceutical sector is entering a period of sustainable growth, driven by the expansion of the generic drug market and ongoing modernization across production and distribution systems.