When will HVN stock break out of its downtrend?

After a quick three-month climb, Vietnam Airlines Corporation's HVN stock has repeatedly hit the bottom.

HVN stock continues to be "locked on the floor" in the trading session on July 23

The trading session on July 23 was another "floor lock" session for HVN shareholders. HVN stock has fallen sharply since the beginning of July, after reaching a long-term high. By the end of July 23, HVN's price had fallen to the floor price of 22,650 VND/share, with roughly 7 million shares ready to sell at that price.

Since its peak at the beginning of July (36,400 VND/share), this airline's stock price has dropped by up to 40%. HVN's market capitalization has also been "wiped out" by more than $1 billion USD in just 3.5 weeks of trade. Why are investors selling HVN shares so aggressively?

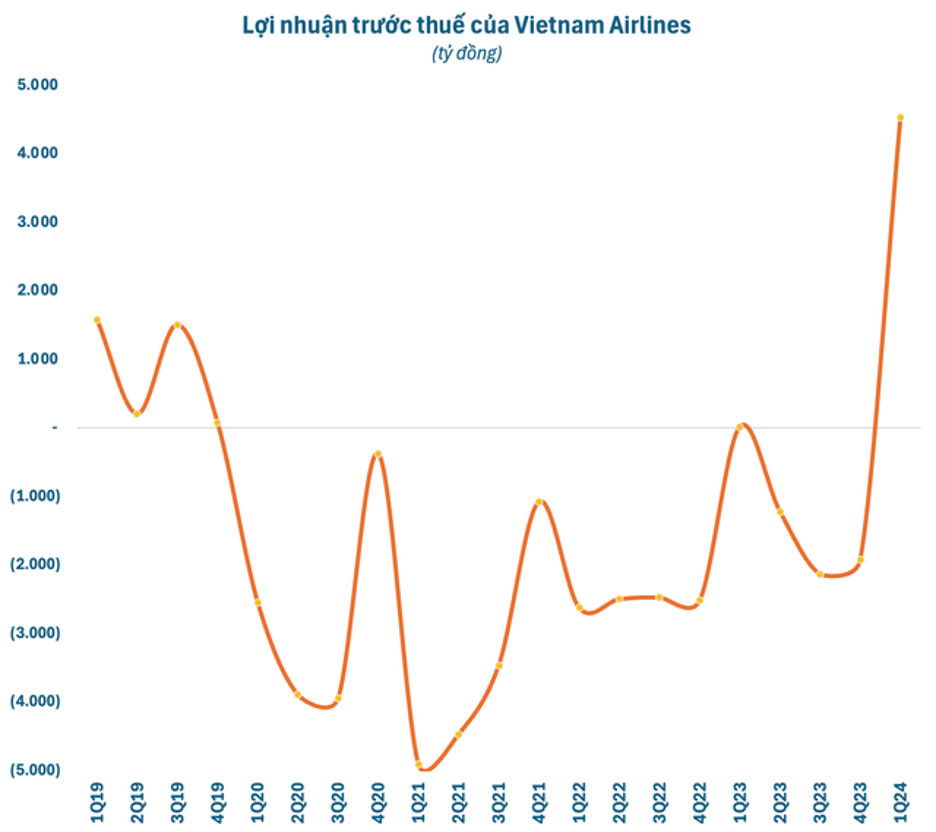

At the State Capital Management Committee's mid-year assessment conference for the first six months of 2024, HVN Chairman Mr. Dang Ngoc Hoa projected that the airline's consolidated pre-tax profit in the first six months of the year exceeded 4,600 billion VND. This data reveals that HVN produced a profit in the second quarter, but it was significantly smaller than the first quarter.

According to analysts, this is also one of the reasons why HVN was sold off, as the second-quarter business results may have fallen short of shareholder and investor expectations. Furthermore, following a period of investor overconfidence and profit-taking, the stock was certain to correct.

Looking generally at the possibilities of escaping the "floor lock" and future prospects, HVN is still on pace to meet its objectives. In 2024, HVN expects consolidated revenue of 105,946 billion VND, a 113.6% increase, and a consolidated pre-tax profit of 4,524 billion VND. If these expectations are accomplished, HVN's company will recover from last year's loss of more than 5,000 billion VND. With early data after six months, HVN has largely reached and even slightly surpassed its pre-tax profit objective.

Regarding debt management, on July 22, 2024, the Governor of the State Bank of Vietnam issued Circular No. 42/2024/TT-NHNN, which expanded financial assistance measures for HVN. This measure implements National Assembly Resolution No. 142/2024/QH15, which allows the State Bank to automatically extend refinancing debt for credit institutions lending to HVN up to three times.

The new circular changes the refinancing laws, making each extension period equivalent to the initial refinancing term. The overall extension length cannot exceed five years (including the two extensions granted under Resolution No. 135/2020/QH14). According to analysts, this action indicates the government's attempts to assist the national airline in overcoming the long-term effects of the COVID-19 epidemic.

However, HVN is now dealing with an aircraft scarcity. Currently, Vietnamese airlines operate just approximately 160 aircraft. Despite the decline in aircraft numbers, the Corporation has increased flying hours over the previous year to fulfill public travel demand.

Pre-Tax profit of Vietnam Airlines

HVN leadership indicated that some challenges the company faces include rising fuel prices, which increase operating costs, and a 4.8% rise in the exchange rate since the beginning of the year, which significantly impacts business activities. Additionally, the entire Vietnamese aviation industry is facing an aircraft shortage due to technical errors from manufacturers, as mentioned.

However, according to analysis from Yuanta Vietnam Securities Company, the aviation industry has passed the difficult period thanks to four main reasons: stable oil prices around 90 USD/barrel (fuel costs account for about 25-28% of operating costs of airlines); continued recovery of international passengers, steady growth of domestic passengers; and the increase in airfare caps.

Moreover, once the Long Thanh International Airport is completed with a capacity of 100 million passengers per year and 5 million tons of cargo, the overload at Tan Son Nhat Airport will be resolved, bringing long-term benefits to airlines and aviation services. HVN, in this trend and with its position as the national airline, is certainly set to benefit.